Getting from A to B: A Roadmap to Freight Forwarding

A Closer Look at Shifting Dynamics like COVID-19, Flight to Scale, and Tech Disruption

Mar 2020

With the rolling in of a new decade came the inking of a “phase one” trade deal between the US and China, finally beginning to draw escalating tensions and tit-for-tat tariffs to an anticlimactic close. The trade war left ripple effects throughout the global freight forwarding space. Last year saw weaker year-over-year performance from top freight forwarding companies as retailers and manufacturers worked through excess inventory accumulated during significant pre-buying activities in 2018 to avoid the impact of potential tariffs. With diminished industrial manufacturing output during the “hangover” in 2019 in the US, but also in key European economies such as Germany, air freight forwarding volumes saw consistent year-over-year declines throughout 2019, whereas sea freight forwarding volume growth remained positive, albeit significantly below the prior year.

The trade wars also reshaped the geographical landscape of the freight forwarding space as some retailers diverted their manufacturing away from China and to countries like Vietnam with favorable manufacturing capacity and cheap labor. In Europe, near-shoring continued to remain a popular solve with European production moving to Central and Eastern Europe or Northern Africa and some US companies turning to low-cost and nearby Mexico. With the shifting of shipping geographies and increased uncertainty , cross border M&A activity slowed relative to historical levels as many players focused on domestic opportunities while concurrently developing longer term strategies to diversify their footprints in attractive markets abroad to reduce the potential impact of future trade disruptions.

With the start of this decade has come a new factor bringing uncertainty to the space: the spread of COVID-19 from China around the globe. As factories have shuttered and supply chains have shifted, the geography of contagion has rapidly and continuously altered manufacturing and logistics plans. Yet, COVID-19 also brings increased demand for the expedient manufacturing and transportation of some desperately needed resources (i.e. respirators, masks, cleaning supplies, medications) that are flying off the shelves in hard hit regions and essential to treatment in local hospitals.

M&A Opportunities Still Abound in Freight Forwarding

Consolidation is nothing new in the freight forwarding space, with ample opportunity still ahead.

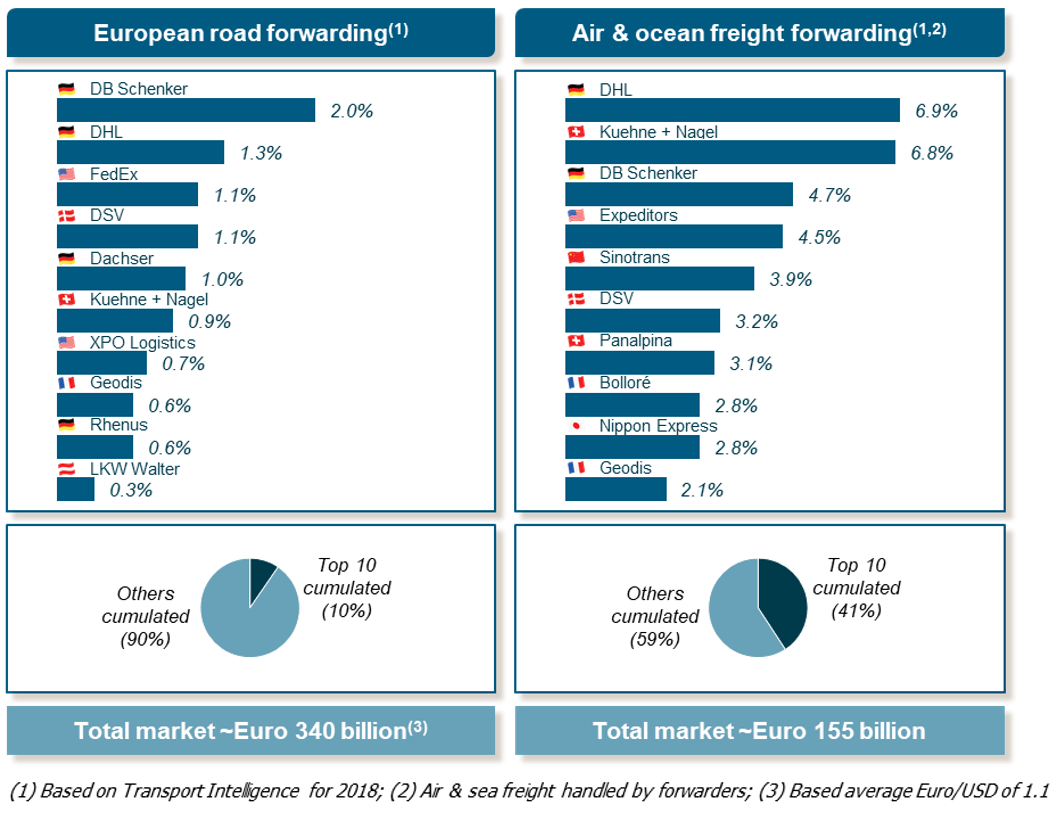

The global forwarding space remains deeply fragmented. In European road forwarding, for example, the top 10 players only hold 10% of market share overall. Even in the more consolidated global air and ocean freight forwarding space, the largest players hold just 41% of the market—leaving the majority ripe for consolidation.

Consolidation appeals to investors looking to enhance their bottom line by: |

||||||

| Building economies of scale – with scale comes the purchasing power and ability to achieve higher capacity and utilization | ||||||

| Expanding global footprints – forwarders can expand their geographical footprint to new destinations | ||||||

| Building end-to-end service capabilities – some use M&A to expand their trade lanes, specialty skills (e.g., transporting perishables) or in order to move toward becoming an end-to-end provider with a global supply chain | ||||||

The market is likely to continue to undergo this flight to scale, which will force small-to-medium sized players to seek larger platforms to remain competitive as requirements to invest in technology, infrastructure, broader footprints and service capabilities accelerate.

Four factors to look for in a target: |

||

| 1 Scale per trade | 2 Automation | |

| Key competitive advantages from scale (e.g., negotiation power, treatment by carriers, optimal capacity utilization, etc.)

Scale is relevant per specific trade lanes – but overall scale at company level is not decisive |

Integration of automated solutions for capacity management, booking, pricing and CRM

Elimination of paper-based processes Tech platform for customer interfacing |

|

| 3 End-to-end service quality | 4 Sales force effectiveness | |

| Engender customer loyalty through superior service

End-to-end solutions from warehouse to warehouse comprising of value-added services and supported by advanced IT |

Sales staff meeting the needs of the most important customers on a consistent basis

Key account management programs for effective guidance and development of relevant sales skills |

|

Tech Disruptors Shake Up Freight Forwarding Space, Making Waves for Traditional Players

Another factor fueling disruption in the freight forwarding space is the emergence of tech platforms looking to eradicate the biggest customer pain points in the industry: price opacity and tedious manual processes.

Many digital freight forwarding start-ups, such as Convoy, Flexport, Turvo and Freighthub, have received significant venture and PE funding amidst record high valuations. The disruption that these innovative players are causing threatens to drastically change the traditional forwarding landscape with pure brokers exiting the market and longstanding traditional forwarders who are slow to embrace the change being displaced by rapidly growing and well-funded new entrants.

But the new innovations that digital startups are bringing to the industry—rate discovery, clear price transparency, track and trace for containers, etc.—also present a ripe opportunity for investors looking to buy and build freight forwarding platforms that can weather the storm of disruption.

Increasingly, we’re seeing traditional freight forwarders embracing technology by either internally developing their own solutions to remain competitive (e.g., Kuehne&Nagel/Freight-Net, Agility/Shipa Freight, Maersk-Damco/Twill Logistics, etc. ) or making strategic investments or forging partnerships with others to stay viable (e.g., DBSchenker/uShip, Maersk/Ali Baba’s One Touch, Geodis/Upply, etc.).

Ultimately, large incumbents that invest in digital technology appear to be best-positioned to prevail combining the benefits of digital with “real-world” door-to-door contract logistics expertise. But at the same time, there will be digital platforms gaining attractive scale in segments of the market, especially the ones that require more standardized services. Many incumbent mid-market players, on the other hand, distinguish themselves by special regional or industry expertise, addressing complex needs such as protective packaging, immediate pickup or temperature control. Still, it will be imperative for them to invest in digitization, enabling efficiency gains as well as interfacing with shippers and carriers directly as well as via the various emerging digital eco-systems.

One takeaway of digitalization seems crystal clear: consolidation may be on the horizon. The many emerging startups in the logistics and transportation space will be acquired by investors hungry to build innovative growth platforms for the future and capitalize on the benefits of supply chain optimization. This will allow them (i) to build critical mass both in terms of shippers as well as logistics services providers and (ii) to add relevant tools for enhancing transparency, visibility, collaboration and improved utilization of transport assets.

Lincoln Perspective: |

In the near term, COVID-19 will certainly have an impact on the pace and volume of M&A activity in the logistics and transportation industry, as well across many other sectors, but the magnitude is difficult to predict as current events are unprecedented and evolving on a daily basis. While we don’t know what the full extent of what the impact will be, historically uncertain economic and market conditions have reduced M&A activity. However, we expect this unprecedented climate to more severely disrupt mega-deals vs. the middle market.

Our expectation is that there will be a pause in activity, but deals will still get done this year, most likely in later quarters. With record levels of dry powder on the sidelines, private equity still faces pressure to put their capital work. Some may even benefit from the thinning of the herd to acquire good businesses at great values.

There is no doubt that the logistics market has been significantly impacted by COVID-19’s spread, including both airfreight and container shipping. While it is indeed impossible to predict implications in the time before a vaccine comes to market, a silver lining may include:

- The current shortage of air cargo capacity in the belly of passenger planes may create opportunity for well-versed forwarders and other emergency logistics players.

- Further, e-fulfillment, contract logistics and last mile businesses could be seen as a field benefitting from the demand (e.g. Amazon just announced plans to hire 100,000 warehouse and delivery workers.)

- Last, there will be a substantial re-stocking taking place in the future to the benefit of air freighting.

Looking ahead at the longer-term, we do believe that opportunity remains for PE investors and corporates looking to consolidate the forwarding space down the line:

| PE, get ready to buy and build: The fragmentation of the forwarding industry offers an attractive backdrop for executing a buy-and-build strategy. The key is to develop a focused thesis to invest in specific verticals to establish scale and market leadership. It is more challenging to build a successful platform that is a copy-cat player in many niches, without clear differentiation/leadership in any particular one, as it can be difficult to compete with larger competitors. This approach is also optimal for creating synergetic exit opportunities. It is particularly appealing to overseas corporate serial acquirers seeking external growth complementing (i) regional presence or (ii) skill sets, while (iii) showing sound protection against commoditization. | |

Corporates, don’t miss out on middle market targets: While many corporates may be seeking larger scale acquisitions, there are actionable targets that can help to:

|

Summary

-

Lincoln International's Global Business Services professionals discuss mergers and acquisitions opportunities in freight forwarding

- Click here to listen to Lincoln International Managing Director Gaurang’s Shastri’s perspectives shared with Bloomberg Radio on March 17 (start at 16:45)

- Click here to download a printable version of this perspective.

-

Lincoln International has created a Playbook to support business leaders in documenting and articulating their COVID-19 response. To request a copy, click here. - Sign up to receive Lincoln's perspectives

Contributors

Meet our Senior Team in Business Services

I am enthusiastic about creating sustainable growth and the highest value for our clients and strive to leave a positive footprint beyond any successful M&A transaction.

Friedrich Bieselt

Managing Director & Head of Business Services, Europe

Frankfurt

The transactions we work on are often trajectory-altering, with high stakes and pressure to get it right. We know our work, however challenging in the moment, is going to be impactful.

Mike Iannelli

Managing Director & Co-head of Business Services

Chicago