Why is competition intense in food M&A?

Structural factors in the M&A market are keeping valuations across multiple sectors — not just food — at healthy levels. These factors include record fund commitments, low (but rising) cost of capital and corporate buyers flush with cash and prioritizing acquisitions to support their growth objectives.

In addition, food is generally a defensive investment — we all need to eat. This stability makes the sector more attractive. This is especially true with recession concerns on the mind of many investors. Despite the inflationary environment (e.g., higher costs for food, labor, packaging, freight etc.), supply chain disruptions and global geopolitical conflicts, food remains an attractive sector for investment.

Where are the opportunities in the food sector?

Based on Lincoln’s food deals and regular dialogue with strategic and financial buyers, several categories and themes resonate with investors, as outlined below:

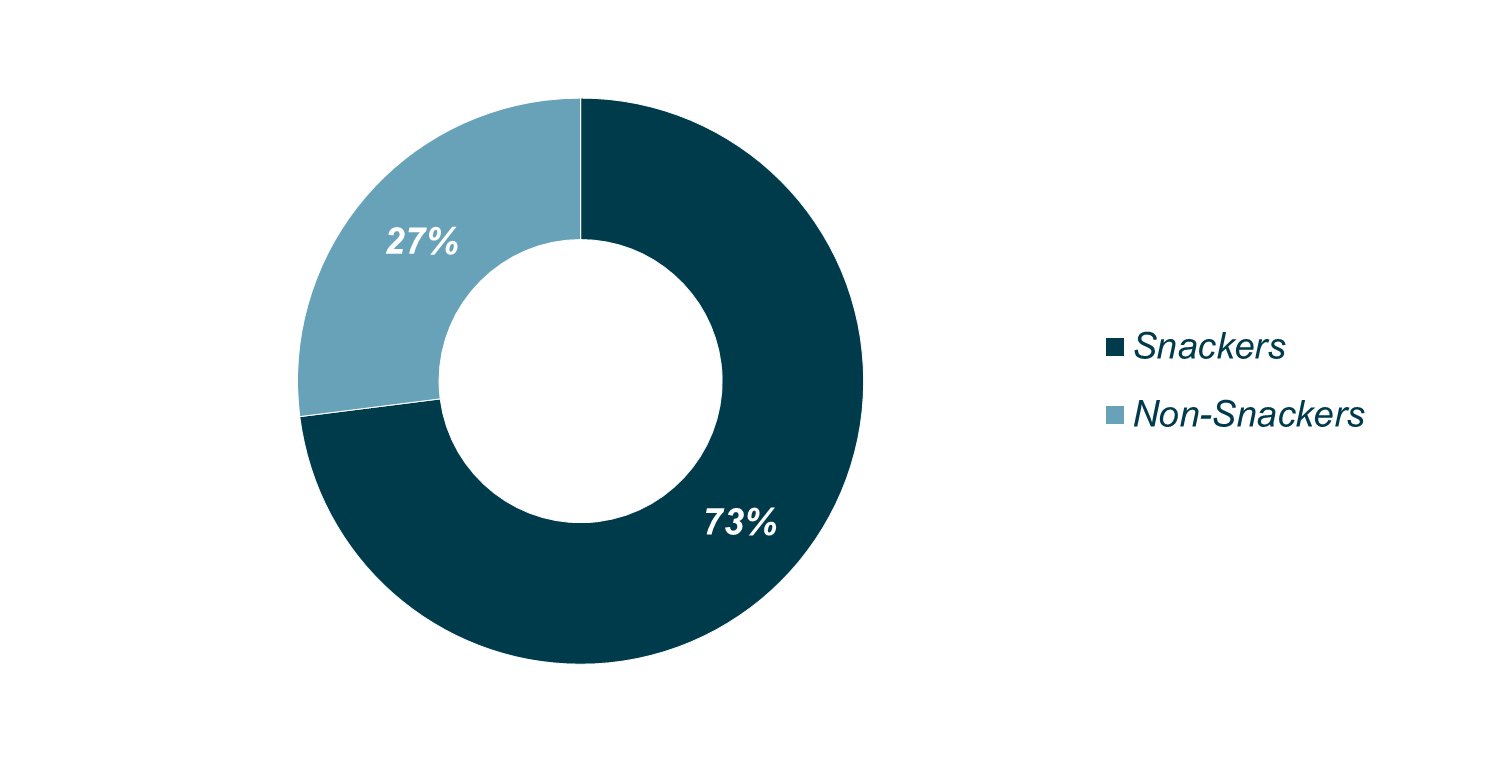

Snacking

|

|

| Snackers in 2015

|

Snackers in 2021

|

|

|

| Snack Frequency 2015, 2018 and 2021

|

Attitudes Toward Snacking, By Age, 2021

|

| Source: Mintel Snacking Motivations and Attitudes, US 2022 | |

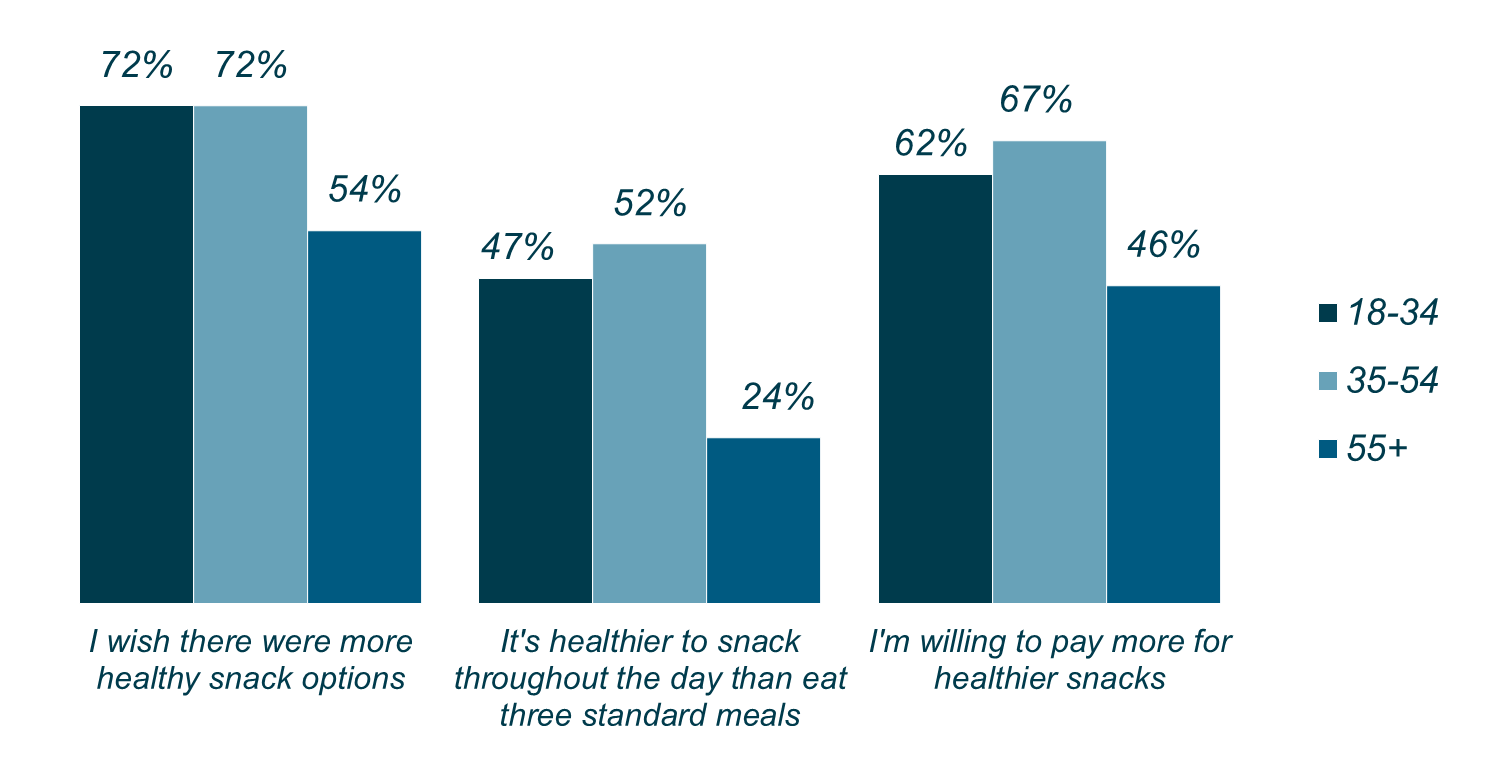

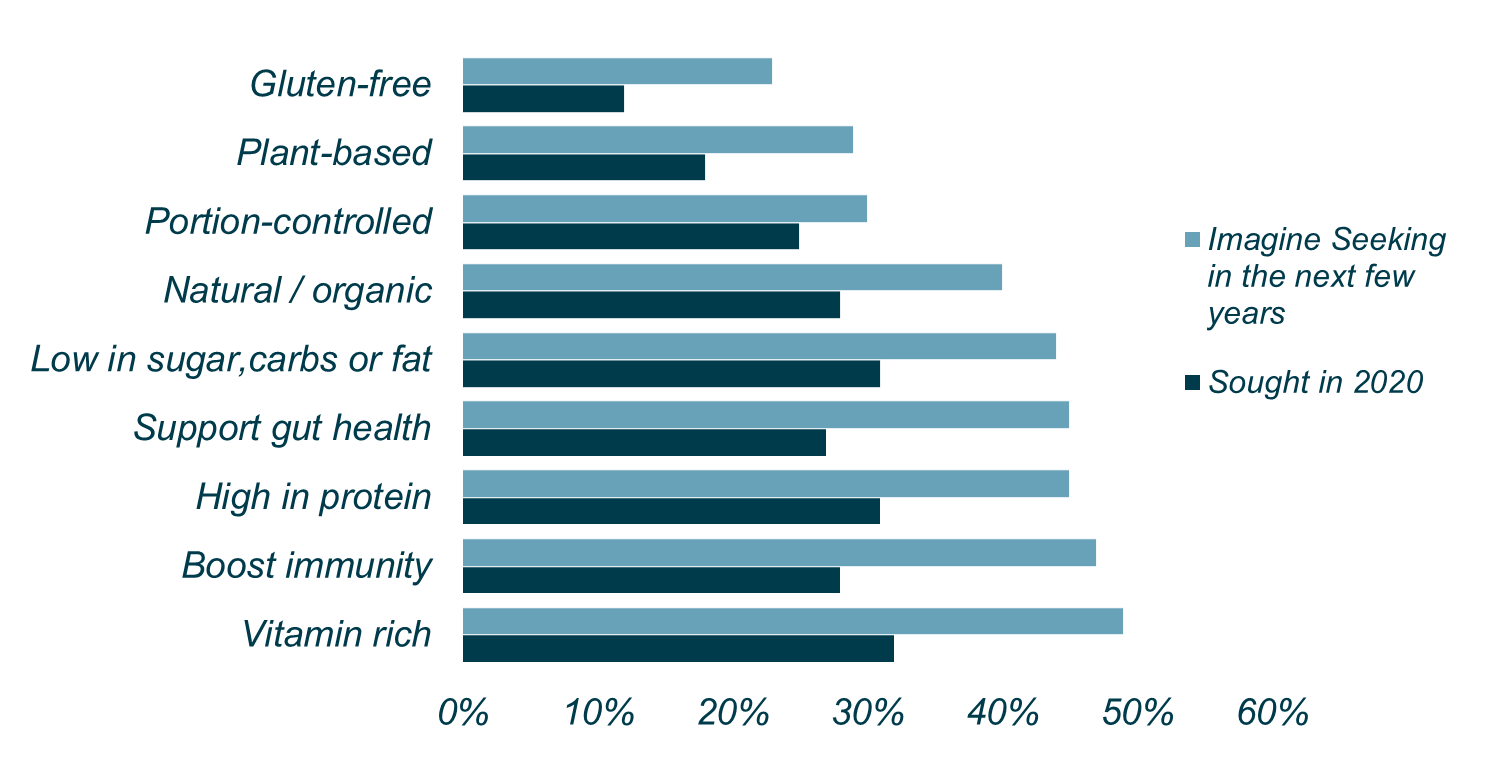

Better-For-You (BFY) / Health and Wellness

- Growth tailwinds favor food companies offering healthier options

- There are a wide range of BFY attributes attracting interest, such as reduced or zero sugar, low carb / keto / paleo, clean label, organic and gluten-free / allergen-free, among others

- The pandemic has accelerated demand for products featuring functional benefits (e.g., immunity) and supporting overall health and wellness

Plant-Based Foods / Ingredients

- Strong, growing consumer demand for plant-based foods, linked to healthy eating trends

- Only one in ten Americans eats their recommended daily amount of vegetables, according to the CDC

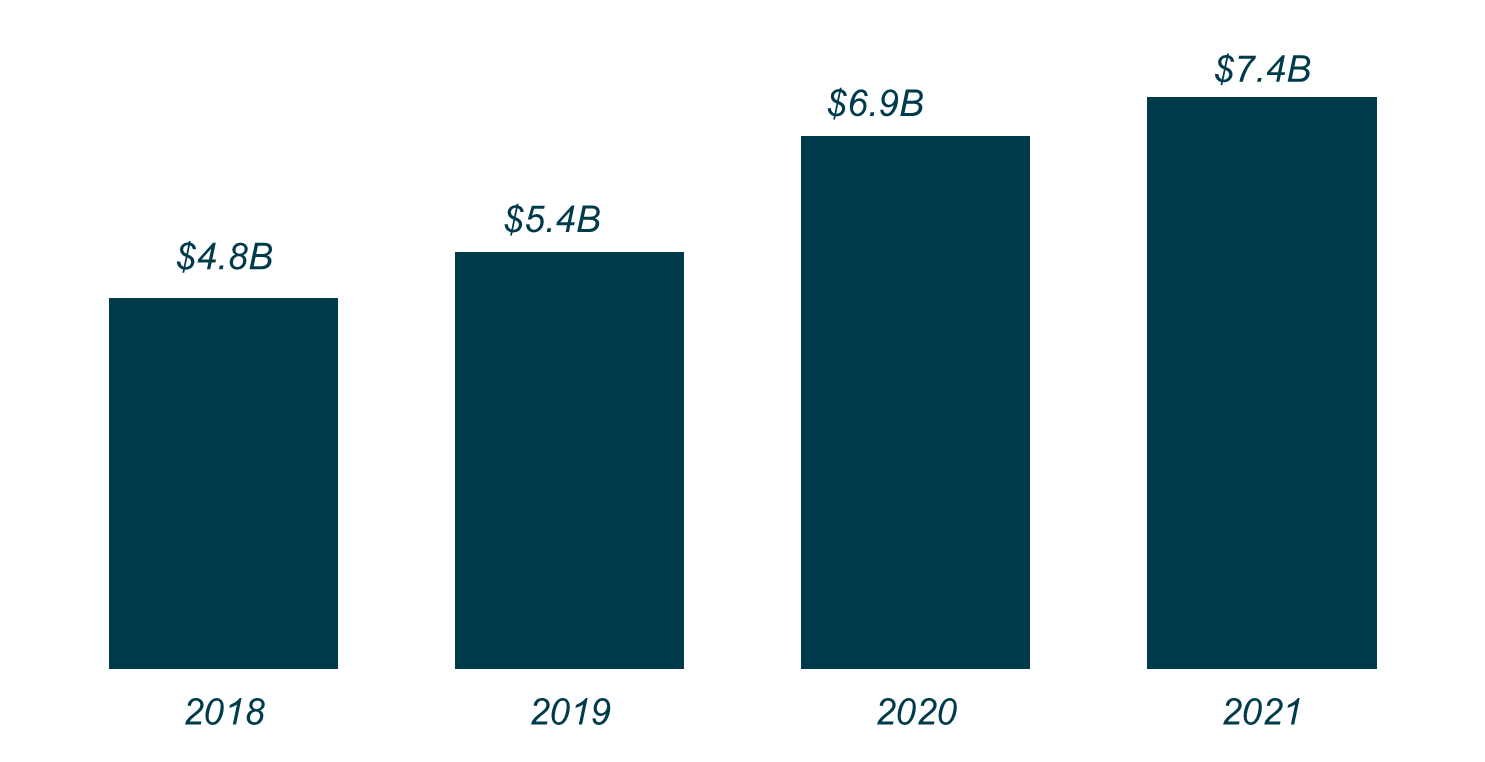

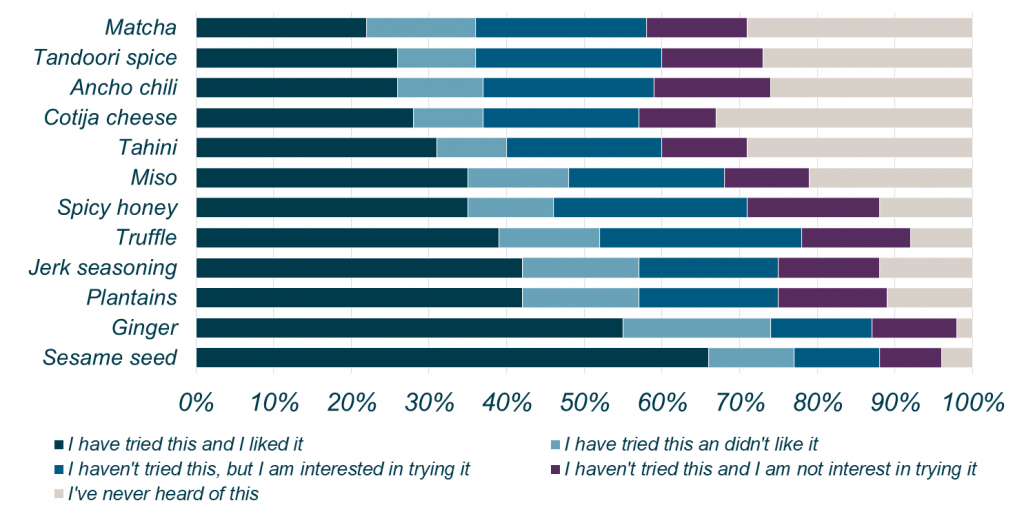

Flavor

- Consumers are increasingly seeking bolder flavors, including ethnic foods from around the world

- Relatedly, consumers are seeking food as an experience, which is reflected by interest in different flavors and ingredients in restaurants

Interest in Flavors and Ingredients on Menu

Source: Mintel – Flavor and Ingredient Innovation on the Menu, US 2022 |

Frozen Food

- Frozen food has been experiencing a renaissance for several years

- The category features higher quality products with cleaner labels than in the past

- Frozen food aligns with consumer preferences for convenience

30% of shoppers have increased their freezer capacity since the onset of the pandemic

Source: AFFI “The power of Frozen”

Bakery

- Bakery is a fragmented category with opportunities for investors to explore a roll-up strategy

- There are numerous bakery executives with whom to partner

- Although the bakery category is capital intensive, demand remains strong

- Tight industry supply in certain product categories, may require investment in capacity expansion to support accelerated future growth

Convenience / Solutions

- Chefs — whether in a restaurant or at home — are seeking time- and step-saving solutions in meal preparation

- With rising labor costs, foodservice operators are responding favorably to opportunities to outsource certain steps / processes so they can maintain a thinner “back of house”

- For consumers tired of cooking at home, any solutions that make meal preparation faster and more convenient are in demand

Where are the opportunities of scale?

Scale matters. But assets of scale trade at a premium due to scarcity. If you can’t find a platform of scale, consider creating one. Consider a roll-up strategy to build the platform you envision. Look at smaller opportunities and grow into it. Alternatively, consider corporate divestitures.

Where are there opportunities for multiple arbitrage?

Look where strategic buyers are temporarily distracted. Perhaps the relevant corporate buyers are in divestiture mode. Maybe they are over-leveraged and need to focus on paying down debt. Did a logical strategic buyer recently announce a large acquisition? Perhaps they need to integrate that target and deleverage their business over the next year before resuming their acquisition focus.

These situations create a temporary opportunity to buy without as much concern of being outbid by a strategic buyer, and then when you go to sell in three-to-five years, those strategic buyers may be back in an acquisition mindset, potentially unlocking multiple expansion on your exit.

What does it take to win?

To win in a competitive sale process, you have to play to win. A few strategies to consider include:

| Develop an angle: Financial investors should develop an angle, but preparation is key. Research a product category or theme and develop an investment thesis. Partner with an experienced food executive. Do the research. Unlock unique insights through your network or through access to data. Capitalize on this preparation when the right opportunity is actionable.

Get aggressive: Despite macroeconomic concerns mentioned previously, in the current M&A market, “A” assets are commanding premium valuations and buyers need to step-up to win. Beyond the valuation, buyers should consider other aspects of their proposal that might be attractive to the seller. For example, buyers should secure committed financing (if needed), accept seller friendly terms, provide a full markup of the purchase agreement and differentiate on speed and certainty. Win over the seller: Just like dating, chemistry is important. From the initial management meeting to subsequent dinners, visits and diligence calls, buyers should treat each interaction as an opportunity to develop a rapport with the seller and the management team. Demonstrate how you would be a great partner who can take a food business to the next level. Don’t forget to provide examples from your relevant experience to prove your track record and demonstrate your ability to add value. Encourage the seller and / or management to ask questions. Part of demonstrating that fit is first listening. Understand what is important to the seller and the management team and ensure you address those considerations in your discussions as well as in your proposal. Purchase price is often the deciding factor but when it is close, chemistry and fit can influence the seller’s decision on which buyer to select. |

Contributors

Meet Professionals with Complementary Expertise in Consumer

Related Perspectives

Recent Transactions in Consumer

Investing in U.S. Food Remains Competitive

Financial and strategic investors often mention the competition to acquire a food company. Investors frequently ask Lincoln International for ideas and perspectives on approaching the food mergers and acquisitions (M&A)… Read More

LBO France and Yarpa have sold McIntosh Group to Highlander Partners

McIntosh Group McIntosh Group is a global leader in the high-end audio category, manufacturing the world’s finest amplifiers, speakers, turntables and other audio products under several iconic brands. The group… Read More

Tosh Dhanalal

Tosh provides advisory services to a diverse client portfolio of founder-led, private equity backed and public companies. He has experience working with direct-to-consumer, e-commerce and multichannel brands in the apparel,… Read More

Pete’s has been sold to Local Bounti

Pete’s Hollandia Produce Group, Inc. (Pete’s) is a leading hydroponic grower of butter lettuce, packaged salad and cress. The company has developed a national Controlled Environment Agriculture (CEA) platform, with… Read More

Beauty and Apparel Sectors: Always in Vogue

Beauty and apparel trends are constantly evolving. Yet one constant is the resiliency of both sectors during previous economic downturns. The “lipstick effect,” or notion that consumers will spend on… Read More

Lincoln Private Market Index Rises Amid Public Equity Market Volatility

Private markets experience growth despite public market volatility, macroeconomic headwinds and continued uncertainty The private markets exhibited marked resiliency in Q1 2022 despite declines in the public markets. The Lincoln… Read More

H2 Equity Partners has sold Cadogan Tate to TSG Consumer Partners

Cadogan Tate Founded in 1977, Cadogan Tate is a leading specialist in fine art and valuables storage and handling. It serves a large and growing customer base of high-net-worth families,… Read More

Beauty Independent | With the Stock Market and VC Down This Year, What’s the Deal Environment Like for Emerging Beauty and Wellness Brands?

Originally published by Beauty Independent on May 17, 2022. Ashleigh Barker, Director in Lincoln’s Consumer Group, offers insights into the beauty industry’s current market dynamics and shares funding strategies that… Read More

Verdane has acquired Hobbii

Client: Verdane Client Location: United Kingdom Target: Hobbii Target Location: Denmark Target Description: Hobbii is a Danish direct-to-consumer platform selling yarn, accessories, and patterns for knitting and crocheting.

Food & Beverage Market Update Q1 2022

While the U.S. continues to see meaningful progress from the pressures of the pandemic, other issues have risen to challenge supply chains and the labor market.

Beauty Independent | The State Of Indie Beauty

Originally published by Beauty Independent on May 4, 2022. Ashleigh Barker, Director in Lincoln’s Consumer Group, discusses the current condition of the indie beauty industry, the challenges brands face and… Read More

Banking on Beauty: Q&A with Lincoln Director Ashleigh Barker

Lincoln International recently welcomed Ashleigh Barker to the firm as a Director in the Consumer Group. Ashleigh comes to Lincoln with extensive experience advising beauty and personal care clients on… Read More

Innovation Industries, Munich Venture Partners, PMV and SET Ventures have sold Luxexcel to Meta Platforms

Client: Innovation Industries, Munich Venture Partners, PMV and SET Ventures Client Location: Netherlands, Germany and Belgium Target: Luxexcel Target Location: Netherlands Acquirer: Meta Platforms Inc Acquirer Location: United States Target Description: Luxexcel is the… Read More

Ashleigh Barker

Ashleigh is a Director in Lincoln’s Consumer Group. She has spent over a decade developing extensive experience covering founders and senior management clients within the beauty, wellness, luxury, retail and… Read More

Five Macro Trends Driving Growth in Global Branded Pet Food

Pet ownership has surged in recent years as pets have become valued members of household families, yielding benefits such as companionship, improved mental health and others. Continued increased pet ownership,… Read More

Ziyad Brothers has been sold to an affiliate of Peak Rock Capital

Ziyad Brothers Ziyad Brothers is a leading omnichannel provider of branded Middle Eastern and Mediterranean foods. Ziyad has a 50-year track record of delivering a diverse product portfolio of over… Read More

The Calida Group has sold Millet Mountain Group to Inspiring Sport Capital and a private investor

Millet Mountain Group Millet Mountain Group is a French pioneer in mountain sports equipment, headquartered in Annecy, France, providing a comprehensive offering, including outdoor apparel, backpack, equipment and shoes for… Read More

Lincoln’s Valuations Database Request

Every quarter, Lincoln’s Valuations & Opinions Group values between 1,600 to 1,800 privately held companies owned by private equity groups. At the end of every quarter Lincoln anonymizes and aggregates… Read More

VR Equitypartner and co-investors have acquired a majority stake in Heizungsdiscount24

Heizungsdiscount24 Heizungsdiscount24 (HD24) is a German e-commerce retailer of heaters and adjacent periphery products serving both primary end consumers (business-to-consumer) and heating installers (business-to-business). HD24 has a comprehensive product portfolio… Read More

Lincoln International Celebrates Sustained Growth in Europe

Lincoln International is pleased to celebrate another outstanding year globally. In 2021, the firm advised on a record number of transactions and achieved significant growth across all of its M&A industry sectors and… Read More

Scale your Career: What Makes a Good Investment Banker Great?

For new analysts and associates, communication, collaboration and coordination are essential components of a successful investment banking career. Individuals who can communicate and collaborate effectively with colleagues across title levels… Read More

Sterling Investment Partners has sold American West Restaurant Group to Sentinel Capital Partners

Client: Sterling Investment Partners Client Location: United States Target: American West Restaurant Group Target Location: United States Acquirer: Sentinel Capital Partners Acquirer Location: United States Target Description: American West Restaurant Group is a large franchise of quick… Read More

Lincoln Private Market Index Wraps 2021 at a Record High, Inspiring a Borrower-Friendly Private Credit Market

Sustainability of enterprise value levels hinges in part on private companies’ ability to address supply chain, hiring and inflationary pressures In Q4 2021, private company enterprise values grew 3.9%, bringing… Read More

Global Consumer Group at Lincoln International Accomplishes Record Year in 2021

Evolving Consumer Preferences Continue to Drive Investor Interest in the Sector Consumer sector transaction activity continues to be robust, and Lincoln’s Global Consumer Group is commanding a significant share of… Read More

Graham Partners has sold Giraffe Foods to Symrise AG

Giraffe Foods Giraffe Foods Inc. is a leading player in the formulation and manufacturing of custom flavor solutions. With advanced research and development and culinary capabilities, Giraffe formulates and produces… Read More