Q1 2023 Lincoln Senior Debt Index

Lincoln International is pleased to release the quarterly Lincoln Senior Debt Index (LSDI). The LSDI represents years of research and analysis of data and was developed by professionals from Lincoln’s Valuations & Opinions Group in collaboration with Professor Pietro Veronesi of The University of Chicago Booth School of Business.

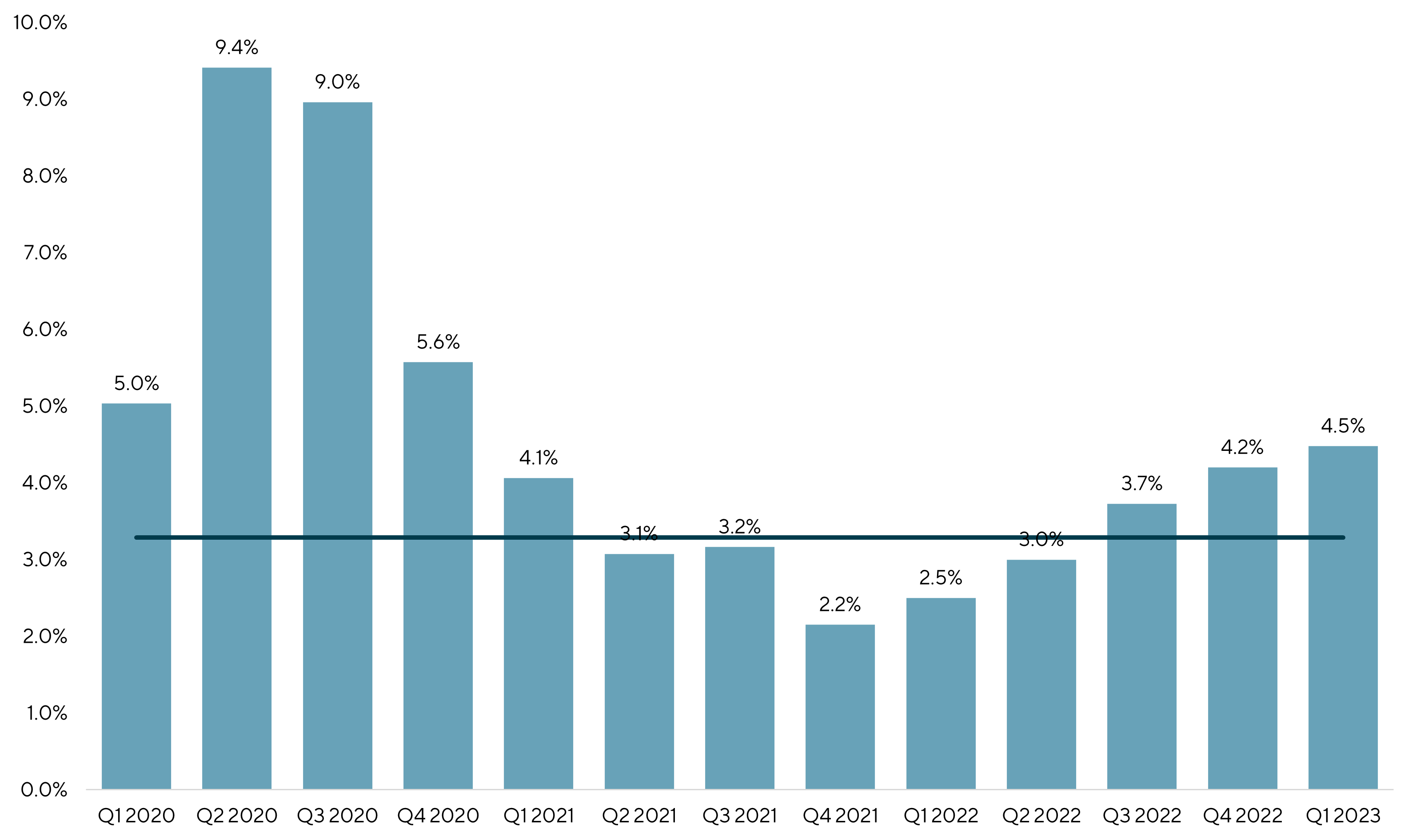

For the quarter ending March 31, 2023, it was good news and bad news for the direct lending market. The good news was that the LSDI yield reached its highest point in its history at 11.6% or a two basis point increase from December 31, 2022 and fair value was stable quarter over quarter at 96.3. However, defaults as of March 31, 2023 continued to increase rising by 30 basis points to 4.5% from 4.2% as of December 31, 2022. In other words, lenders benefited from high interest rates resulting in record yields and stable prices while the accompanying economic slowdown in revenue and earnings combined with high interest rates created additional credit stresses in portfolio companies.

Over the long-term the direct lending market and broadly syndicated loan (BSL) market are highly correlated. However, for the quarter and year ending March 31, 2023 the two markets performed quite differently. The most notable difference is the yield differential between the LSDI and BSL market. For the quarter ending March 31, 2023, the yield difference was only 2.3%; on average since 2016 the yield difference has been 3.9%. LSDI yields have risen from 8.7% to 11.6% (2.9%) from March 31, 2022 to March 31, 2023 whereas BSL yields have risen from 4.4% to 9.4% during this same period (5.0%).

The LSDI provides insight into the direct lending market as it is a fair value index consisting of four components:

|

Each of the four components are then categorized into three types of senior loans:

|

-

Quarterly Overview

- Covers Q1 2023

- The LSDI provides insight into the direct lending market as it is a fair value index consisting of four components: 1. Total return (income return plus capital gain return); 2. Price (i.e., fair value); 3. Spread; and, 4. Yield to maturity.

- Each of the four components are then categorized into three types of senior loans: 1. All senior loans – consisting of first lien, Unitranche, and second lien loans; 2. Senior loans consisting of first lien and 3. Second lien loans.

- Click here to download a printable version of this report.

In addition, we provide additional descriptive statistics including: (a) loan-to-value; (b) the impact of interest rate and credit changes on total return; (c) the results of stress testing spread changes in the current and subsequent quarters and, (d) default rates.

The U.S. non-investment grade corporate loan market has two segments: the BSL market, which attracts larger companies (i.e., as an approximation companies with EBITDA greater than $150 million) and direct lending market (i.e., companies less than $150 million of EBITDA). While correlated, there are subtle but significant differences between the two markets. Both markets primarily provide floating rate loans; however, divergences exist in terms of market liquidity, company size and credit facility size. Given the greater liquidity in the BSL market, pricing and terms are a function of technical market and competitive factors, whereas the more illiquid direct lending market has a stronger orientation to assessing company fundamentals.

In contrast to the Morningstar LSTA US Leveraged Loan 100 Index which is comprised of companies borrowing in the BSL market, the constituents in the LSDI are virtually all companies borrowing in the direct lending market.

How We Obtain the Information

On a quarterly basis, Lincoln values more than 4,500 private companies primarily owned by over 125 alternative investment funds and lenders to funds. Most of these companies are levered via borrowings from the direct lending market. A significant percentage of the LSDI constituents are based upon valuations of loans provided for non-public business development companies and other private investment vehicles and, therefore, not disclosed in public filings.

For many of the private companies valued quarterly, Lincoln advises on the fair value of at least one senior debt security in the capital structure. All valuations conform with GAAP and fair value principles and have been reviewed by fund management, fund boards, limited partners and auditors.

Additional information can be found in our methodology discussion and on our website.

The direct lending market is a significant source of capital to private equity backed middle-market companies. The LSDI benefits market participants by providing information to facilitate a greater understanding of the attributes of this important source of capital to the private sector.

| 96.3 |

| Average Fair Value of Loans in the Index as of Q1 2023 |

Results

Total Return

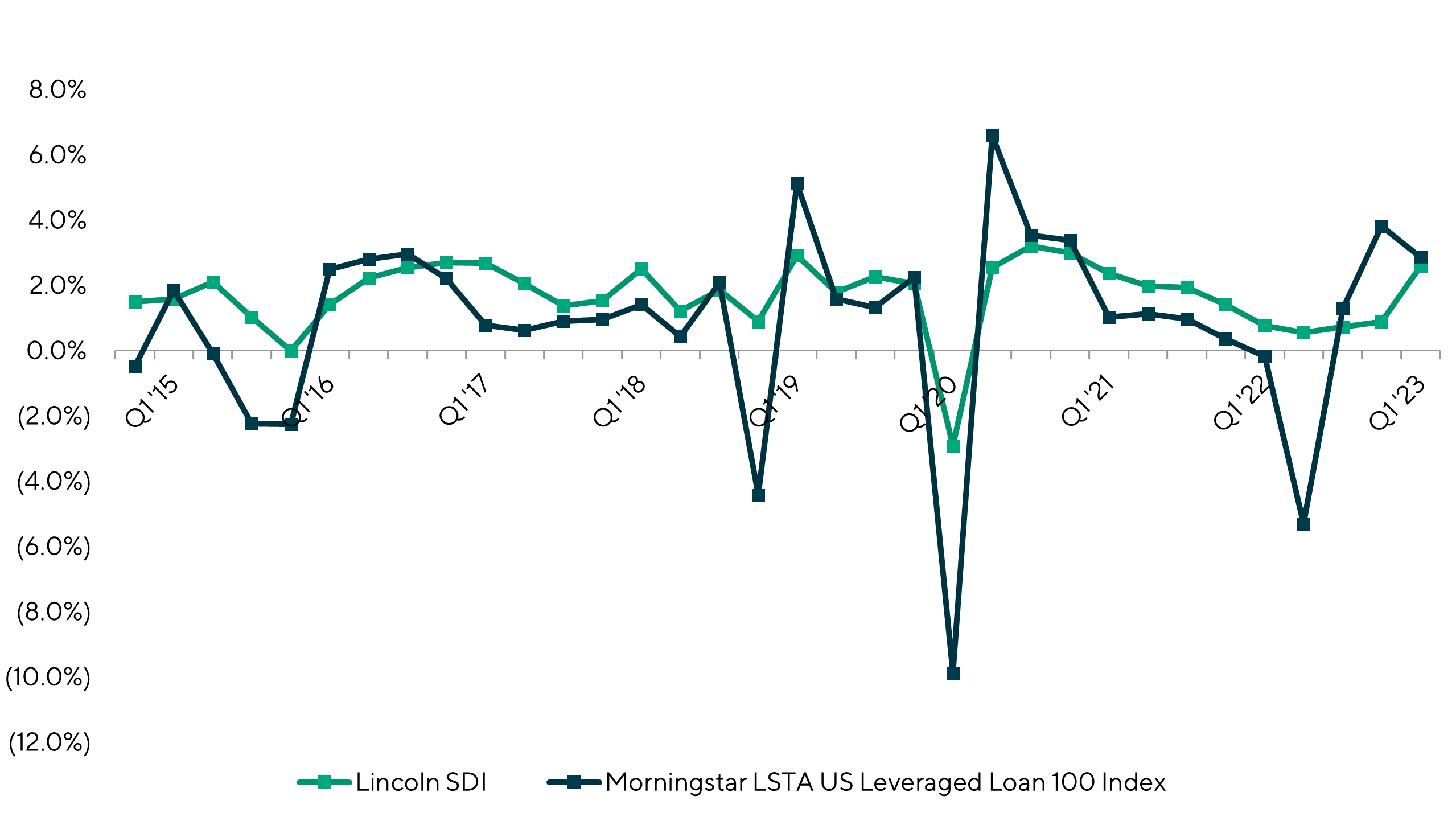

Comparison of Total Return – Lincoln Senior Debt Index (All Loans) to Morningstar LSTA U.S. Leveraged Loan 100 Index

Correlation and Comparison of Quarterly Returns – Lincoln Senior Debt Index (All Loans) to Broadly Syndicated Loan Market

Yields

Comparison of Yields – Lincoln Senior Debt Index (All Loans) to Broadly Syndicated Loan Market

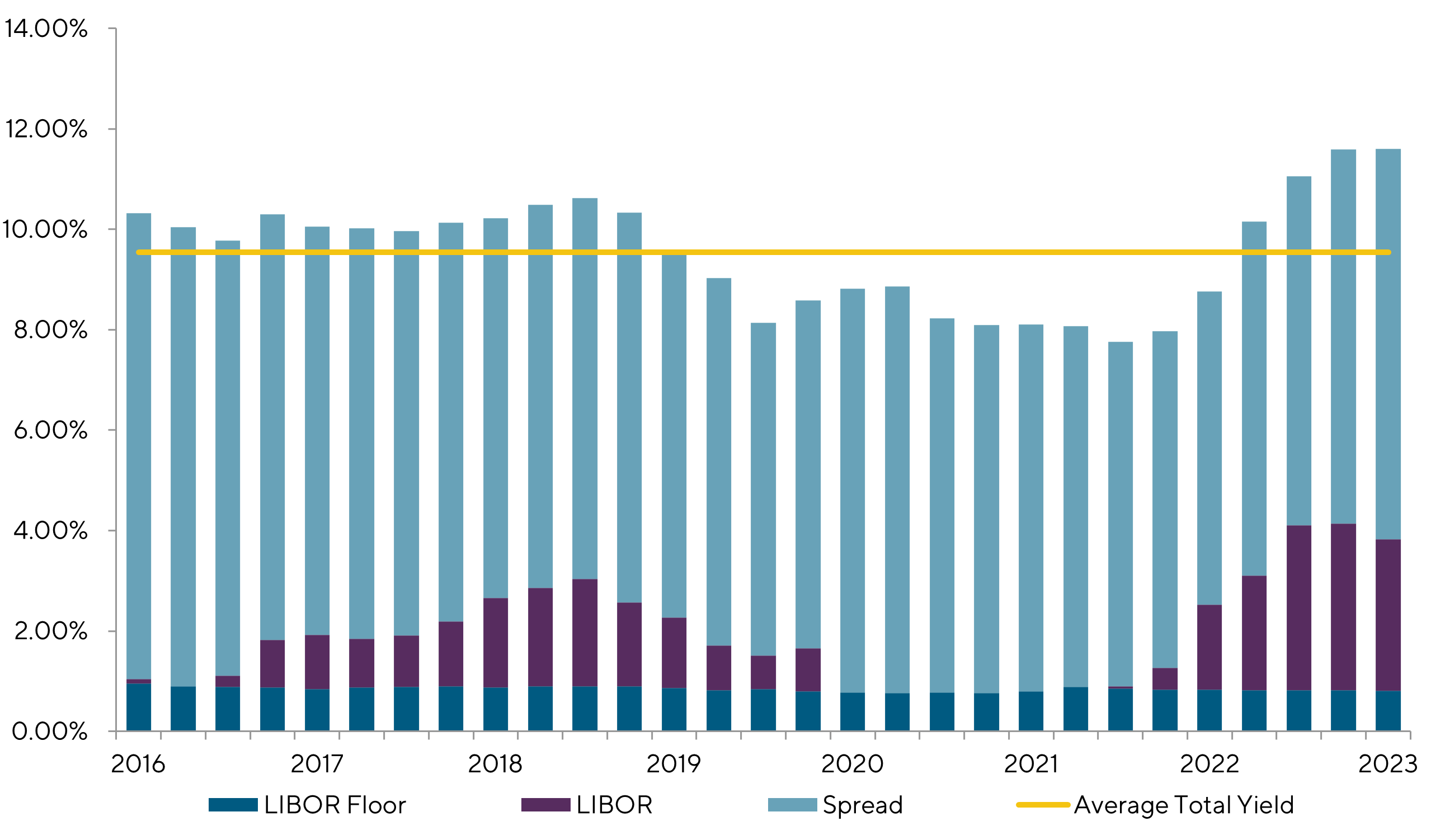

Decomposing Yields in the Direct Lending Market – LIBOR Floors and Spreads

Decomposing Yield – LIBOR, LIBOR Floors and Spreads – All Loans

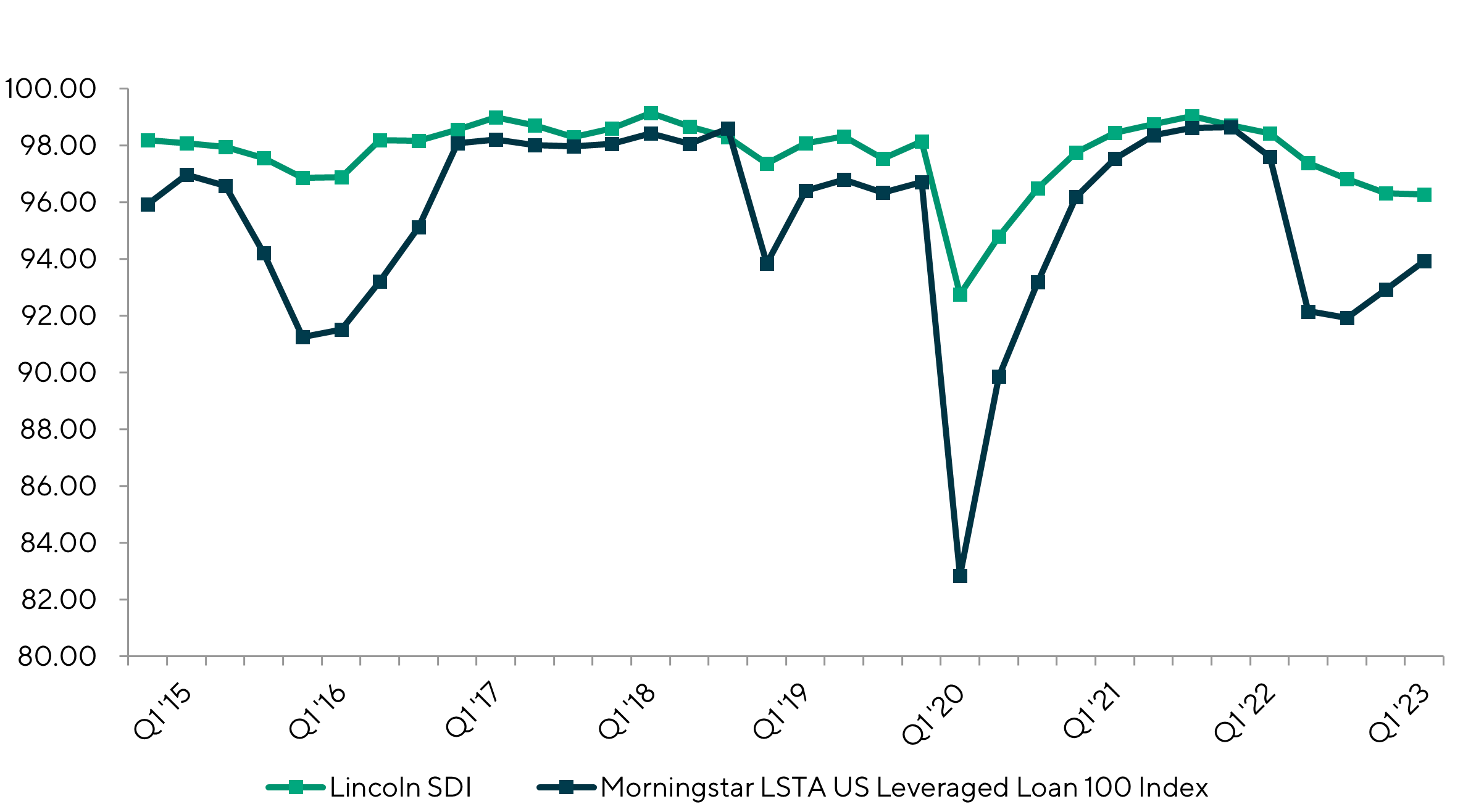

Fair Value – Price – Trends

Fair Value – Lincoln Senior Debt Index (All Loans) Compared to the S&P / LSTA U.S. Leveraged Loan Index

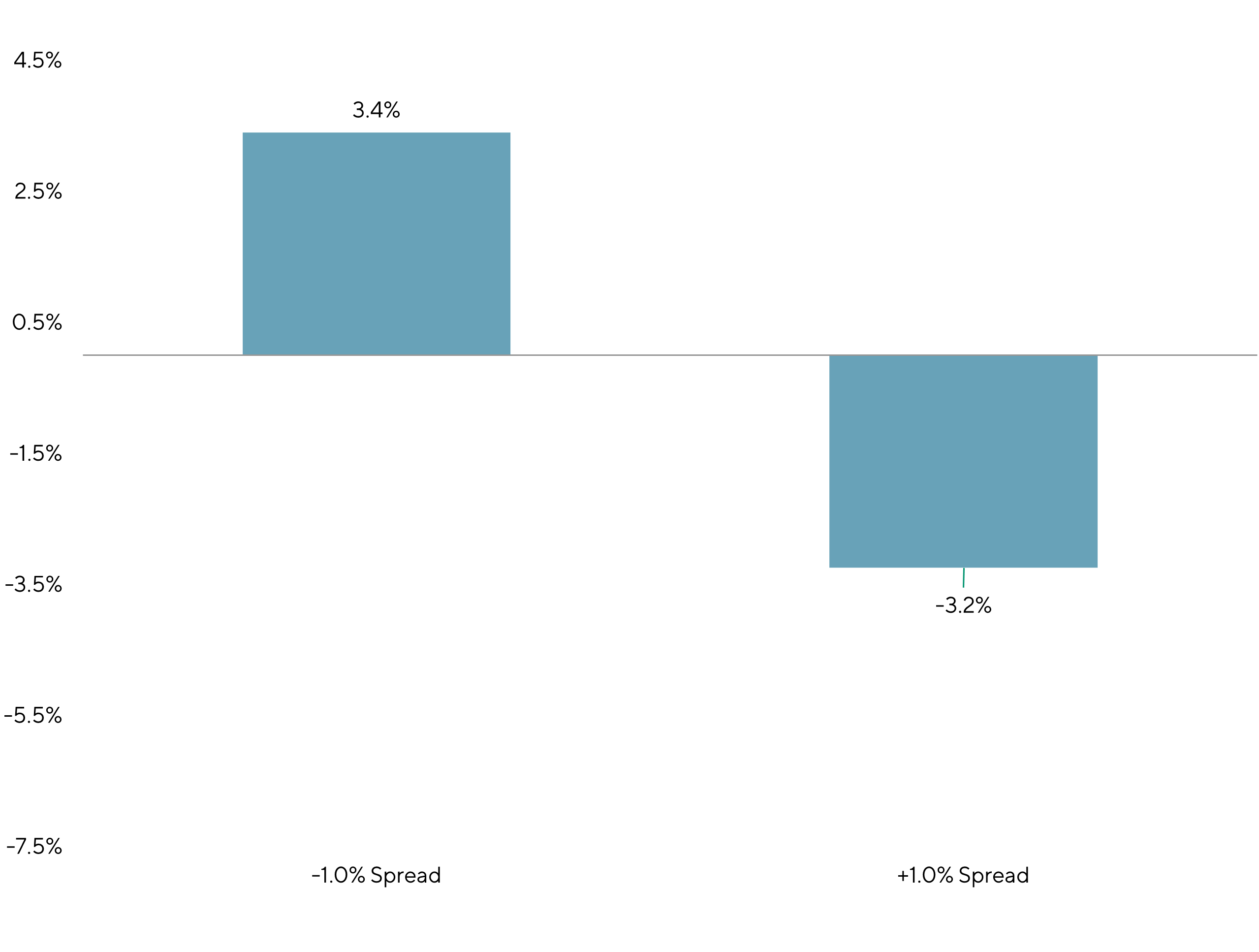

Bifurcation of the Impact on Total Return Due to Credit Risk and Interest Rate Risk

Decomposition of Index Returns: Interest Rate versus Credit Risk

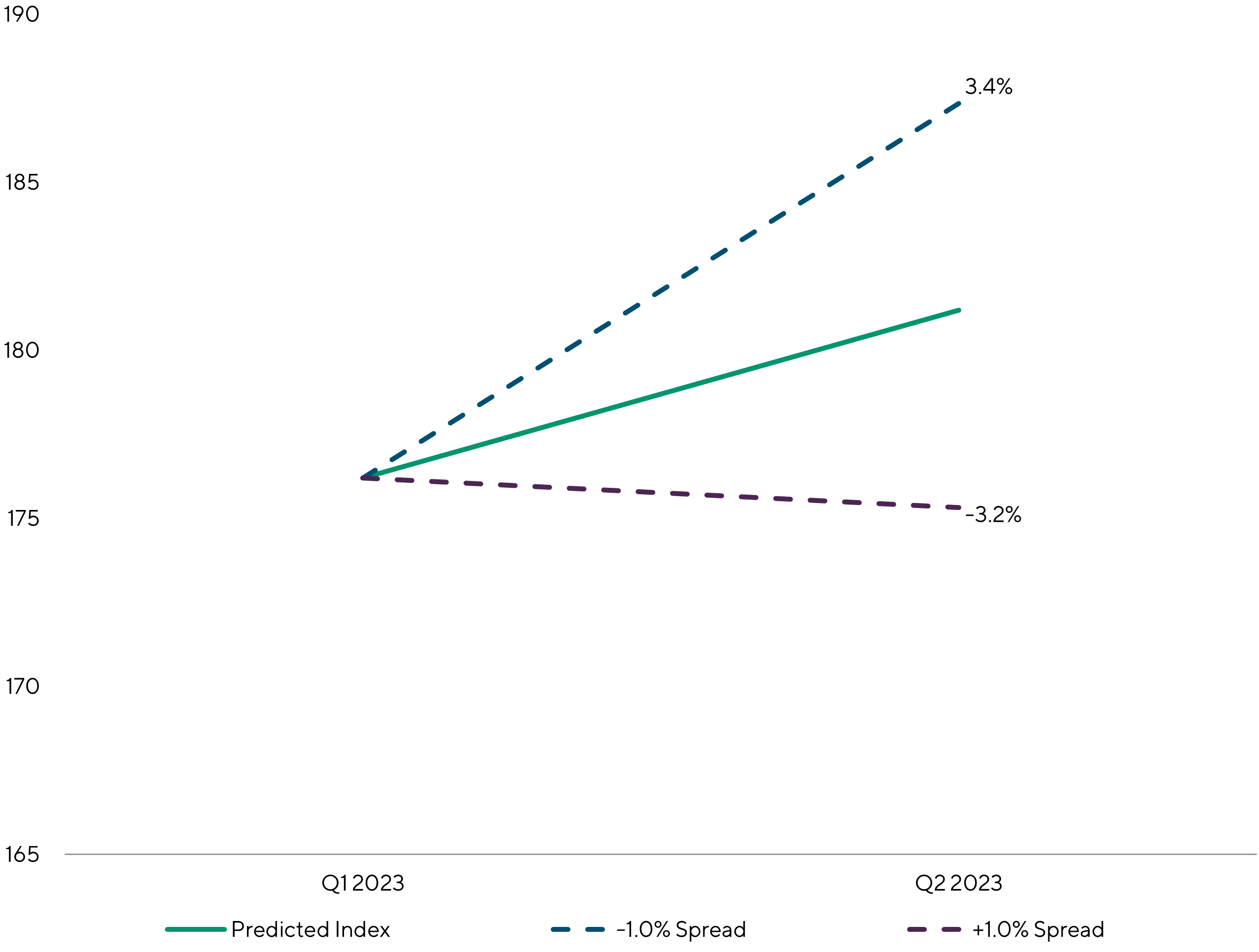

Lincoln Senior Debt Index Forecasted Spread Sensitivity

Methodology

Source of Data and Sample Size

On a quarterly basis, Lincoln determines the enterprise fair value of over 4,500 portfolio companies for approximately 125 private equity sponsors and lenders. These portfolio companies report quarterly financial results to the sponsor (i.e., private equity group) or lender. Lincoln obtains company and loan level information to create the LSDI.

All information is prepared in accordance with the fair value measurement principles of generally accepted accounting principles. Finally, each valuation is then vetted by auditors, company management, boards of directors and regulators.

Additional information about the methodology of the LSDI can be found at: www.lincolninternational.com/perspectives/an-overview-of-the-lincoln-senior-debt-index.

Academic Advisor

Professor Pietro Veronesi is the Chicago Board of Trade Professor of Finance at the University of Chicago, Booth School of Business. He is also a research associate of the National Bureau of Economic Research and a research fellow of the Center for Economic and Policy Research.

Professor Veronesi’s research has appeared in numerous publications, including the Journal of Political Economy, American Economic Review, Quarterly Journal of Economics, Journal of Finance, Journal of Financial Economics and Review of Financial Studies. He is the recipient of several awards, including the 2015 AQR Insight award, the 2012 and 2003 Smith Breeden prizes from the Journal of Finance, the 2008 WFA award, the 2006 Barclays Global Investors Prize from the EFA, the 2006 Fama / DFA prizes from the Journal of Financial Economics and the 1999 Barclays Global Investors / Michael Brennan First Prize from the Review of Financial Studies. Professor Veronesi teaches both masters- and Ph.D.-level courses. He is the recipient of the 2009 McKinsey Award for Excellence in Teaching.

His undergraduate work was in economics at Bocconi University where he received a laurea magna cum laude with honor in 1992. He earned a master’s degree with distinction in 1993 from the London School of Economics. He joined the Chicago Booth faculty upon obtaining his Ph.D. in Economics from Harvard University in 1997.

SummaryQ1 2023 Lincoln Senior Debt IndexFrom 2014 through March 31, 2023, a portfolio of direct lending loans has yielded higher returns and lower volatility relative to BSLs. The LSDI provides market participants many unique valuation insights into the fair value of direct lending loans and represents a significant enhancement to the information available within an opaque market. |

Contributors

I find immense fulfillment in enabling clients to achieve their objectives and navigate the complexities of today's ever-changing landscape.

Chris Croft

Managing Director & Co-head of Transaction Opinions

New York

I enjoy sharing insights about market and valuation trends with my clients, while also leading a differentiated and high-touch process.

Brian Garfield

Managing Director & Head of U.S. Portfolio Valuations

New York

I enhance my clients’ decision making and governance processes by providing independent and objective financial advice in a highly responsive manner.

Chris Gregory

Managing Director & Co-head of Transaction Opinions

New York

I enjoy the opportunity to provide clients with insightful and unbiased advice that will help them make the most informed decisions possible.

Ron Kahn

Managing Director & Co-head of Valuations & Opinions

Chicago