Drilling Down on Industrials: Spotlight on Consumable Tools

With bumpy markets leaving investors wondering how much longer the bull market can run, private equity sponsors are on the hunt for companies they can hold onto throughout the next economic cycle. While U.S. – China trade wars have created headwinds for manufacturing and auto companies reliant on global supply chains and customer bases, one subset of the Industrials space remains particularly bright: consumable tools.

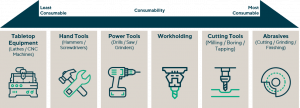

The tool market generally includes manufacturers of components and equipment, including woodworking, metalworking and hand tools. Within the market, several sub-sectors exist which can be classified according to the consumable nature of its products. Abrasives for cutting, grinding and finishing, or cutting tools for boring and milling, represent the most consumable in nature—which, in turn, makes these companies highly sought after by potential acquirers in search of less cyclical investment targets.

Tool companies that can substantiate their product’s consumable nature from market feedback and data can generate predictable, recurring revenue streams, even in the case of a down market.

To illustrate, consider 2009 when tabletop equipment-like players on the least consumable side of the spectrum cycled upwards of 40-45%. In stark contrast, the most consumable players only moved moderately (10% to flat). No doubt that 2009 was an extreme case, but even looking at late 2015 as a proxy for a more “normal” recession, this trend holds true. We see the mini-industrial recession in late 2015 as a good measure for how a business may perform in the next cycle. This is because it was a less extreme fall than we felt in 2009 and it is more recent (businesses have evolved dramatically over the past 10 years). In late 2015, most strong consumable players found ways to grow, albeit slowly, throughout the cycle.

This trend has also piqued the interest of less consumable corporates like big capital equipment providers. Equipment players are chasing consumable assets that are tangential to their current offering to help bolster revenue in the case of a near-term recession.

The end result? High multiples and competitive processes in the tool space.

Hot Tools: Finding the Most Attractive Prospects in the Tools Market

Private equity has $1.0+ trillion in available dry powder—and is willing to bid aggressively. Strategic buyers have $2 trillion on hand and new tax laws to generate more funds for acquisitions. As private equity sponsors and strategic buyers go head-to-head, competing to bid on the most attractive tool acquisition targets, what factors should they keep in mind? On the flip side, what attributes should sellers attend to pre-sale?

- Brand Recognition Matters: Brand recognition goes a long way in the tools space. The reasons are twofold. First, brands create barriers to entry, keeping low-cost countries from bringing their competing products to the market. Second, brand recognition drives end-user pull-through. The best tool players have loyal end-users who demand the key industrial distributors carry their preferred brand. Ultimately, brand name recognition facilitates premium pricing—driving financial benefits for acquirers.

- Attractive Market for Consolidation: With a high degree of market fragmentation, private equity acquirers view tool companies as attractive “buy-and-build” candidates. Meanwhile, large corporates are looking to build a collection of brands, which have enhanced value as you put them together.

- Manufacturing Model: As tariffs make outsourcing to China more expensive, there is a shift in preference from virtual manufacturers sourcing from Asia back to owning the manufacturing themselves domestically. Manufacturing know-how and related intellectual property also further supports the value proposition to the customer.

- Distribution Relationships: Investors should ensure targets have a strong, established network, providing access to key distributors and end users. Brands with a diverse channel mix with national, independent, e-commerce and alternative distributors perform best.

- Product Innovation and Quality: Companies with proprietary, patented products are highly coveted in the marketplace. Acquirers remain focused on those companies that maintain ownership of their intellectual property.

- Historical and Projected Growth: As always, critical factors for consideration include a proven track record of historical growth and margin expansion as well as an achievable growth plan supporting future above-market growth.

- Cash Generation Profile: Finally, the most attractive targets will boast high free cash flow conversion with strong gross and EBITDA margins, as well as low CapEx. Acquirers look for companies with gross margins in excess of 40% and EBITDA margins in excess of 20%, demonstrating the value brought to its customers.

Summary

-

While U.S. - China trade wars have created headwinds for manufacturing and auto companies reliant on global supply chains and customer bases, one subset of the Industrials space remains particularly bright: consumable tools.

- This trend has piqued the interest of less consumable corporates like big capital equipment providers. Equipment players are chasing consumable assets that are tangential to their current offering to help bolster revenue in the case of a near-term recession.

- As private equity sponsors and strategic buyers go head-to-head, competing to bid on the most attractive tool acquisition targets, what factors should they keep in mind? On the flip side, what attributes should sellers attend to pre-sale?

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Contributor

There is nothing more satisfying than completing a deal and seeing the true advisory value we brought to the situation, and the excitement of the client.

Robert Reifman

Managing Director & Co-Head of Industrials

ChicagoMeet our Senior Team in Industrials

I am a rigorous advocate for my clients with a hands-on, communicative approach, focused on delivering intense advocacy and outlier results.

Sean Bennis

Managing Director & Global Head of Industrials

Chicago

I enjoy leading clients and realizing their objectives, while structuring solutions to issues that are both intriguing and challenging.

Øyvind Bjordal

Managing Director & Head of Switzerland

Zurich

I strive to provide actionable strategies and an efficient process for my clients navigating transactions.

Eric Cartier

Managing Director

Los Angeles

I build trust with my clients through integrity and clear communication. Our clients value providing them with our market insight and expertise.

Ulrich Desl

Managing Director & Co-Head of Industrials, Europe

Frankfurt

Building long-term relationships is key for me personally – I want to be the advisor of trust for my clients.

Dr. Michael Drill

Managing Director & Head of Germany

Frankfurt