Reality Check: Assessing Private Equity’s 2022 Predictions

In Q4 2021, Lincoln International surveyed nearly 400 private equity investors on their expectations for dealmaking in the year ahead. In the three quarters since, public equity markets have seen marked volatility. The economic uncertainty is impacting mergers and acquisitions (M&A) decision-making as investors keep a close eye on global regulators’ ability to curb rising inflation without sending the economy into a recession.

While much about the dealmaking environment has changed since Q4 2021, some constants remain continued priorities for investors, despite the changing economic landscape. Below we check in on several of private equity’s (PE) top predictions—and how they played out.

Summary

-

In Q4 2021, Lincoln International surveyed nearly 400 private equity investors on their expectations for dealmaking in the year ahead.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

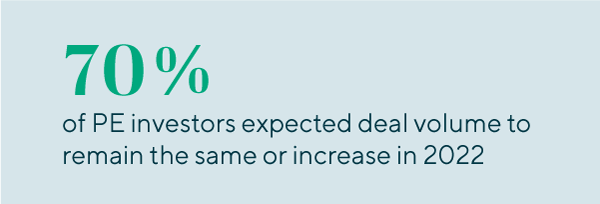

Expectation:

Looking Ahead:PE is still sitting on record levels of dry powder, translating to deals getting done even in tougher economic conditions. While investors’ desire to deploy capital remains strong, market conditions have made them more selective, lowering the availability of quality assets that are sure to remain healthy through the lifetime of the hold period. These dynamics can lead to pricing standoffs, with sellers looking to secure high multiples seen several months ago and buyers looking to snag deals as recession worries percolate. In today’s environment, new complexities mean dealmakers must tread carefully alongside a trusted advisor. |

Expectation:

Looking Ahead:In the current economic environment, concerns of inflation, supply chain challenges and labor shortages are on the minds of all investors. But one concern comes out on top: the threat of a downturn. All private market players are asking whether a recession is coming—or if we are already in one. As the economic situation plays out, Lincoln expects dealmakers to put an increasing focus on the due diligence process to ensure their investments are well-positioned for resilience during a recession. |

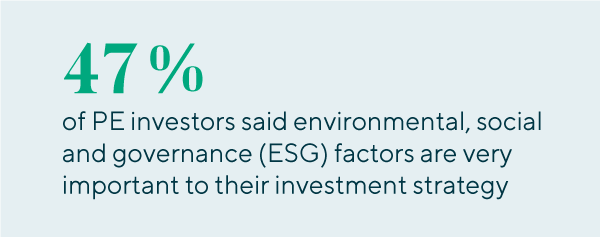

Expectation:

Looking Ahead:We expect continued pressure from limited partners (LPs) and stakeholders to push companies to stick to stated ESG goals. Even with a potential economic downturn on the horizon, momentum behind ESG investing will endure as LPs indicate preferences for ESG-conscious assets in their capital allocations and PE sponsors align their portfolios in turn. |