What’s Old is New Again: Value-Based Care Delivery in the Home

Dec 2022

In 1930, physicians visiting patients in their residences represented 40 percent of all encounters. 20 years later this figure had fallen dramatically to just one visit in 10. By the time Reagan became President, only about one percent of patient visits happened in the home. There were many factors influencing this evolution – cost, regulation, technology and societal changes. However, the U.S. is now amid a realignment of care delivery back into the home and community, reversing a century-long trend.

The confluence of several meta-trends has set the stage for this paradigm shift. First, the aging population has created insatiable demand. There will be 70 million seniors (over 65) in the U.S. by 2030. That number will balloon to 98 million by 2060, and seniors will represent nearly 25% of the U.S. population. Second, many seniors live with chronic conditions, mobility limitations or cognitive impairments that reduce their ability to ambulate. There are also currently more than 13 million “dual eligibles” who account for a disproportionate share of the disease burden and medical cost. It is generally recognized that the U.S. system for senior care is reactive and broken. There are virtually no interventions between acute episodes to mitigate the long-term trends of declining health. Health systems, physicians and managed care organizations are thinking creatively to find better ways to care for elderly including ways to avoid costly hospitalizations. Third, the COVID-19 pandemic fomented a movement amongst payors, patients and physicians alike for more in-person and virtual care delivery in the home for greater patient safety, engagement, access and satisfaction.

Summary

-

Lincoln International provides an overview of the value-based care movement centered on home and community based settings including trends, drivers and representative participants.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

While these factors have rekindled the movement of more home-based management of seniors, questions remain about the ability of the medical delivery system to care for the non-medical needs of seniors as well as the misalignment of incentives around costs in a fee-for-service paradigm.

Exposition of the Ecosystem

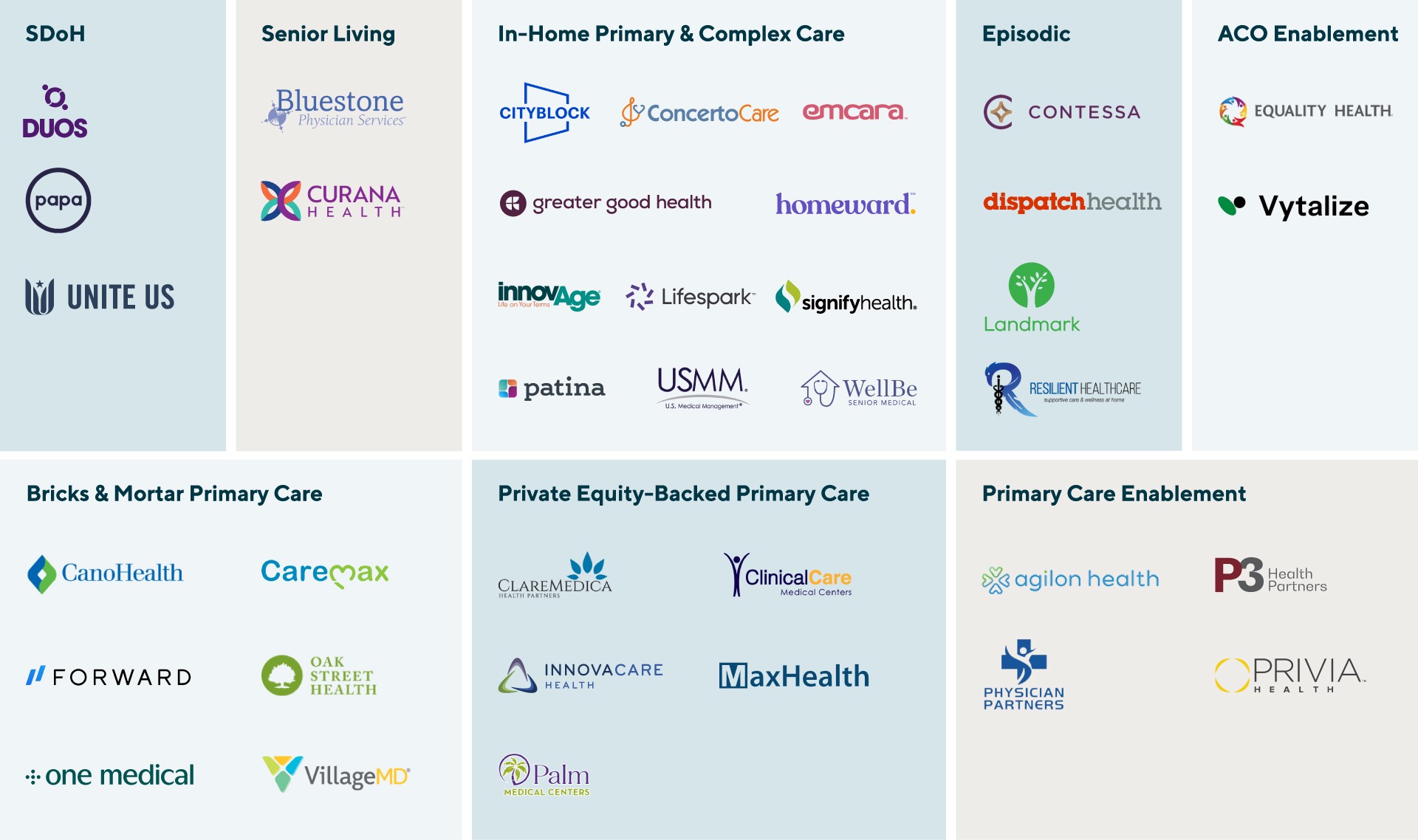

For too long, healthcare providers have relied on a siloed approach that prioritizes securing discharges and treating episodes of care, leaving significant opportunity to improve process efficiencies and patient outcomes. Across the value-based care (VBC) landscape, three categories of businesses are primed to break down silos and improve delivery of care.

| In-Home Primary and Complex Care: This large subset of businesses takes a holistic approach to care with a comprehensive view of the patient, oftentimes deploying a tech-based approach to complement providers deployed into clients’ homes. Representative participants in this category include ConcertoCare, InnovAge, Lifespark, U.S. Medical Management and WellBe Senior Medical.

Episodic Care: These home health partners manage acute episodes with a “hospital at home” level of care. Episodic providers can sometimes be a competitor to in-home primary care in cases where they ultimately become in-home primary providers, or they can complement the existing primary care service providers as they help patients transition from in-facility to at-home care. Representative providers include Contessa Health, DispatchHealth and Landmark, among others. Social Determinants of Health: These organizations address environmental, socio-demographic and health-adjacent concerns to help improve health status and access to care (e.g., facilitating meal delivery, facilitating social interactions, transportation and more). Sample participants include DUOS, papa and UniteUs. |

Attractive investment opportunities across the VBC ecosystem continue to attract new investors every day. In addition, several repeat investors—such as Town Hall Ventures, Oak HC/FT, Deerfield Management and HLM Venture Partners among others – have made multiple investments in VBC providers, further establishing credibility across the sector.

VBC Provider Landscape

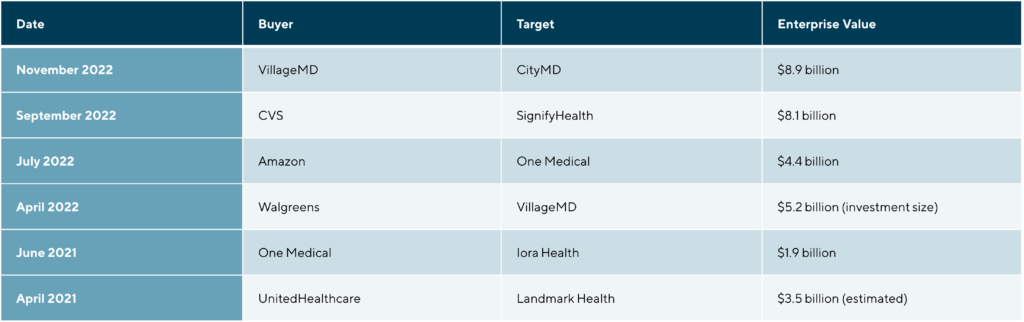

Assessment of Recent Transactions

Given health delivery’s tremendous growth potential and their strong consumer brand awareness, large retailers have been getting in on the opportunity bridging the “last mile” of care delivery. While mass merchants have great brand awareness, geographic reach and some brand permission into health and wellness, they typically lack the clinical knowledge and personnel necessary to treat and bill for care. As a result, there has been considerable acquisition activity from this non-traditional category of buyer.

In most industries, earnings before interest, taxes, depreciation and amortization (EBITDA) is used as the traditional basis of valuation. For VBC models, however, many companies have negative EBITDA due to the significant scale required to reach profitability. In the absence of EBITDA, either revenue, medical spend under management, or covered lives are frequently used as proxies for determining valuations.

Notable Recent Strategic Deals

Lincoln Perspective

Investments in technology, care strategy and resource delivery will be essential to effectively provide seamless, personalized care in a way that can help address health inequities and gaps in access. Mergers and acquisitions (M&A) can be a key driver of those investments at scale, and the window of opportunity is currently wide open.

As the M&A landscape evolves, it presents opportunities for streamlining delivery of resources and care while treating patients across the continuum of their care journey. Healthcare businesses themselves, as well as their investors, should prioritize the following considerations when evaluating a potential transaction.

| Efficiency: For too long, home health care has not been aligned on efficiency. Additionally, historical reimbursement themes have provided incentives for use of services rather than actual service outcomes. Additionally, the traditional care model focuses largely on reactive health care versus preventative care. Eliminating those incentives and aligning payment and outcomes can not only ensure patients receive effective and efficient care, but it also helps providers demonstrate how they track against competitors.

Standardization: Operators need to standardize services in order to improve care quality. Historically, organizations have staff whose care delivery varies in length, ultimately blurring the relationship between measure of cost and treatment outcome. Companies that can effectively demonstrate to consumers and hospitals the savings they drive will be attractive targets for investors. Data on demonstratable savings is often scrutinized closely by potential investors, so having clear, compelling data on outcomes is critical. Additionally, established partnerships with an anchor payer or health system can help ensure home health providers receive patients that can benefit most from a VBC approach. Moreover, VBC companies can harness the data of payers and health plans to understand risks and develop more preventative care strategies. Quality: What ultimately ends up driving value for targets is the quality of care the company delivers to plan members. It is not good enough to build a tech solution and take on the associated risk. Quality of care means establishing robust care protocols supported by data-backed evidence. Investors focus diligence efforts on evaluating how a business delivers on a range of key performance indicators—such as reduced costs relative to peers, platform scalability, lower rate of re-hospitalization for patients and proof of driving improvements in clinical outcomes. |

Contributors

Meet Professionals with Complementary Expertise

It’s extremely rewarding to work in one of the largest and most diverse global business sectors helping support clients to realize their goals.

Matthew Lee

Managing Director, Head of UK & Co-head of Healthcare, Europe

London

I enjoy working closely with clients to overcome challenging situations and to develop strategies to meet their business goals.

Dirk-Oliver Löffler

Managing Director & Co-head of Healthcare, Europe

Frankfurt

My goal is to bring the best of Lincoln to each and every transaction, ensuring the topmost outcomes for our clients.

Roderick O’Neill

Managing Director & Co-head of Healthcare

New York