Strong Momentum for the German M&A Market in 2020 Despite a Challenging Economic Environment

Sep 2019

Originally published in M&A Review, Sep. 2019

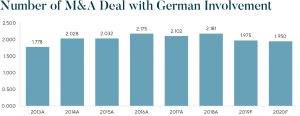

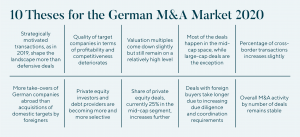

Amid growing levels of political and economic uncertainty across Europe, the number of M&A deals with German involvement decreased by more than 10% in the first half of 2019 compared to the same period in the previous year. Managers and investors are tarting to become more cautious when contemplating acquisitions and are aware of the risks associated with the high valuations that sellers are still expecting for their businesses. Despite gloomy prospects for the German economy, disruptive trade disputes, Brexit and rising regulatory scrutiny for foreign investments as well as for merger control, the German M&A market will still remain active.

Based on our current project back-log and our ongoing discussions with larger corporates, private equity players and various business owners, we expect continued, robust M&A activity in Germany over the next 15 months. Increasing globalization, digitization, unsolved succession issues in Mittelstand companies, low interest rates and enormous liquidity in the markets will continue to be the main drivers for mergers and acquisitions. In previous years, the M&A activity was largely driven by a strong economy as well as the confidence of senior management teams of potential buyers to acquire corporates.

Going forward, the majority of transactions will be driven by the urge of companies to team up with other partners or new owners in order to protect or improve current competitiveness in a fast-changing global and digital world.

For 2020, we expect continuous deal flow across all industry sectors with relatively higher activity in non-cyclical businesses like technology, consumer goods, media, healthcare and med-tech. Strong consolidation will also take place in struggling sectors like automotive, retail, e-commerce and financial institutions. For many years, German corporates have been an important deal source for management buy-outs. For the next few years, we expect an increase in portfolio reviews and divestment activity of non-core businesses of larger quoted companies.

The German market will continue to be characterized by private M&A. However, the last years have seen an increased number of larger public M&A deals. This trend is expected to continue in 2020. Finally, the growing influence of shareholder activism will trigger additional deals in the future. The targeting of ThyssenKrupp by hedge funds like Cervian and Elliott, is the first time activist investors have successfully led to a break-up of a DAX 30 company.

German Corporates Continue to Eye American Targets

German companies, especially larger quoted corporates, remain very keen to grow their business by acquisitions in familiar markets. Just relying on organic growth will not be sufficient to secure critical size on a longer term and justify current high valuations on the stock market. Overall, we see significant interest from larger German groups to strengthen their presence not only in Western Europe but also in the US, China and other selected Asian geographies. After certain reluctance in former years to invest in highly valued American companies, German management teams have become more and more courageous to pursue larger acquisition opportunities in the USA.

Source: 2013-2018 actual figures from imaa institute (2019); 2019-2020 forecast figures from Lincoln International (2019).

Figures include all publicly announced deals with either a German target company or a German acquiring company

The takeover bid by German Infinion Technologies for its American competitor Cypress Semiconductor, valuing the chip maker at US$ 10 billion, is a good example that illustrates this trend. At the time of the acquisition, Cypress Semiconductor was valued at 18.2 times EBITDA. Another visible deal is the envisaged acquisition of robotics firm Corindus by Siemens Healthineers in a US$ 1.1 bn deal. The offer price for this young and fast growing American med-tech company includes a 77% premium on the last closing price before announcement. With this strategic acquisition, Siemens Healthineers is opening up a new field for its image-guided therapies business.

Admittedly, the US administration prohibits certain takeovers by Chinese buyers, but for German buyers, the situation changed rather positively under the presidency of Donald Trump. The new tax reform makes it even more attractive for European corporates to acquire in the USA.

Ongoing Interest from Chinese Buyers

In the last few years, many German midsized companies were acquired by Chinese corporates. Recently Chinese investors were less active in the German market. However, we believe that the long-term outlook for takeovers with Chinese participation remains positive. In the sell-side processes that Lincoln International is running in Germany, Chinese buyers are regularly approached and are very active in reviewing opportunities.

From a sell-side perspective, the general view on Chinese buyers has changed in recent years for shareholders and incumbent management teams. Sellers initially had the expectation of a high selling price, paired however, with a significant amount of deal uncertainty when it came to Chinese buyers. This is a thing of the past. Chinese buyers have increasingly changed their image from fickle buyers to sophisticated and educated when it comes to valuation, the structure of the sales process and communication with involved parties.

In addition to China’s traditional industrial and automotive investments, future M&A activity will increasingly focus on fashion/retail, food and pharmaceuticals. Chinese investors including state-owned companies, listed companies and private companies will also pursue even bigger deals as the United States’ protectionist policies deter foreign buyers.

Private Equity Under Huge Investment Pressure

In addition to strategically motivated buyers, private equity investors and family offices continue to show huge appetite for so-called Mittelstand companies. These purely financially driven buyer groups are under enormous investment pressure and compete heavily against strategic buyers for the relatively few and available attractive target companies. Due to the fact that the number of profitable German buy-out targets in primary situations is rather limited, financial sponsors need to pay relatively high prices and thus justify their valuation with compelling business plans. For the execution of ambitious growth projections, private equity firms continue to professionalize their structures, noticeably by building up sector know-how and global networks. Going forward, private equity may take advantage of controlled auction processes; this buyer group is much faster and more pragmatic and innovative in due diligence exercises and SPA negotiations than larger foreign corporates (especially from Asia) with complex decision processes.

Valuation Multiples Already at their Peak

After a strong 2018, most of German corporates experienced a slow-down in growth and have faced some challenges to meet their 2019 budgets. Profit warnings and revised business plans are not helpful to drive valuations. However, high levels of dry powder combined with low interest rates and scarcity of solid assets are likely to keep valuation multiples on a relatively high level.

According to a survey from German Finance magazine, the average EBITDA multiple in private M&A deals achieved a new record level of 9.8m times. Even if 2018 was the peak in purchase prices, we still expect outlier valuations for attractive businesses. For profitable and growing companies with a clear technological edge and critical size, double digit EBITDA multiples will continue to be the rule and not the exception.

Remaining Window of Opportunity for Exits

More and more business owners have realized that the M&A boom in Germany peaked already over the last 12 months and that there might be a remaining window of opportunity over the next 18 months to sell companies at attractive terms and conditions. They also understand that with a possible economic downturn, it will be difficult to find buyers able and willing to match today’s ambitious valuation expectations two years from now. Based on this consideration, we expect that a lot of companies will continue to come to the market. As sellers, we see an increasing share of family owned business and non-core activities from larger corporates. For German business owners, the time is still excellent to consider a company sale. For plenty of international groups, the acquisition of a German competitor is on the top of the priority list. American and Asian strategists considering take-overs in Europe usually intend to focus on targets based in Germany, Europe’s largest economy. German companies are known for innovative technologies, automation know-how, professional structures and well-trained employees. The label “Made in Germany“ still has an enormous attraction for foreign investors.

Summary

-

Lincoln International discusses why German corporates continue to target American mergers and acquisitions.

- Chinese investors including state-owned companies, listed companies and private companies will also pursue even bigger deals as the United States’ protectionist policies deter foreign buyers.

- Private Equity under huge pressure to invest and high levels of dry powder combined with low interest rates and scarcity of solid assets are likely to keep valuation multiples on a relatively high level.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Contributor

Building long-term relationships is key for me personally – I want to be the advisor of trust for my clients.

Dr. Michael Drill

Managing Director | Head of Germany

FrankfurtMeet our Senior Team in Germany

I am enthusiastic about creating sustainable growth and the highest value for our clients and strive to leave a positive footprint beyond any successful M&A transaction.

Friedrich Bieselt

Managing Director & Head of Business Services, Europe

Frankfurt

Building long-term relationships is key for me personally – I want to be the advisor of trust for my clients.

Dr. Michael Drill

Managing Director | Head of Germany

Frankfurt

I enjoy working closely with clients to overcome challenging situations and to develop strategies to meet their business goals.

Dirk-Oliver Löffler

Managing Director & Co-head of Healthcare, Europe

Frankfurt

I lead with an entrepreneurial mindset and serve as a trusted advisor to our clients, delivering deep process and sector expertise to help them thrive in a rapidly evolving technology landscape.

Harald Mährle

Managing Director & Global Co-head, Technology

München

I maintain an open and transparent dialogue with clients to achieve mutually beneficial outcomes.

Juan Carlos Montoya

Managing Director

Frankfurt