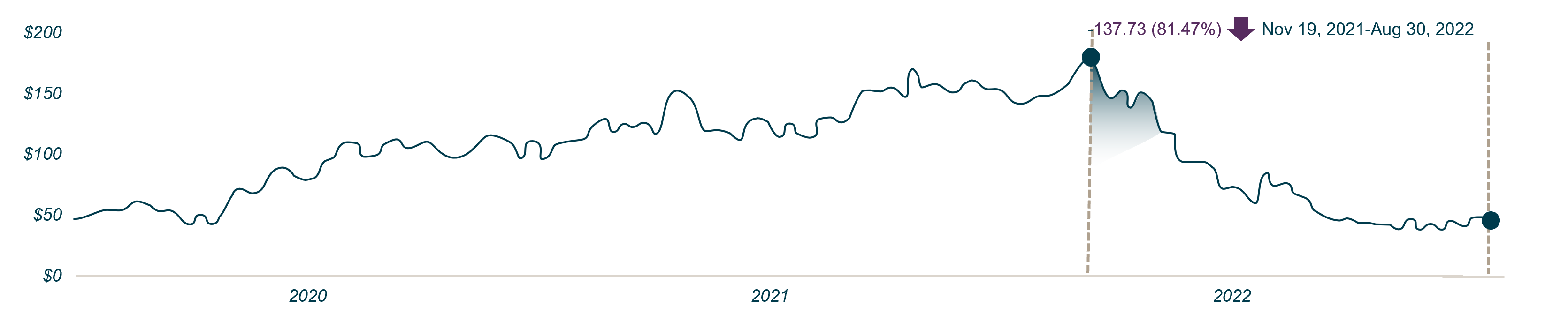

Revenue Growth vs. Profitability

|

Direct-to-consumer (DTC) Evolution

|

Channel Conflict Insights

|

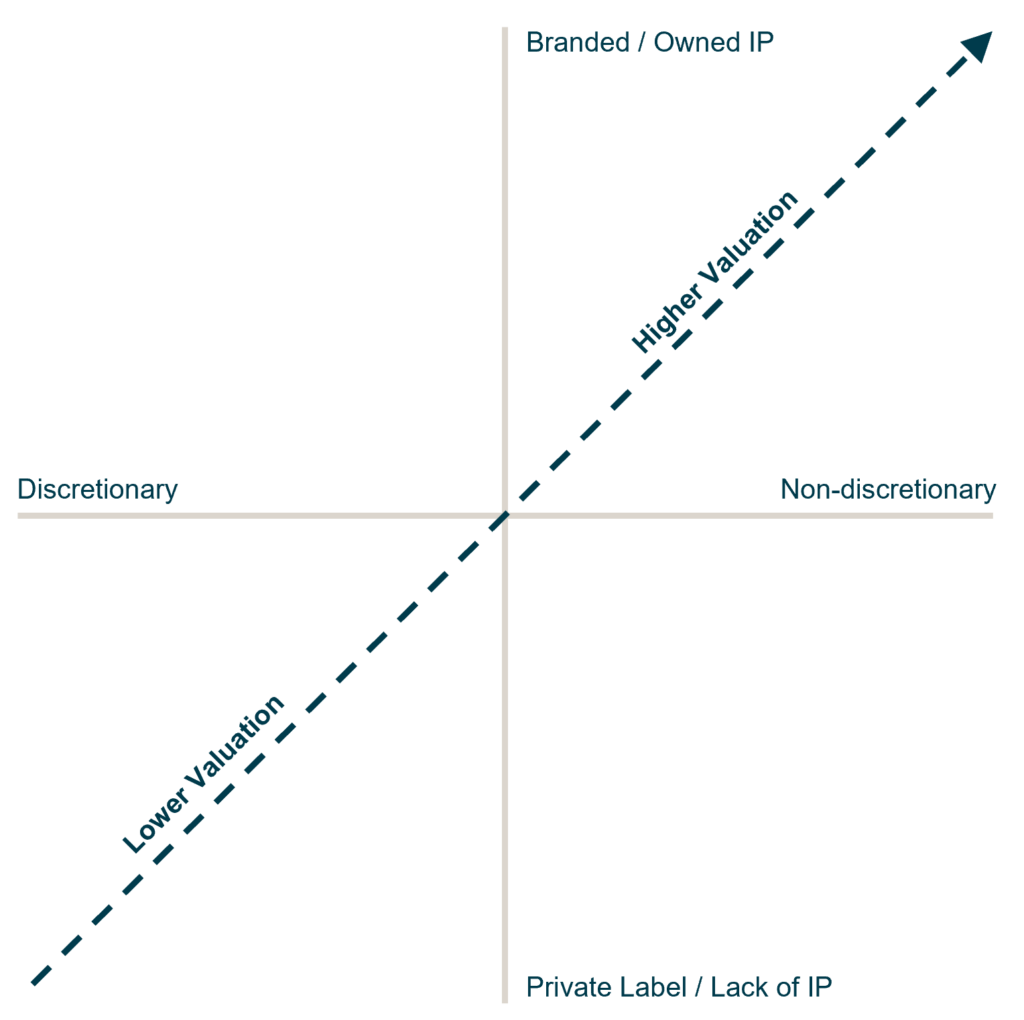

The Pet Company Valuation Spectrum

|

| Lincoln Insights

We have broad experience across the pet sector, selling companies for premium and outlier valuations based on both revenue and EBITDA multiples. The depth of our experience over a number of years and different M&A environments provides us with unique insights on how to best position pet companies to maximize value and terms for sellers. As the pet M&A environment continues to evolve, we are excited to share our perspectives and experience with companies as they assess their strategic alternatives and the best time to explore a transaction. |

Contributors

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

LondonMeet Professionals with Complementary Expertise in Consumer

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago

I design strategies and offer solutions that fit the unique ambitions of each client I serve.

Brian Little

Managing Director

Los AngelesRelated Perspectives

Recent Transactions in Consumer

Pet Trends Impacting M&A in 2022

The pet industry has evolved significantly over the past few years with several trends impacting the way pet product brands, manufacturers, retailers, customers and investors view the sector. In 2020,… Read More

Even as Possible Recession Looms, Prospects for Private Markets Look Strong

It is no secret that public markets are facing notable volatility. But from where I sit in the trenches of private market dealmaking, the near-term prospects for private equity remain… Read More

Real Deals | Creativity in Cautious Times

Originally published by Real Deals on July 28, 2022 How has the private lending market matured over the last few years? Xenia Sarri: The one thing that we’ve seen continue to… Read More

Chief Executive | Uncovering Resiliency: Breaking Down Deal Dynamics in Changing Market Conditions

Originally published by Chief Executive on June 23, 2022. As market conditions change and uncertainties rise, Rob Brown, Global Chief Executive Officer of Lincoln International, offers three observations on the… Read More

Sustainable Energy Investment Trends: Insight from Private Equity

As stakeholder priorities on environmental, social and governance (ESG) continue to crystallize at a rapid pace, investors are often allocating capital aligned with sustainable energy efforts to incorporate more environmental… Read More

Five Ways ESG Will Alter PE-Backed Dealmaking in the Next Five Years

Under the pressure of the global pandemic, the push from shareholder to stakeholder capitalism crystalized. Company scrutiny came not only from traditional institutional investors like insurers, pensions and endowments —… Read More

Data Center Download: Accelerating Growth, Record Interest in the Space and Transformational Opportunities

Our world has become more reliant than ever on data. As technological innovation stretches from the smartphones in our pockets to wearables, self-driving cars, cloud computing, artificial intelligence, Industry 4.0… Read More

Buyouts | How to Enhance the GP-led Secondaries Transaction Process

Originally published by BuyoutsInsider on November 24, 2021. The GP-led secondaries market is booming and the continuation vehicle structure (GP-led) has unquestionably arrived as a competitive strategic alternative to traditional… Read More

Webinar | Q4 2021 Dynamics in M&A & Financing

On Tuesday, September 21, 2021, Lincoln International’s global Capital Advisory Group hosted a webinar to discuss the latest dynamics and developments in the M&A and financing markets amidst what is… Read More

Navigating the SPAC Explosion: Target Company Considerations When Contemplating a Sale to a SPAC

When the COVID-19 pandemic hit, the slowdown in mergers and acquisitions (M&A) was widespread. But as deal activity reemerged, one structure saw a resurgence beyond all expectations: special purpose acquisition… Read More

Bloomberg Radio | Tax Change Fears Put Gas On Hot M&A Market

Rob Brown, Lincoln International Managing Director and CEO North America, discusses the state of M&A, how deals are getting done during COVID-19 and the potential future of dealmaking with Bloomberg… Read More

Mergermarket | Consumer Trendspotter on European M&A

View original document here, published July 17, 2020. Written by Mergermarket, the leading provider of forward-looking… Read More

Mergers & Acquisitions | M&A Trends

View original post from Mergers & Acquisitions on May 8, 2020 here. TRENDS The enterprise values of private middle market companies dropped 7.5 percent in the first quarter, according to Lincoln’s Quarterly… Read More

Tying the Knot: Auto Suppliers Should Follow the OEMs’ Example and Partner up to Meet Industry Demands

The automotive industry continues to undergo radical transformation as the impact of electrification, autonomous driving and ride sharing gains pace. To address these new technologies, players in the auto industry—both… Read More

Global Dynamics Drive Hazards and Opportunities in the Auto Industry

As the economy shudders, dipping its toe into the waters of a recession, macroeconomic, regulatory and geopolitical trends have been disrupting the automotive industry, creating headwinds and pockets of opportunity… Read More

Managed Security Service Providers: Mission Critical to the IT Security Landscape

U.S.-China Tensions, Tariffs and Tightening Regulations

Tension and tariffs drives Chinese M&A activity to markets outside the U.S. Mounting tension between Washington, D.C. and Beijing are top of mind in the dealmaking climate. As tariffs continue… Read More

PE Firms Seeking Software

Software is powering everything from supply chains to healthcare, and private equity firms have taken notice. It’s well documented that private equity firms are sitting on more dry powder than… Read More