DOGE and Policy Shifts: M&A Impacts

| In its opening weeks, the second Trump administration has unleashed a wave of White House directives aimed at advancing the president’s “America First Agenda.” The actions range from symbolic (e.g., discontinuing production of the penny, ending support of paper straws and establishing a strategic cryptocurrency reserve) to substantial (e.g., eliminating entire federal agencies, imposing tariffs on imported goods and halting military support for Ukraine).

The White House’s “shock and awe” campaign of rapid change has left mergers and acquisitions (M&A) market participants off-balance, leading some to forestall the launch of sale processes or even delay the closing of new investments. At the same time, investors are searching for opportunities to back the businesses poised to benefit from a shifting landscape. Lincoln International is uniquely positioned to guide clients through the changing federal landscape, with deep sector expertise and decades of experience advising on both buy-side and sell-side M&A transactions in the government services sector. |

Summary

-

Lincoln International’s sector experts explore how DOGE is impacting the government services sector, from shifting valuations to widespread policy implications.

- Click here to download a printable version of this report.

- Sign up to receive Lincoln's perspectives

Sector Drilldown: Government Services

Government services and defense technology businesses are on the front lines of dramatic policy shifts. President Donald Trump officially established the Department of Government Efficiency (DOGE) on January 20, 2025, as the newest piece of the Executive Office of the President. Reporting directly to Susie Wiles, the White House Chief of Staff, DOGE is no longer a campaign-trail concept designed to capture voter attention but a formalized advisory body with a clear objective: cut federal spending.

With DOGE driving efficiency across federal agencies, the government services sector is experiencing disruption. Companies able to quickly adapt to changing procurement priorities and efficiency mandates can expect heightened interest from both strategic and financial buyers, particularly those seeking to capitalize on technology-driven digital transformation.

Additionally, some government services providers are capitalizing on the opportunity to strengthen customer relationships by rehiring laid-off employees and redeploying them under existing contracts to maintain mission capacity. The increased labor supply also may serve to relieve upward pressure on wages, making it easier for firms to grow.

DOGE: From Concept to Execution

Since its conception in November 2024, DOGE has faced legal challenges and public scrutiny. Officially, it replaces the Obama-era U.S. Digital Service (USDS), initially created in 2014 to address HealthCare.gov’s technical issues. The agency has been repurposed as the United States DOGE Service (retaining the USDS acronym), and Trump’s executive order officially tasked it with “modernizing federal technology and software to maximize efficiency and productivity.”

Each of the 438 federal agencies will establish a dedicated “DOGE Team,” designating at least one engineer, HR specialist, legal advisor and team lead to reimagine government operations. An early focus was cutting over $500 billion in annual unauthorized expenditures, which senior advisor Elon Musk describes as funds “used in ways Congress never intended.”

The establishment of DOGE sparked market uncertainty for the government contracting sector—evidenced by an immediate post-election decline of over 25% in many defense and government-focused public sector stocks. In recent weeks, government contracting firms have begun to report DOGE’s impact.

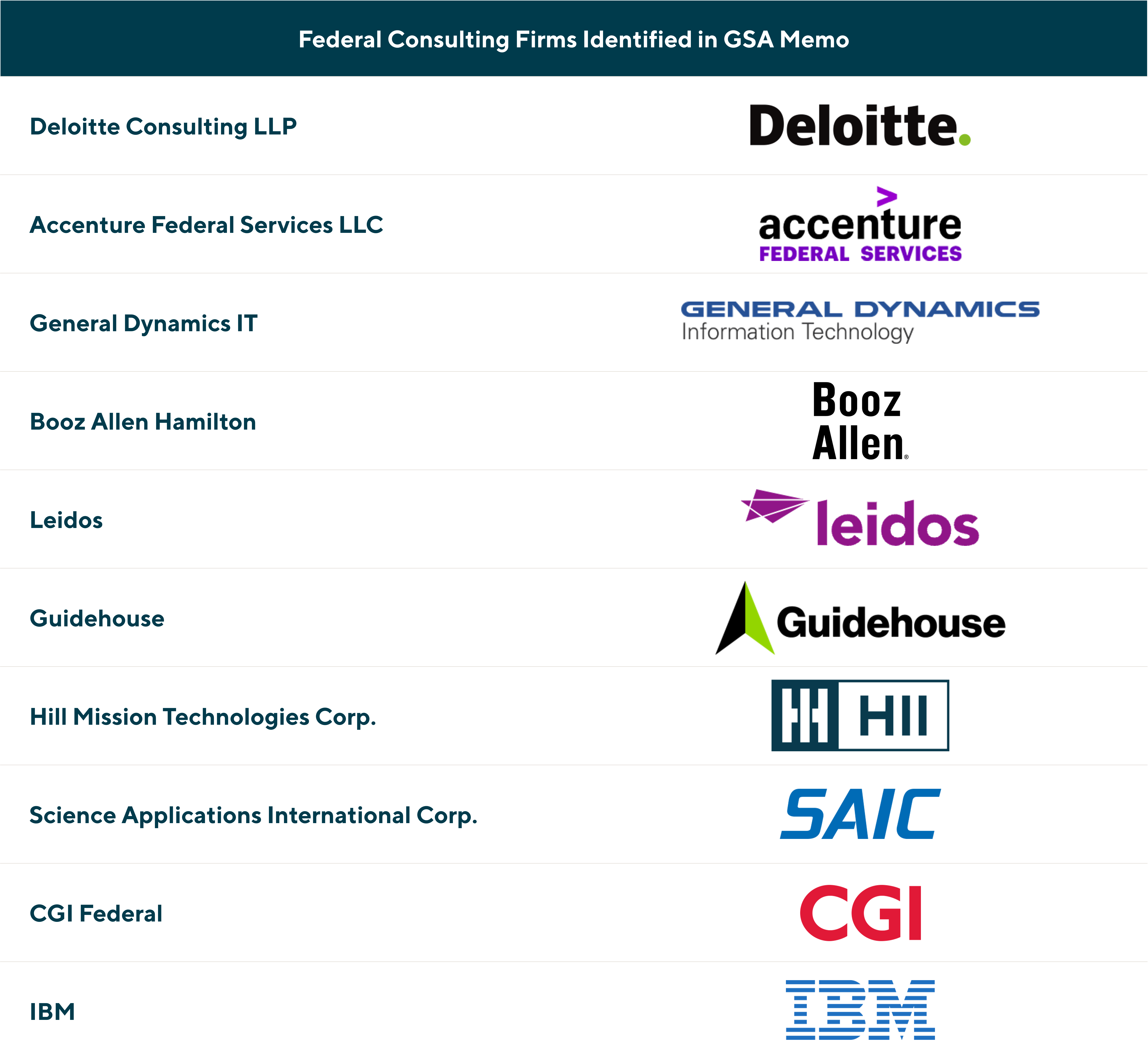

On February 26th, Stephen Ehikian, Acting and Deputy Administrator of the General Services Administration, sent a memo taking aim at the top 10 federal consulting firms. He directed agencies to aggressively review over $65 billion in contractual commitments and terminate any deemed “non-essential” or not providing “substantive technical support.”

ICF International’s stock price fell by nearly 25% between the inauguration on January 20 and February 26. Following its February 27 earnings call, the stock declined an additional 20% after the company reported stop-work orders on $90 million in annual revenue, representing approximately 4.5% of its total revenue and over 9.0% of its federal business.

What began as a seemingly limited initiative has evolved into a broader campaign, leaving industry participants to speculate about DOGE’s next target and where the cuts will end.

Opportunities Amid Challenges

Despite challenges, key opportunities are surfacing for the government services sector.

While the government services sector has traded down from pre-election highs, EBITDA multiples have proven resilient by historical standards. The average market EBITDA multiple for the peer set is 11.1x, 16.6% below its 10-year average of 13.4x. This is in stark contrast to the impact of the Obama-era Budget Control Act of 2011, when an across-the-board 7-8% reduction in federal spending caused many stocks to trade down to 6x EBITDA.

EV / LTM EBITDA

Notes: $ in millions. Financial metrics include: AMTM, BAH, CACI, ICFI, LDOS, SAIC, VVX; historical financial metrics between 2012 and 2024 also include Mantech, Dynamics Research Corporation, Perspecta, PAE, Engility Holdings, and KeyW.

DOGE’s approach is markedly different. Rather than indiscriminate cuts, the department emphasizes targeted efficiency improvements and modernization. Its mandate is to eliminate waste, fraud and abuse, decrease unnecessary regulations and improve efficiency of government. If leaders stay true to the mission of streamlining federal operations, DOGE has the potential to deliver long-term benefits to the government services sector, fostering innovation and value creation rather than the stagnation and disruption associated with sequestration.

Early “cuts” now show promising signs of being repositioned as “reallocations.” Defense Secretary Pete Hegseth has ordered senior defense officials to draft a proposal reallocating $50 billion of the 2025 budget (a projected 8%) to align spending with the president’s national security priorities. Concurrently, Republican lawmakers seek to add more than $100 billion to the Pentagon’s proposed 2025 budget, bringing total annual military spending close to $1 trillion – a robust bankroll by any practical measure.

The center of gravity in government innovation appears to be shifting from Washington, D.C. to Silicon Valley, as Palantir – a key player in the new administration’s tech strategy – anticipates nearly doubling its government sector revenue in 2025, from approximately $1 billion to an expected $2 billion. Many Beltway defense contractors have seen the writing on the wall and have joined Palantir’s partnership ecosystem, strengthening ties between DC and Silicon Valley.

Sector Implications

Who Is at Risk?

DOGE’s initial focus on unauthorized expenditures has placed numerous federal programs and agencies under scrutiny, with many now facing significant legal and operational challenges. As these agencies navigate mounting uncertainty, the broader implications for federal operations and resource allocation remain a pressing concern. Companies associated with disrupted agencies or programs will need to diversify revenue streams to mitigate risk. Similarly, non-technology-enabled firms supporting non-critical missions may face reduced demand as federal priorities shift.

Who Will Benefit?

Conversely, high-performing, technology-enabled firms aligned with critical missions stand to gain in the long term. Defense technology-related companies are particularly well-positioned to benefit from increased efficiency, streamlined procurement processes and private sector demand for innovation. We also anticipate continued pressure to shift away from in-house developed Government Off-the-Shelf (GOTS) software towards existing Commercial Off-the-Shelf (COTS) tools that can be inexpensively modified to suit government needs. This shift will benefit GovTech software firms that have invested in developing software to support government agency missions.

The Role of Private Sector Innovation

Incentivizing innovation and high performance is crucial for the future of the government services sector.

During the Cold War, then-undersecretary of defense William Perry orchestrated a “revolution in military affairs” by dedicating funding to DOD research efforts. His work between 1977-81 was instrumental in developing America’s stealth aircraft technology. Years later, the DOD has shifted from a producer to a consumer of innovation.

The U.S. government’s reliance on private sector innovation has grown significantly over the past six decades. From 1960 to 2020, the federal government’s share of global R&D funding fell from 45% to 6%, with nearly three-quarters of global R&D investments now outsourced to the private sector.

Despite current turmoil and uncertainty, this decades-long shift underscores the importance of private sector contributions to the Defense Industrial Base (DIB). As DOGE initially challenges the government operations sector, private companies will continue to play a critical role in driving innovation and ensuring mission success.

Implications for M&A Activity

Many government services companies are sitting on the sidelines for Q1 in 2025, reading the headlines and responding to changes in their business rather than initiating transactions. However, well-positioned firms can take advantage of the market lull to attract private equity investors and strategic buyers alike. Premium businesses tend to trade for premium multiples in any market, and the current cycle is no different.

At the same time, delaying a sale process until H2 2025 may be the wisest strategy for businesses directly impacted by DOGE or those needing to return to the market. A delay offers disrupted or unstable businesses the opportunity to realign operations, positioning themselves more effectively once the opening salvos of “Shock and Awe” have passed and DOGE’s strategy becomes more cohesive.

Connect With LincolnAs DOGE reshapes the federal landscape, Lincoln International remains at the forefront of advising clients in the government services sector. With over 100 successful transactions, our team of dedicated government services bankers average over 20 years of experience representing government contractors in M&A transactions and have a strong track record representing sellers serving federal departments and agencies. We anticipate continued deal activity as DOGE’s initiatives create new opportunities for high-performing companies. With Lincoln’s guidance, clients can navigate the uncertainty of this unique market shift and capitalize on the opportunities created by DOGE’s transformative initiatives. |