Debt Advisory

Through our debt advisory services, we design innovative financing solutions to help clients realize their strategic objectives.

-

150+

capital advisory transactions completed in the past three years

Market Leading Relationships, Credibility and Results

For more than 20 years, Lincoln’s global debt advisory team has helped clients achieve their capital-raising objectives. Focused exclusively on the large and continuously evolving credit markets, our bankers bring premier insights about current market terms and trends. We leverage our strong relationships with a wide range of private and public lending institutions, including commercial banks, private and public debt funds, business development corporations (“BDCs”) and equity capital providers, to find tailored solutions for each client.

Areas of Focus

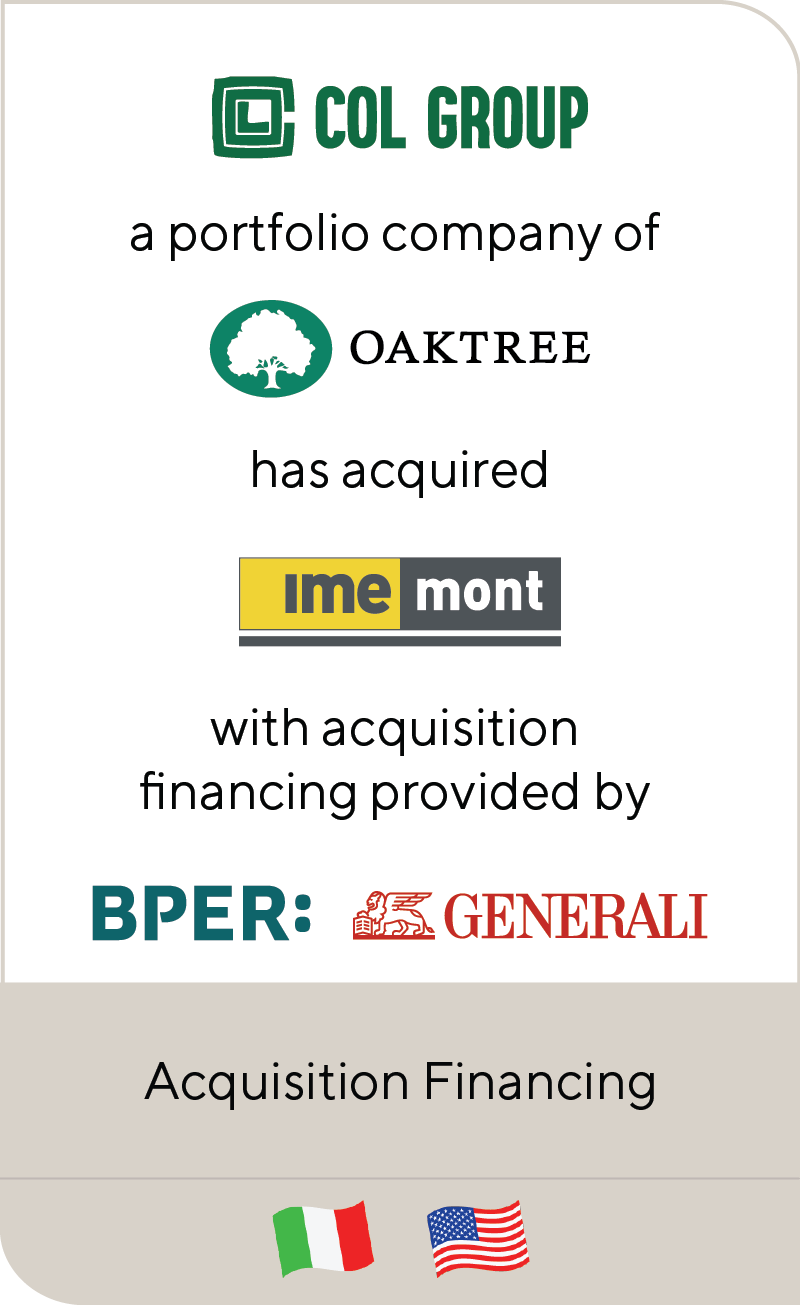

- Acquisition Financing – New Platforms or Add-on Acquisitions

- Dividend Recapitalization Financing

- Refinancing

- Structured Capital

True Advisors & The Right Partner for Critical Decisions

To optimize your success when pursuing capital-raising objectives, the right advisor is paramount. Our team helps navigate through every phase of the financing process, from the preparation of offering materials, through term sheet negotiation, lender selection, credit documentation and even funds flow on the closing date.

We are adept and experienced at handling a variety of challenging situations, including tight timelines, cross-border/multi-currency facilities, proprietary deals with limited information, acquisition financing in competitive auctions and dividend recapitalizations that return all invested equity (or more).

You’ll gain access to our relationships with over 500 capital sources worldwide and partner with a full deal team led by engaged, senior-level bankers with deep experience. Working collaboratively across the Lincoln platform, we bring industry knowledge, strategic insights and capital markets expertise to each engagement. Lincoln’s debt advisory team enhances certainty of closing by generating multiple bespoke capital structure alternatives and consistently connecting our clients with the best financing package available in the market.

Since the recession, the main shift within the U.K. debt markets has clearly been the emergence of debt funds as prominent finance providers to the mid-market. Some market participants are currently considering bringing unitranche and ABL structures to the European markets. These structures are popular in the U.S., and it will be interesting in the next few years to see whether they will gain traction in the U.K. and the rest of Europe.

Perspectives & Publications

Recent Transactions

Meet Our Senior Team with Debt Advisory Expertise

By linking my experience in debt advisory and mergers and acquisitions, I look forward to delivering flexible and innovative financing solutions to make an impact that matters with long-term target clients, as Lincoln does best.

Daniele Candiani

Managing Director & Co-head of Capital Advisory, Europe

Milan

I build trust with clients by putting their interests first at all times.

Aude Doyen

Managing Director & Co-head of Capital Advisory, Europe

London

I strive to be a strong advocate for my clients and offer a fresh and creative perspective to financing situations that exceed expectations and provide the flexibility needed to grow their businesses.

Christine Tiseo

Managing Director & Co-head of Capital Advisory

Chicago