Dividend Recap Activity Reaches All-Time High

What drives this activity and what risks do boards face?

As the initial economic fallout from COVID-19 dissipated towards the end of 2020, the drought of dividend recaps in 1H20 was followed by a flood of large, mostly high quality and low COVID-19 impacted borrowers into the debt markets. The pace has quickened in 2021, and year-to-date the volume of dividend recaps has set records—and we expect that trend to continue.

Summary

-

Lincoln International professionals in the Valuations & Opinions Group and Debt Advisory Group provide perspective on the all-time high dividend recap activity, such as what is driving this activity and what risks boards face.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

How has the pandemic impacted dividend recap volume and pricing?

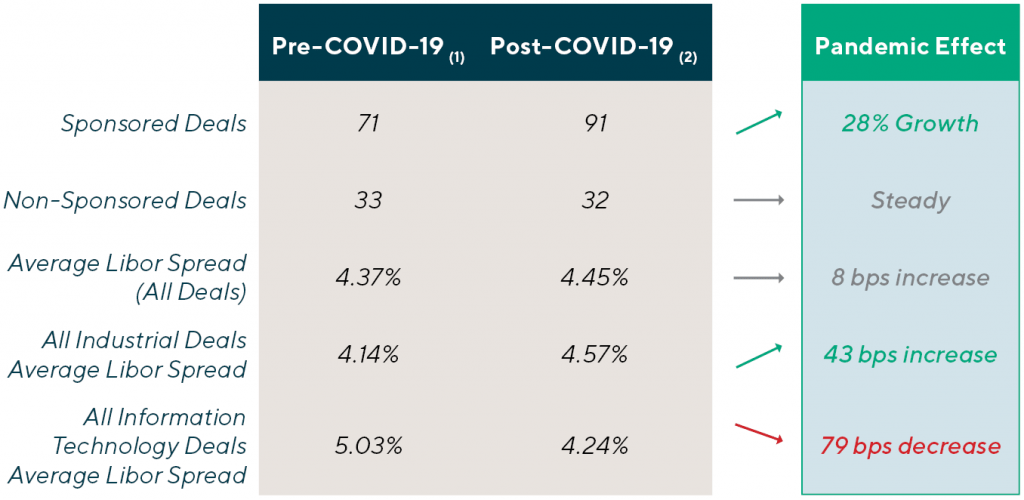

Sponsored borrowers have aggressively ramped up dividend recap activity with overall pricing remaining flat on average though “barbell” in terms of industry sector with IT borrowers taking advantage of COVID-19 tailwinds.

Sources: S&P LCD Comps and Refinitiv

(1) Pre-COVID represents 1/1/2019 – 3/13/2020

(2) Post-COVID represents 3/14/2020 – 3/3/2021

In the current market, many companies are experiencing or have experienced a “COVID-19 bump,” which is driving higher EBITDA levels. Buyers, however, remain skeptical about the sustainability of the increased performance. Differing views of this “new normal” EBITDA are creating a disconnect between buyers and sellers, causing some owners and boards to move forward with a dividend recapitalization now and a sale later, when full value can be realized for the increased performance of the business.

REASONS TO CONSIDER A DIVIDEND RECAPITALIZATIONSponsored borrowers have aggressively ramped up dividend recap activity with overall pricing remaining flat on average though “barbell” in terms of industry sector with IT borrowers taking advantage of COVID-19 tailwinds. As the number of dividend recaps in 2021 continue to increase at a rapid clip, the reasons sponsors may pursue a dividend recap include: Current leverage level is below “market,” including situations where a sponsor over-equitized the initial purchase. Company is generating strong free cash flow with the ability to service a higher level of debt (focus on fixed charge coverage). Owners would benefit from a near-term return of capital driven by potential tax law changes or fund dynamics. Allows owners to take “chips off the table” and de-risk fund returns today without giving up the upside expected in a future exit through M&A. Parallel path process as a potential alternative to a full sale in the event the board/management believes appropriate value has not be achieved through sale process. |

|

CHARACTERISTICS OF GOOD POTENTIAL BORROWERSLincoln identified the following four traits that lenders look for in borrowers pursuing a dividend recap: Steady historical revenue with good visibility – ideally demonstrated by some combination of multi-year contracts, sole-source relationships, recurring “sticky” customers, and/or high barriers to entry or competition. Favorable industry dynamics – underlying market growth and low cyclicality. Relative stability in cost structure and asset base – borrower not undergoing major operational changes or embarking on large capex projects. Private equity-backed or other institutional ownership is preferred. Non-sponsored companies will likely have access to lower levels of leverage, all else being equal. |

|

USE OF SOLVENCY OPINIONS TO MITIGATE RISKS INHERENT IN A DIVIDEND TRANSACTIONIn the event the borrower becomes distressed or insolvent in the future, creditors may allege the dividend was a fraudulent conveyance. Directors: Potential “Unwinding”: Secured Lenders: |

|

CONSIDERATIONS AND RISK MITIGANTS FOR BOARDSTo lessen the risk of future fraudulent conveyance claims and minimize personal liability, board members should: Investigate financial flexibility of borrower and its ability to achieve strategic goals with the increased leverage. Understand the legal requirements to pay a dividend (i.e. surplus under DGCL §154). Obtain a Solvency Opinion from a qualified investment bank. Lincoln’s clients obtain solvency opinions for many reasons, but the personal liability that members of the Board of Directors could face is often the leading one.

|

The Lincoln DifferenceLincoln’s Valuations & Opinions Group, which performs 2,200 valuations per quarter as part of an investment bank with highly active M&A and Capital Advisory Groups, brings real world experience and deep industry expertise to every one of its fairness and solvency opinions engagements. In addition, the portfolio valuation work performed on behalf of over 100 alternate asset managers has earned Lincoln a sterling reputation and credibility within the institutional LP community. |

Contributors

I enhance my clients’ decision making and governance processes by providing independent and objective financial advice in a highly responsive manner.

Chris Gregory

Managing Director & Co-head of Transaction Opinions

New YorkMeet Professionals with Complementary Expertise

I find immense fulfillment in enabling clients to achieve their objectives and navigate the complexities of today's ever-changing landscape.

Chris Croft

Managing Director & Co-head of Transaction Opinions

New York

I enjoy sharing insights about market and valuation trends with my clients, while also leading a differentiated and high-touch process.

Brian Garfield

Managing Director & Head of U.S. Portfolio Valuations

New York

I enhance my clients’ decision making and governance processes by providing independent and objective financial advice in a highly responsive manner.

Chris Gregory

Managing Director & Co-head of Transaction Opinions

New York

I enjoy the opportunity to provide clients with insightful and unbiased advice that will help them make the most informed decisions possible.

Ron Kahn

Managing Director & Global Co-head of Valuations & Opinions

Chicago