While the near-term demand and sentiment for residential building products and building products mergers and acquisitions (M&A) will be determined by the path of mortgage rates and interest rate policy set by the Federal Reserve, building products investors and strategic parties are looking to structural factors that will support the market in the medium to long-term. Namely:

| Demographics – Aging millennials will drive an additional 12.7 million new households formed in the 2020s

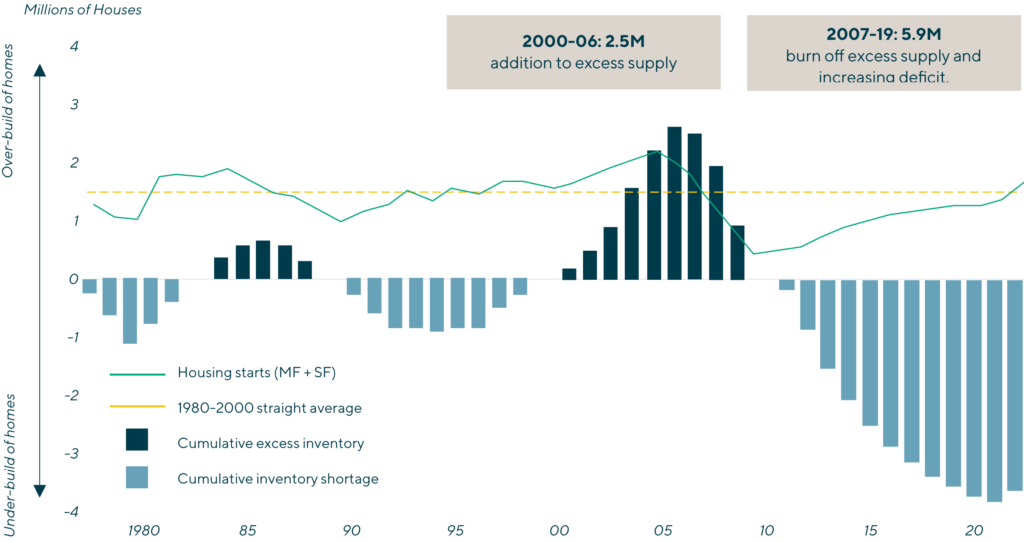

Undersupply – Seven million more new homes needed in the 2020s to meet the above demographic demand and to fill the current two and a half million undersupply of homes Mortgage Rate Normalization – Mortgage rates will normalize as the spread of the 30 year to 10 year treasury rate is currently near all-time highs; this spread plus other factors should result in lower mortgage rates going forward |

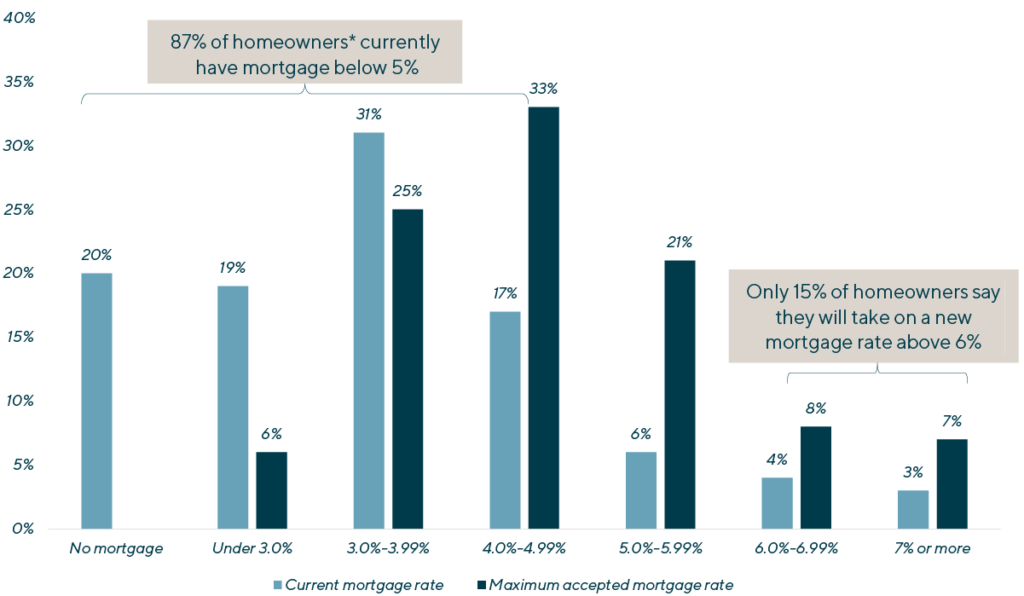

Homeowners’ Highest Acceptable Mortgage Rate Willing to Take On for New Home PurchaseSource: New Home Trends Institute by John Burns Real Estate Consulting, LLC

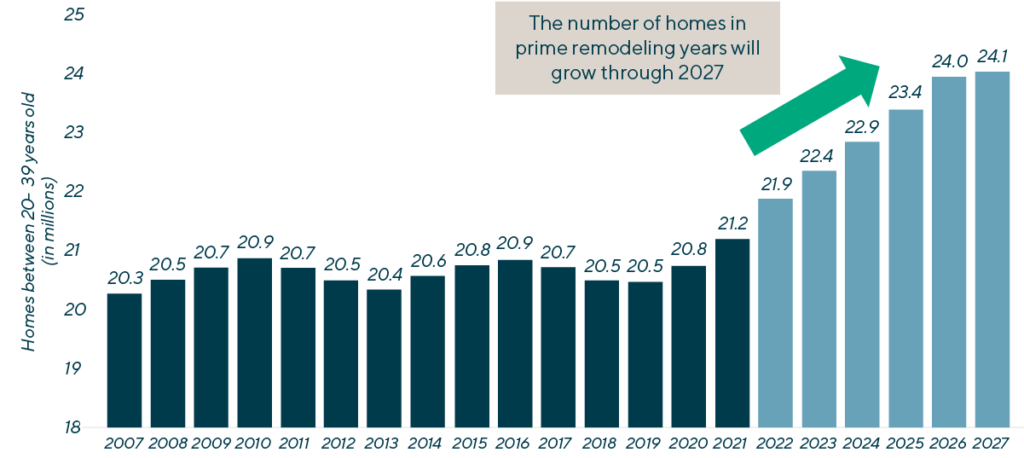

Single-Family Homes in “Prime Remodel” YearsSource: U.S. Census Bureau; John Burns Real Estate Consulting, LLC

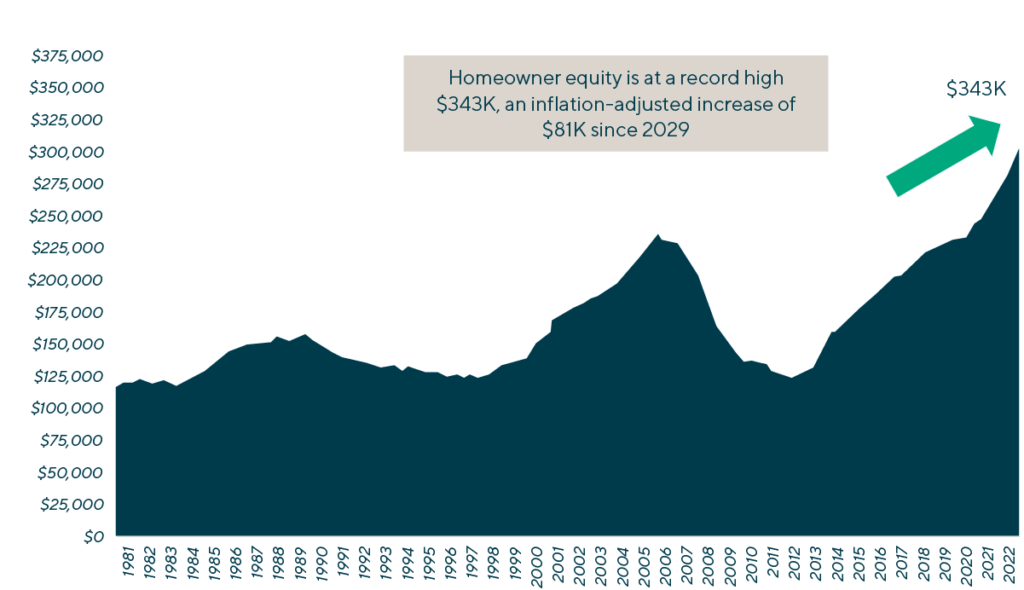

Inflation-Adjusted Homeowner Equity per Owned HouseholdSource: Federal Reserve; Census Bureau; John Burns Real Estate Consulting, LLC |

Contributors

Meet Professionals with Complementary Expertise in Building Products

I strive to deliver value-added advice, leveraging deep industry knowledge and extensive industry relationships.

Guillaume Suizdak

Managing Director & Co-head of Industrials, Europe

ParisRelated Perspectives

Recent Transactions in Building Products

The Eventual Normalization of the Housing Market will Create a Busy Period for Building Products M&A

In late 2022, building products companies were assessing the impact of the flash freeze in the new residential construction market caused by mortgage interest rates more than doubling. However, as… Read More

Beauty Outlook: Optimism for an Attractive 2023

Many investors are eyeing the year ahead for the beauty and personal care industry as it is ripe for accelerated growth due to several factors. 2022 had a key focus… Read More

Regulatory Compliance Watch | In-person Exams Resume

Originally posted by Regulatory Compliance Watch on March 3, 2023. The SEC plans to increase its on-site interactions with regulated entities but will continue to conduct remote examinations when applicable.… Read More

Aerospace and Defense: Factors Powering M&A Activity

Lincoln International was pleased to speak on the Reshaping the Supply Chain Landscape: M&A Trends panel at Aviation Week Network’s A&D Supply Chain conference. During the panel, industry experts revealed… Read More

U.S. Distribution M&A Continues in an Evolving Market

Macroeconomic uncertainty, particularly the combination of widespread price inflation (and the Federal Reserve’s response to it) and expectations for a downturn in 2023, have eroded investor confidence since mid-2022, driving… Read More

Private Equity International | How Private Equity Valuations Measure Up

Originally posted by Private Equity International on February 28, 2023. Private equity firms have been navigating market volatility for the past 12 to 18 months, and public market valuations have… Read More

Pitchbook | Private Credit Borrowers Turn to Structured Capital, PIK with Debt Costs on the Rise

Originally posted by Pitchbook on February 27, 2023. Borrowers are navigating higher interest rates and input costs while earnings are slowing in many cases, and lenders are hesitant to add… Read More

Private Equity International | Covenant Breaches Trend Upward as GPs Navigate Uncertainty

Originally posted by Private Equity International on February 22, 2023. According to the Lincoln PMI (LPMI), private equity (PE) firms and their portfolio companies are becoming increasingly concerned about financial… Read More

CFO | Earnings Multiples for PE-Backed Firms Fall for 7th Straight Quarter

Originally posted by CFO on February 22, 2023. For private companies, a modest increase in EBITDA kept their valuations from declining in Q4 2022. In fact, the Lincoln PMI (LPMI)… Read More

IPEM | Event: Cannes 2023

Lincoln International was pleased to attend IPEM Cannes 2023 from January 23 to 25. The event provided attendees the opportunity to connect with other professionals in the private capital markets,… Read More