The Next Course for UK Chain Restaurants

Sep 2020

During the month of August, Britons were encouraged to dine out through the “Eat Out to Help Out” scheme. Every Monday, Tuesday and Wednesday participating restaurants offered a 50 percent discount, up to £10 per person, on food and non-alcoholic drinks. 84,000 restaurants took part, benefitting diners with an average £5.25 discount on their bill.

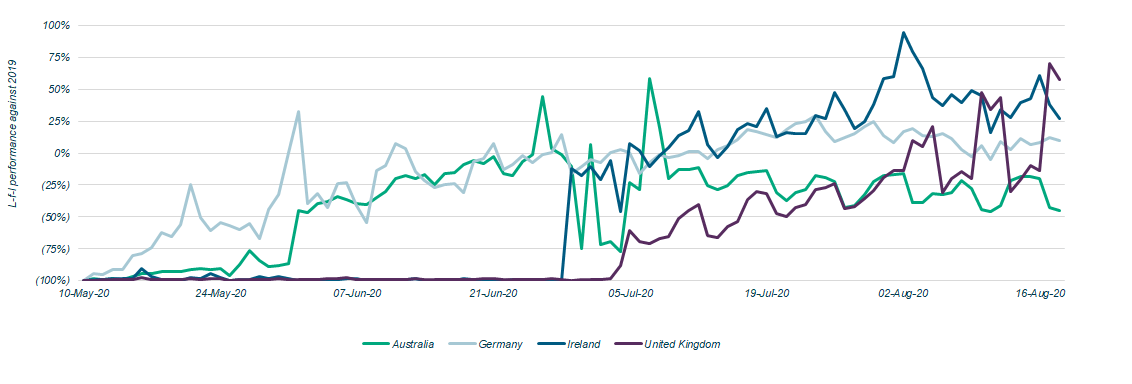

The effort brought diners to the table after months away—August trading peaked at a 70% LFL high against the same day of the week in 2019 based on OpenTable bookings. In the final week of the scheme, full week sales were up 39% from the prior year. Many chain restaurants are now self-funding a continuation of the initiative in September, with Propel reporting that establishments including Prezzo, Franco Manca, TGI Fridays, Slug and Lettuce, Loch Fyne, JD Wetherspoon will be continuing to offer variations of the government discount scheme.

Seated diners across a sample of c. 20,000 re-opened restaurants within the OpenTable network

In the years following the last recession, full-service chain restaurants experienced sales growth. However, after reaching a peak of 4,326 chain restaurants in 2016, the market began to over correct and decline to approximately 4,000 locations in the UK by the end of 2019.

Historically, private equity investors gravitated towards chain restaurants because of their “cookie cutter” model and ability to open restaurants in attractive locations that yielded strong returns. However, when the number of chain restaurants peaked in 2016, there was a saturation of “food concepts” (i.e. burger themed restaurants) and establishments struggled to compete in the crowded marketplace.

While many in the industry are hopefully optimistic that the industry will recover from the challenges created by COVID-19, others believe a full recovery will never happen.

Looking ahead, many market participants expect that restaurant sales will reach 65-75% compared to 2019 by year end, and 75-85% by the end of 2021. To find success, restaurants will need to innovate in how they attract customers back to the premises. In addition to offering a safe eat-in environment or excellent service, diversification of income streams will become necessary and common place and we will continue to see an increase in delivery options.

As the government ends support schemes like furlough and rent cancellations, PE investors will take advantage of bargain acquisitions on the high street as many multi-site operators will continue to struggle. Others will sit on the sidelines waiting for the market shake out before placing their bets. PE investors with existing chains looking to expand will seize an opportunity to grow cherished concepts with low capital expenditure requirements in attractive locations at good value leases.

For more information on the UK restaurant sector, please download our analysis and benchmarking report here.

Summary

-

Lincoln International's UK restaurant sector professionals explore the future of the industry and implications of the Coronavirus (COVID-19).

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives