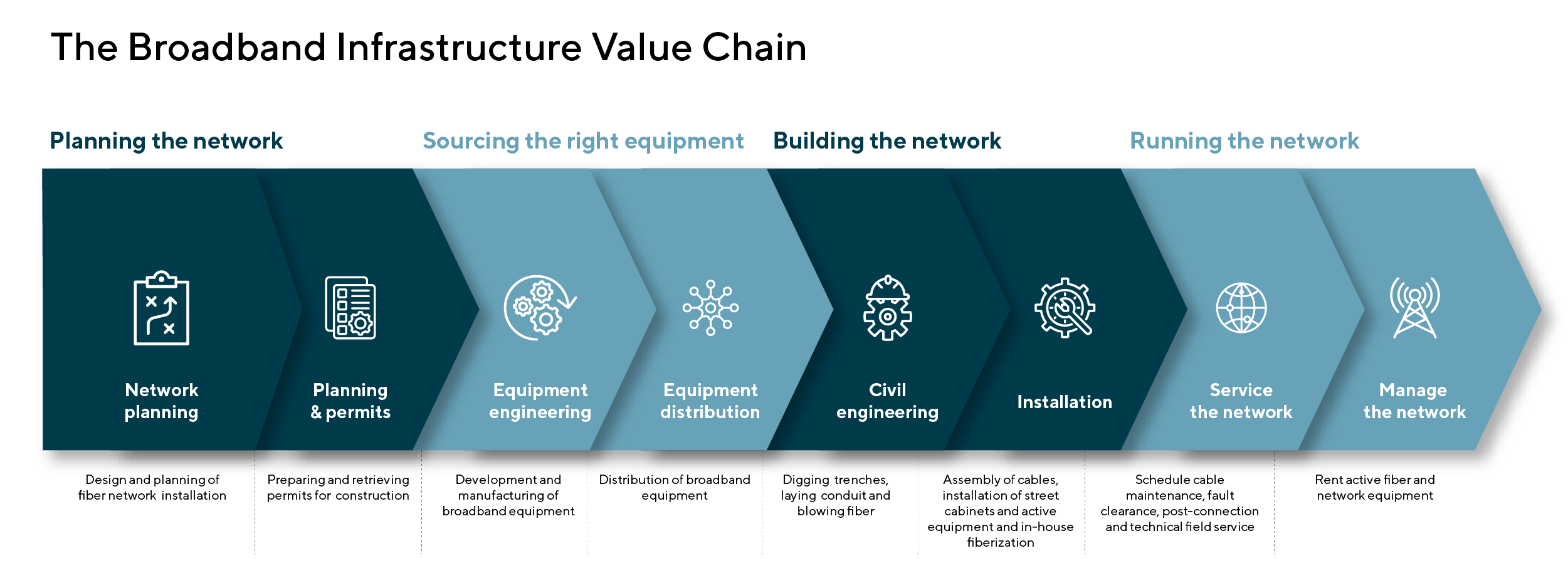

These infrastructure updates create numerous investment opportunities across the broadband infrastructure value chain:

Lincoln Perspective

Fiber roll-out activity and broadband network upgrades are progressing. Many industry participants along the entire broadband infrastructure value chain currently enjoy high demand, leading to strong growth and profitability.

Over the years to come, fiber roll-out activity will peak and consequently, at some point, companies will need to reposition themselves and adapt their business model.

Current topics in the sector include:

| Building of Platforms: The fragmentation of the market offers significant roll-up potential along the entire broadband infrastructure value chain. Examples of companies that have followed a successful buy-and-build strategy include Vitronet, Netzkontor and BTV Multimedia (all backed by DBAG), Netceed (backed by Cinven and Caryle) or Amadys (backed by Equistone). Early 2023, BTV Multimedia and Amadys were acquired by Netceed.

End-market Diversification: As the sector evolves, companies are required to look into new end markets (e.g., energy, EV charging stations, district heating) to counterbalance the potential future decline in fiber roll-out activity. Given demand for fiber services and equipment is currently strong, there is limited desire nor capacity to organically venture into new end markets. Add-on mergers and acquisitions (M&A) therefore is a key tool to bring new competencies in-house next to customer relationships. Acquisition Hires: Engineering, planning and construction companies’ growth is limited by a lack of qualified personnel. Certain tasks, such as splicing, also require specialized personnel. Acquisitions are a key enabler to scaling capabilities in a timely fashion while demand is strong. Succession Issues: Many smaller, owner-led firms are looking to become part of a larger organization in order to secure the future of the business and monetize the value of the company they built. Consolidation in Fiber Networks: The rise of interest and construction costs, supply issues, insolvencies and fiber overbuild, among others, have impacted the fiber sector in Germany. In addition to continued organic fiber rollouts, we expect a wave of consolidation in the fiber network sector. |

Contributor

Meet Professionals with Complementary Expertise in Industrials

I am a rigorous advocate for my clients with a hands-on, communicative approach, focused on delivering intense advocacy and outlier results.

Sean Bennis

Managing Director & Co-head of Industrials

Chicago

I enjoy leading clients and realizing their objectives, while structuring solutions to issues that are both intriguing and challenging.

Øyvind Bjordal

Managing Director | Head of Switzerland

Zurich

Building long-term relationships is key for me personally – I want to be the advisor of trust for my clients.

Dr. Michael Drill

Managing Director | Head of Germany

FrankfurtRelated Perspectives

Recent Transactions in Industrials

German Broadband Infrastructure Market Set for Further Consolidation

It is no longer a surprise that access to high-speed internet is a necessity for individuals, businesses and governments worldwide. In Germany, the federal government has recognized this and set… Read More

FDH Aero, a portfolio company of Audax Private Equity, has acquired BJG Electronics

BJG Electronics Based in Ronkonkoma, New York, and founded in 1979, BJG Electronics serves both original equipment manufacturers (OEMs) and aftermarket-services providers in the aerospace and defense industry. The acquisition… Read More

I.R.I Group obtained a financing package to finance its growth path and to refinance the existing debt

I.R.I. Group I.R.I. Group is a private capital holding company founded with the goal of building a pole of excellence for Italian small and medium-sized enterprises operating in the precision… Read More

Caledonia Investments has acquired Air-serv from CSC ServiceWorks

Client: Caledonia Investments Client Location: UK Target: Air-serv Target Location: UK Acquirer: Caledonia Investments Acquirer Location: UK Target Description: Air-serv installs and maintains air, vacuum and jet wash machines at petrol pump forecourts across the UK… Read More

Graham Partners has sold Desser Aerospace to VSE Corporation

Client: Graham Partners, Inc. Client Location: United States Target: Desser Aerospace Target Location: United States Acquirer: VSE Corporation Acquirer Location: United States Target Description: Desser Aerospace is a leading global partner for aviation aftermarket… Read More

H2 Equity Partners has agreed to sell TB&C to Delta Electronics

TB&C TB&C, headquartered in Germany is a leading manufacturer of bespoke high-voltage components and sunroof systems for the automotive industry. The company was founded in 2004 and has since emerged… Read More

Lineage Capital has sold Syracuse Glass Company to Oldcastle BuildingEnvelope, a portfolio company of KPS Capital Partners

Syracuse Glass Company Syracuse Glass Company is a leading architectural glass and aluminum fabricator serving the small- to mid-sized job market in the Northeastern U.S. Headquartered in Syracuse, New York,… Read More

Stellex Capital Management has acquired David Brown Santasalo from N4 Partners

Client: Stellex Capital Management Client Location: United States Target: David Brown Santasalo Target Location: United States Acquirer: Stellex Capital Management Acquirer Location: United States Target Description: David Brown Santasalo is an aftermarket-focused gearing group that engineers,… Read More

Charles Xia

Charles provides mergers and acquisitions (M&A) advisory services to clients across various industries, including consumer, healthcare and industrials. He has extensive experience working alongside public companies as well as private… Read More

GEF Capital Partners and ENC Energy SGPS have sold ENC Energy Brazil to Gás Verde, a subsidiary of Urca Energia

ENC Energy Brazil Founded in 2012, ENC Energy Brazil (ENC Brazil) is a leading builder, owner and operator of LFGTE (landfill gas-to-energy) plants in Brazil, with more than 20% expected… Read More

Engine & Transmission Exchange has partnered with Gauge Capital

Engine & Transmission Exchange Founded in 1985 and headquartered in Milwaukee, Engine & Transmission Exchange (ETE) is one of the largest independent aftermarket transmission remanufacturers in the United States. Family-owned… Read More

Deutsche Beteiligungs AG has sold BTV Multimedia Group to Netceed, a portfolio company of Cinven and Carlyle

BTV Multimedia Group BTV Multimedia Group is a leading provider of passive and active equipment as well as services for broadband network deployment, maintenance and upgrades, primarily focused on the… Read More

Alpine Investors has completed a single asset continuation vehicle transaction involving Apex Service Partners

Client: Alpine Investors Client Location: United States Target: Apex Service Partners Target Location: United States Target Description: Apex Service Providers is a heating, ventilation and air conditioning (HVAC); plumbing and electrical services… Read More

ERA Industries has been sold to L Squared Capital Partners

Client: ERA Industries Client Location: United States Target: ERA Industries Target Location: United States Acquirer: L Squared Capital Partners Acquirer Location: United States Target Description: Headquartered in Elk Grove Village, Illinois, ERA Industries is a leading,… Read More

Colmec Group, a Scandinavian distribution platform for truck tire lifecycle management, has been sold to Norvestor

Colmec Colmec is the leading truck and bus tires distributor in Scandinavia and Poland. Since its founding in the 1960s, Colmec has, under the ownership of the Eckerström family, grown… Read More

Ambienta and other shareholders have sold Next Imaging to Azimut Libera Impresa

Next Imaging Next Imaging is a platform promoted by Ambienta, aimed at creating an international value-added distributor of imaging and machine vision solutions. The platform encompasses iMAGE S, the Italian… Read More

GenNx360 has refinanced Tooling Tech Group

Tooling Tech Group Headquartered in Fenton, Michigan, Tooling Tech Group is a leading North American provider of end-to-end tooling and automation solutions across numerous verticals and end markets. The company… Read More

Deutsche Invest Capital Partners has sold Loibl Förderanlagen to Martin Group

Loibl Förderanlagen Loibl Förderanlagen is a leading Germany-based specialist for bulk material handling solutions with more than 60 years of experience, providing mission-critical, tailor-made modular solutions with a focus on… Read More

Midwestern Electric, a portfolio company of CAI Capital Partners, has acquired Kuharchik Construction and Wyoming Electric & Signal

Client: CAI Capital Partners Client Location: United States Target: Midwestern Electric Target Location: United States Target Description: Midwestern Electric provides infrastructure services.

Chemicals Quarterly Review Q1 2023

A growing push and pull demand for biobased chemical intermediate solutions will drive further mergers and acquisitions (M&A) activity. There is an ever increasing emphasis for more environmental, social and… Read More

Founders and Société Générale Capital Partenaires, Isatis and bpiFrance have sold a majority stake in Milexia to Crédit Mutuel Equity

Milexia Headquartered in Saint-Aubin, France, Milexia is a pan-European leader, specializing in the value-added distribution of electronic components, subsystems and scientific instrumentation, addressing mainly the defense and space sectors, but… Read More

Diploma has sold Hawco to Bay Tree Private Equity

Hawco Hawco is one of the UK’s leading value-added distributors of HVAC/R, drinks dispense and vending machine components selling through the Hawco and Abbeychart brands. Its value-added services include bespoke… Read More

Blue Sea Capital has acquired Rhino Tool House

Rhino Tool House Rhino Tool House is a leading provider of end-to-end assembly line products, engineered automation solutions and value-added services for blue-chip manufacturing companies. Rhino Tool House utilizes a… Read More

Canlak Coatings, a portfolio company of SK Capital Partners, has acquired Ceramic Industrial Coatings

Client: SK Capital Partners Client Location: United States Target: Ceramic Industrial Coatings Target Location: United States Acquirer: Canlak Coatings Acquirer Location: United States Target Description: Ceramic Industrial Coatings is a market-leading independent wood coating manufacturer that primarily… Read More

Frontenac has completed a single asset continuation vehicle transaction involving Motion & Control Enterprises

Client: Frontenac Client Location: United States Target: Motion Control Enterprises Target Location: United States Target Description: Motion & Control Enterprises provides solutions for engineered systems, automation, fluid power, compressed air, flow control, lubrication and… Read More