Room for Growth: Home Furnishings Industry Showing Areas of Opportunity

| Few industries have experienced highs and lows as much as the home furnishings sector over the last three years. Driven by COVID-19 stay-at-home measures and remote work, the industry saw incredible pull-forward and purchase behavior in 2021 and 2022. To meet consumer demand, retailers and brands aggressively started buying inventory despite supply chain issues and container costs that increased by 700%+. Due to the delivery delay from supply chain issues and an expected continuation in demand, brands and retailers ordered as many products as possible, resulting in significant backlog and inventory levels just as demand started to moderate in late 2022. |

Summary

-

Lincoln International predicts that the home furnishings industry will be more active in 2024.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

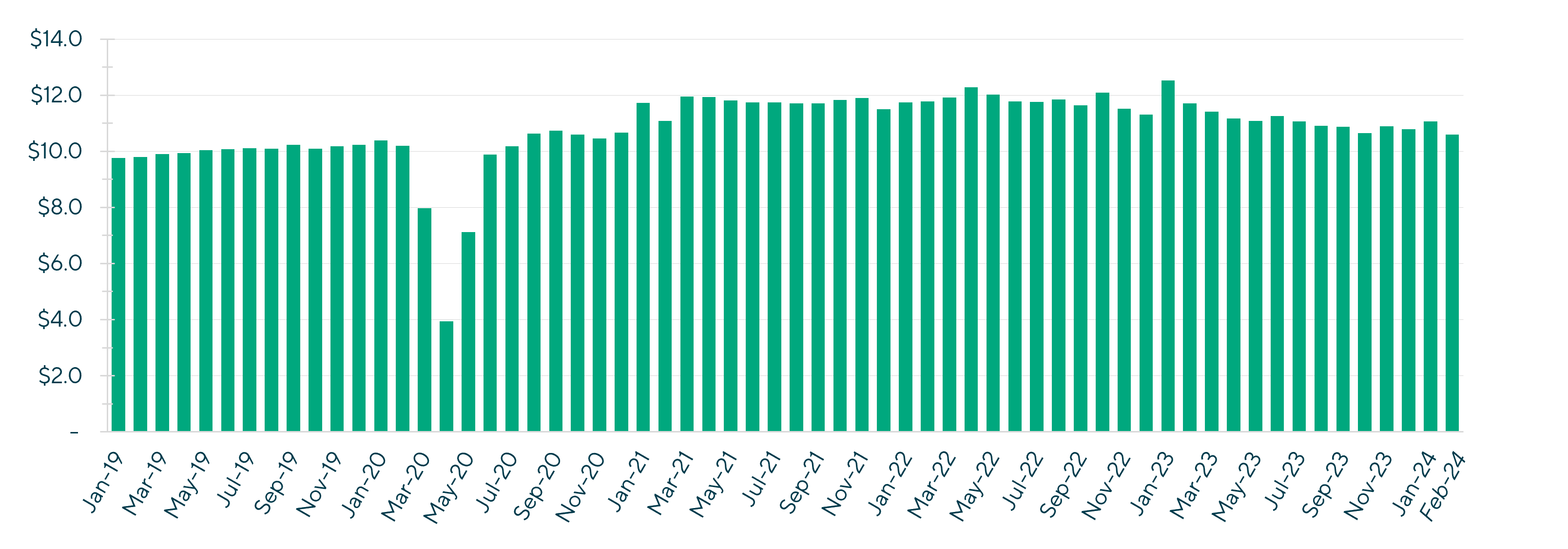

While the supply chain recovered, inflation and rising interest rates contributed to slowing demand throughout 2022 and 2023 as the industry contracted 5.2%. As shipments were delivered, retailers found themselves with excessive inventory. The surplus led to significant gross margin contractions as retailers discounted heavily to move products throughout 2022 and 2023. The chart below highlights the volatility the industry has experienced as reflected by the Monthly Sales for Retail and Food Services Report, published by U.S. Census Bureau over the last three years.

U.S. Furniture and Home Furnishings Retail Sales(1)

($ in billions)

Source: (1) U.S. Census Bureau. It includes establishments primarily engaged in retailing new furniture, home furnishings and related home products.

Despite the significant volatility in performance, the home furnishings industry remains a $132 billion retail market in the United States. There will always be market share takers in this extremely large segment due to superior models, products or services. Based on discussions with dozens of companies in the sector, Lincoln International believes 2024 will be pivotal, given this is the first year where inventory levels are back to normalized levels with a backdrop of moderating inflation and anticipated interest rate reductions.

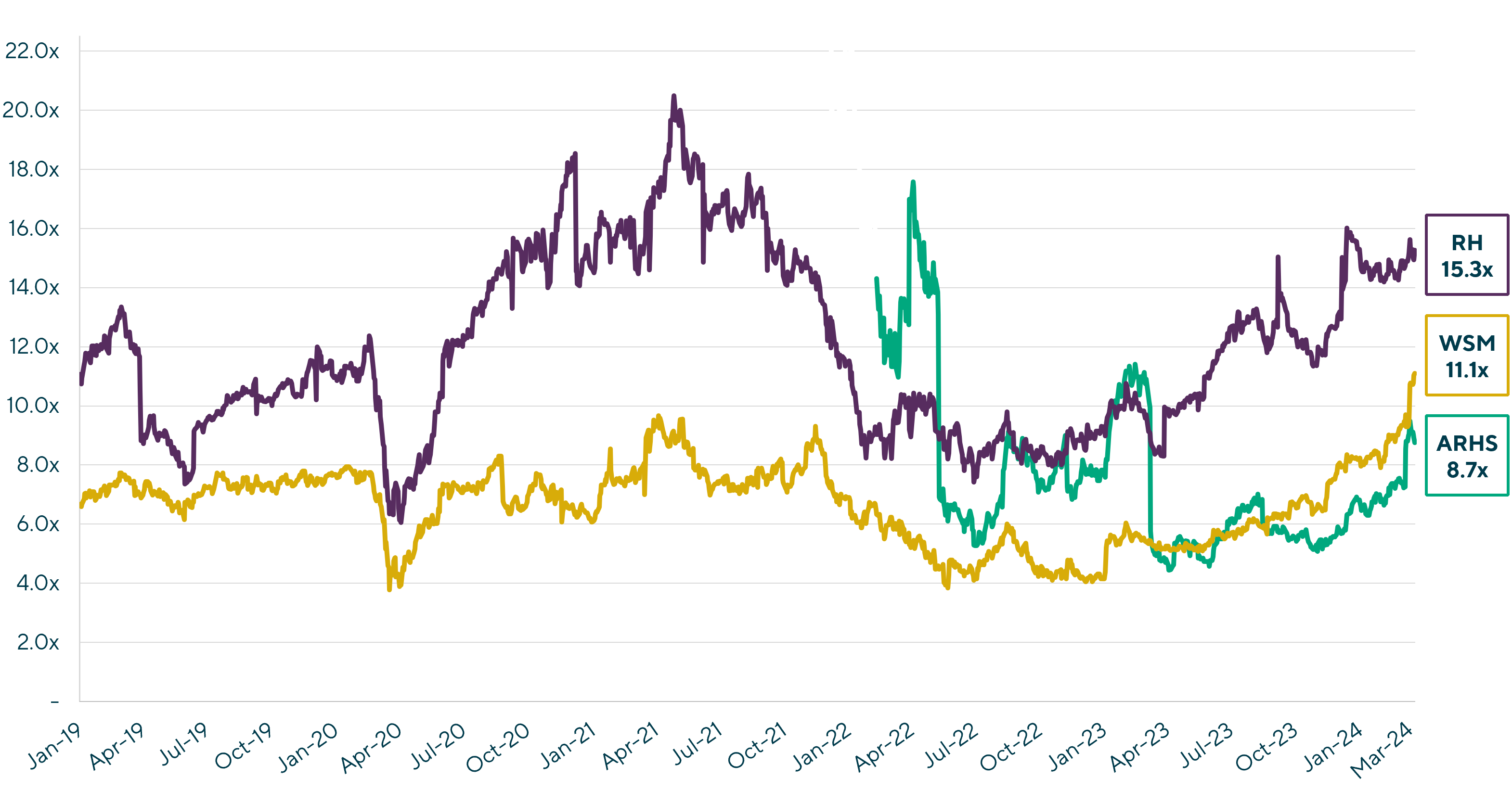

Premium Brands Showing Promise of Growth

While many brands and retailers are facing challenges, several differentiated ones continue to take market share within their sectors. In the public markets, stocks of premium brands, including Arhaus, Williams-Sonoma and RH stocks have rebounded off 2023 lows with companies outperforming analyst expectations (see chart below for enterprise value to LTM EBITDA multiples). Even though stock prices and valuation multiples have increased meaningfully, it’s not all positive as the actual results have shown the stress of the industry on performance with modest or negative revenue growth and contracted margins. Stabilization and expected continued recovery in the premium sector is resulting in investors rewarding these premium brands.

EV / LTM EBITDA Multiples(1)

Notes: (1) CapIQ; Data as of March 20, 2024

(2) Arhaus IPO’don 11/8/2021 and the respective line begins on 2/11/2022 once trading normalized

(3) Lovesac IPO’d on 6/27/2018 and the respective line begins on 9/9/2021 once trading normalized

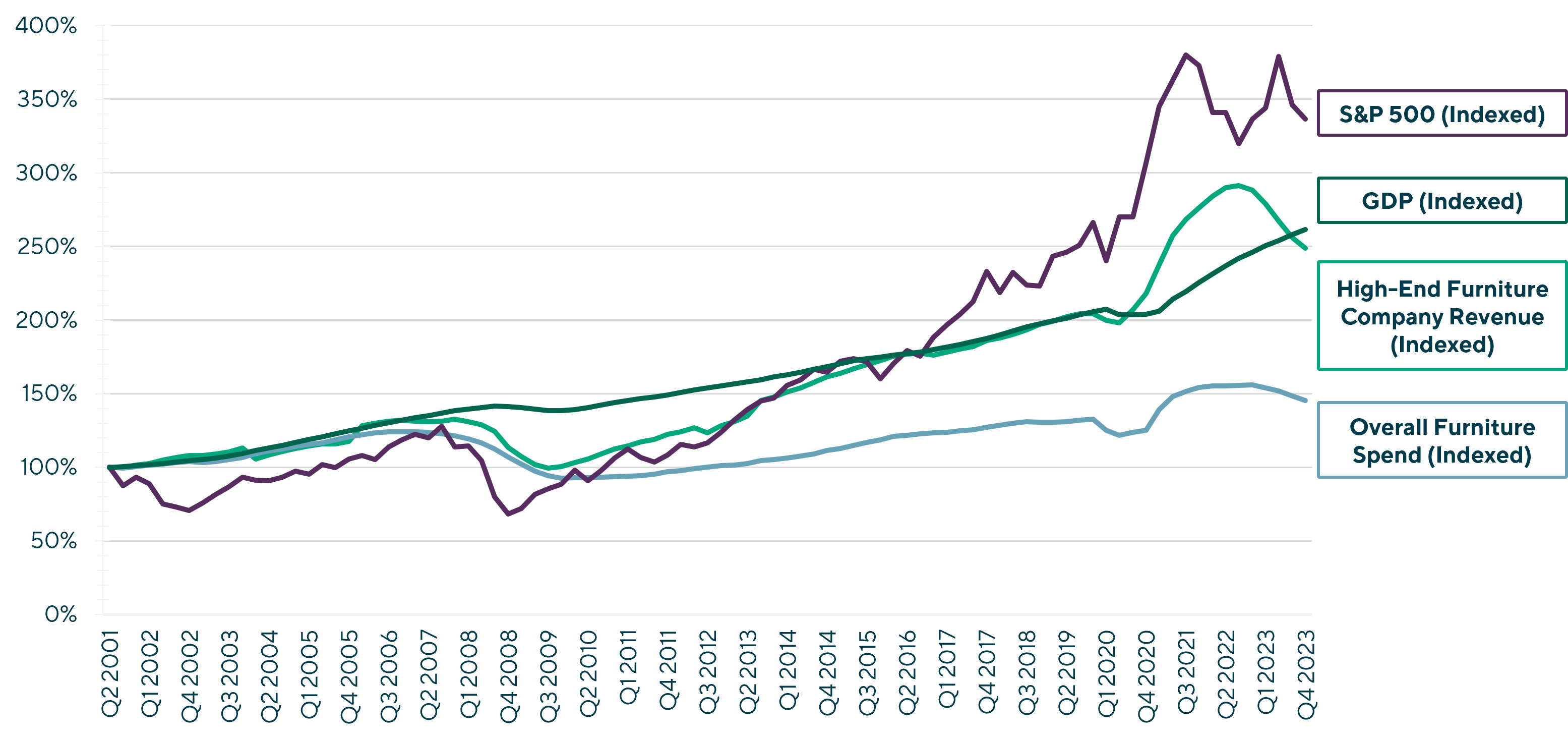

We expect this trend will carry over into the private markets as premium brands and retailers frequently mirror the performance of their public counterparts, given these companies are typically more project-driven than transactional. With the moderation of interest rates and increased wealth, home remodeling trends are improving, generating a positive outlook for the premium segment. In our long-term analysis of the premium segment, the wealth effect, as measured by the performance of the S&P 500 index, is a strong predictor of sales in the premium segment, with the S&P 500 increasing 23% since October 2023. The chart below highlights the relationship between LTM sales of the premium segments and the S&P 500 over the last 20 years.

Furniture Spending vs. S&P 500 and GDP

Stabilization of the Value and Promotional Segment

The value and promotional segment is another area showing signs of improvement. In discussions with a leading manufacturer in this segment, the company continues to experience strong growth on top of 13% growth last year. By focusing on the largest retailers in the value and promotional segment of the market, the company offers retailers a more compelling mixture of products and services to its retailers driving its growth. Additionally, Big Lots recently reported that its furniture sales held up relatively well sequentially versus other categories in Q4 2023 versus Q3 2023. However, according to the Monthly Sales for Retail and Food Services Report, furniture retail stores saw a 10.1% decrease year-over-year in February 2024 to $10.6 billion. In spite of this drop, monthly sales are still ahead of where monthly sales were pre-pandemic.

Despite the conflicting data across the sector, the valuation and outlook for several businesses are more positive than they have been in the last two years. Retailers are calling for a better 2024 and predict an accelerated demand for home furnishings.

2024 M&A Outlook

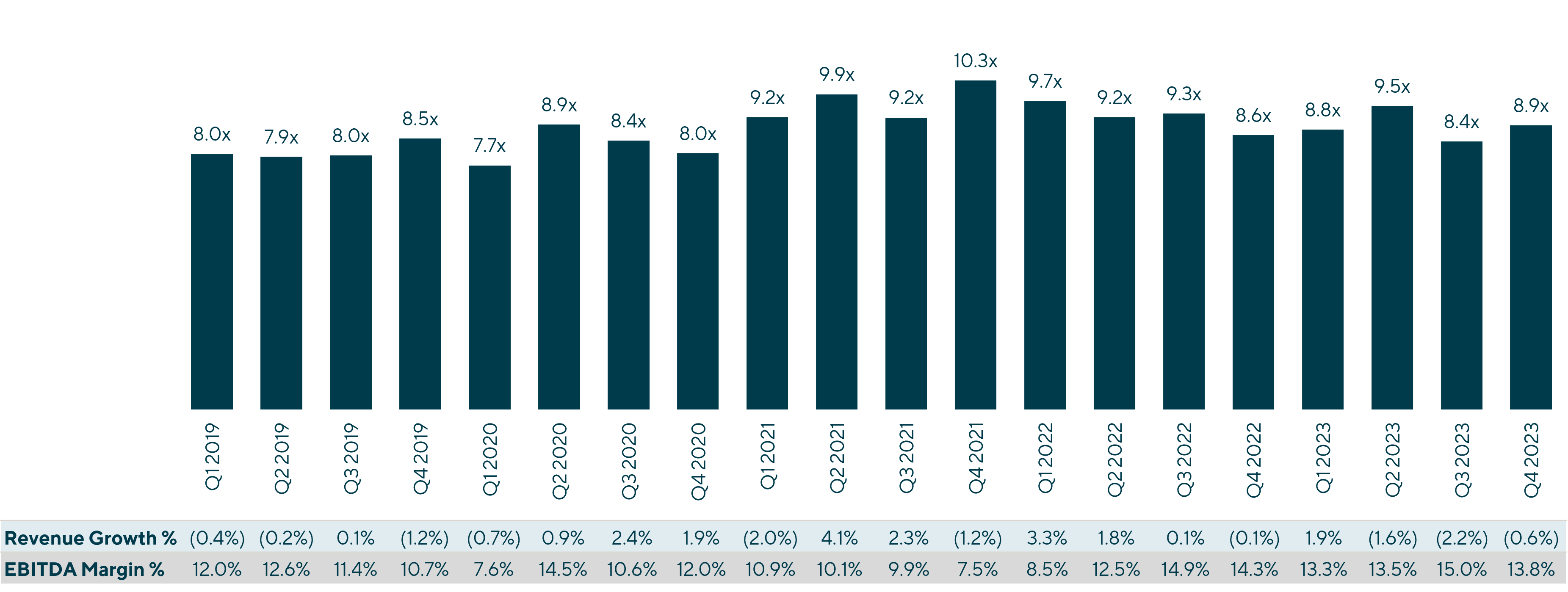

In our discussions with both financial and strategic buyers, we are sensing a greater interest in mergers and acquisitions (M&A) opportunities. During 2023, financial acquirers and lenders exhibited increased discernment and rigor in their investment and financing strategies, particularly regarding large-ticket, discretionary durable companies. This led to a significant impact on home furnishings M&A processes as financial investors shied away from companies battling margin compression, elevated inventories and uncertain growth outlook. 2023 saw very little activity with much of the headlines in the industry driven by distressed sales or unexpected liquidation of some prominent companies. As Lincoln’s Private Market Proprietary Data indicates, private equity groups are marking portfolio company valuations at higher levels but still meaningfully lower than two years ago.

Furniture – Average EV / LTM EBITDA

Source: Lincoln International Private Market Proprietary Data as of March 6, 2024

While most companies are sitting on the sidelines and waiting for either improved company financial performance or financial investor interest in the category to pick back up, we are noticing continued cautiousness. With the compression in M&A valuation multiples and the opening of the lending markets (albeit at higher pricing and lower leverage levels), we are seeing greater interest from financial buyers in differentiated opportunities in the sector. In our discussions with private equity groups, we are seeing investors look for good opportunities at attractive values as platform opportunities or add-ons to existing portfolio companies.

Similar to Tempur-Pedic’s acquisition of Mattress Firm in 2023 (scheduled to close in mid-2024), 2024 has started with a large strategic buyer transaction as Ashley Furniture is acquiring Resident Home – marrying one of the largest home furnishings retailers with one of the largest, and most profitable, direct-to-consumer mattress brands.

Lincoln is in active discussions with clients and strategic buyers as companies are looking towards growth again after focusing much of their recent time on stabilizing their businesses.

After a relatively quiet M&A market over the last two years, we expect 2024 to be more active as both financial and strategic buyers have demonstrated greater interest in the category.

| If you are interested in learning more about what we are seeing in the market, please contact a home furnishing professional below. |

Contributor

Meet Professionals with Complementary Expertise in Consumer

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago

I design strategies and offer solutions that fit the unique ambitions of each client I serve.

Brian Little

Managing Director

Los Angeles

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

London