Tying the Knot: Auto Suppliers Should Follow the OEMs’ Example and Partner up to Meet Industry Demands

The automotive industry continues to undergo radical transformation as the impact of electrification, autonomous driving and ride sharing gains pace. To address these new technologies, players in the auto industry—both at the original equipment manufacturer (OEM) and supplier level—need to meet unprecedented high capital requirements.

This is occurring as the near-term outlook for production volumes and sales is hazy with uncertainty. The Chinese market, so frequently the driver of global growth, is down a dizzying 12.1% year-to-date. The U.S. is past its peak of production and we are uncertain as to how deep the next downturn could be. In addition to concerns about cycle, the likelihood of recession in the U.S. appears to be rising, growth in Europe is anemic, with recent U.S.-China trade war escalations beginning to boil over to impact other players on the global stage.

With a weaker outlook and increasing capital demands, the industry’s focus has shifted to evaluate partnerships and joint ventures as well as acquisitions to achieve strategic objectives. Partnering allows automakers to achieve economies of scale and share the burden of the substantial investment required to build the cars of the future, gaining synergies from technical advances developed by each party to date.

This summer, for example, we saw Volkswagen and Ford enter a multi-faceted partnership in the autonomous driving and electrification space. Volkswagen agreed to join Ford in investing $1 billion in Argo AI, throwing into the mix its own Autonomous Intelligent Driving technology. The two groups will use Volkswagen’s Modular Electric Toolkit (MEB) as the architecture underpinning both of their electric vehicle platforms.

This announcement is one in a long list of partnerships that have taken the auto industry by storm in the past several years as automakers spread the cost and risk of tech investments amongst their peers. In June, for example, SoftBank and Toyota’s self-driving car joint venture, Monet, received investments from five different Japanese automakers.

Tier 1 suppliers face similar challenges and partnerships present a path to success

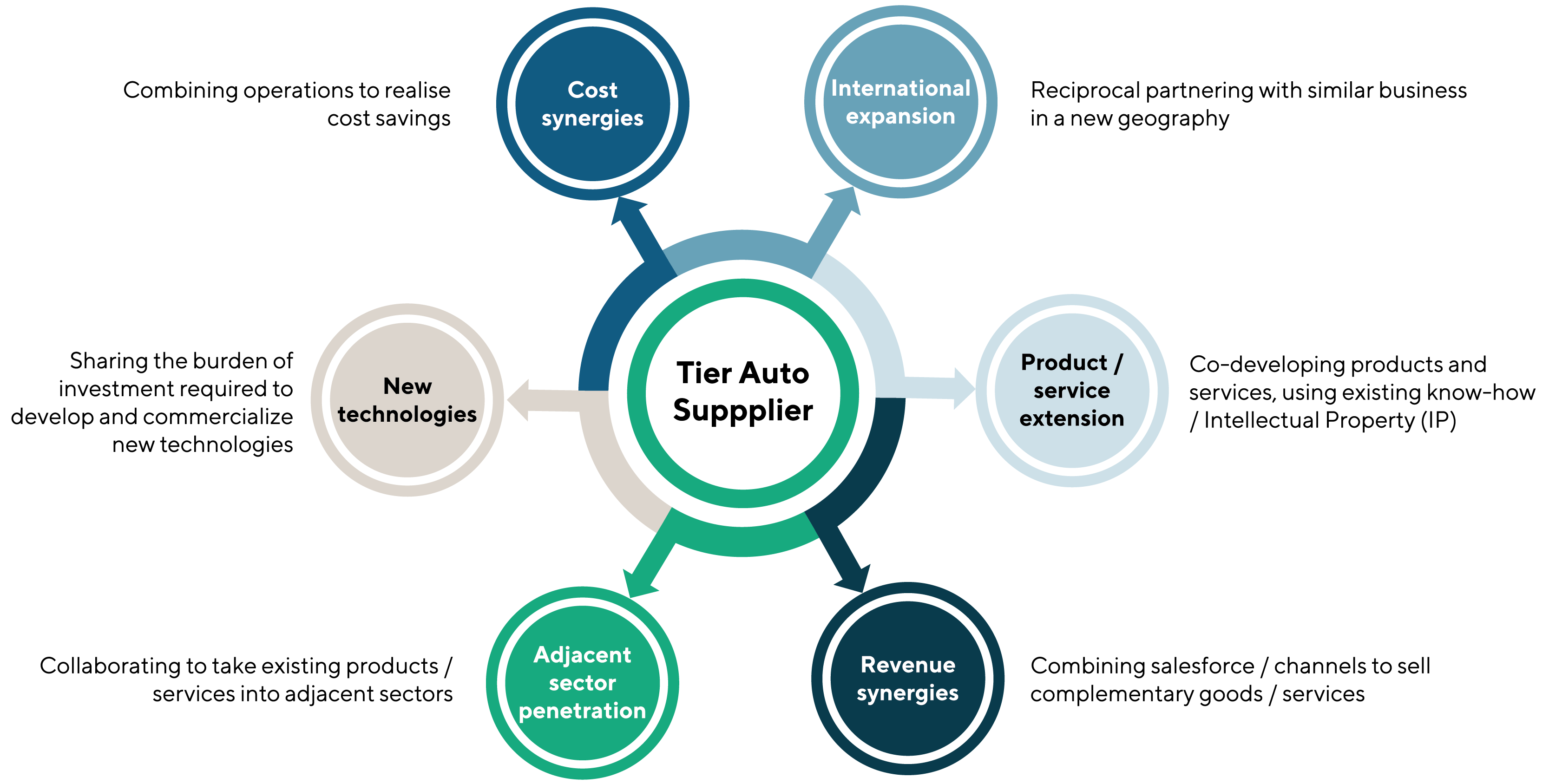

The impact of such deals is rippling down into the middle market. Our team believes that there is ripe opportunity for Tier 1 suppliers to partner too—with tech companies, with their own competitors or with businesses in adjacent sectors—to accelerate their growth trajectory.

Bosch is one example. Their recent deals include:

- EM-motive – established as a joint venture between Daimler and Bosch to develop electric motors before being bought out by Bosch

- Partnering with Mahle in the turbo charger space, before subsequently selling the business to Fountainvest

- Acquiring a shareholding, alongside Continental and the leading German OEMs, in the HERE digital mapping business

In a period of such turbulence and such uncertainty about the timing and nature of change in the industry, many suppliers are unwilling or unable to place “big bets.” Careful partnering—in the form of collaboration agreements and limited scope partnerships as well as full-blown equity JVs—can generate positive “news flow” and provide a window into new tech developments without breaking the bank.

However, such arrangements require meticulous planning and rigorous execution by seasoned experts if they are to deliver the intended benefits. Unlike any other investment bank, Lincoln has a specialist team in place to help identify and evaluate options, filter ideas robustly to select the right partner and execute deals that deliver real value. Whether a partnership is on the table because of the cost-prohibitive price of acquiring—or, as we increasingly see, the partner is simply not for sale or is headquartered in a market where a local partner is required by law (think: China or the Middle East)—you need an advisor who is qualified to “kick the tires,” give the relationship a “test drive,” and cement a match which will last.

Summary

-

Lincoln International's automotive experts team up with the firm's joint ventures and partnering team to discuss the increasingly important role of partnerships in the auto industry.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Contributors

Meet our Senior Team in Automotive & Truck

I leverage strategic insights and industry connections to unlock value for clients.

Joe Sparacino

Managing Director

Boston