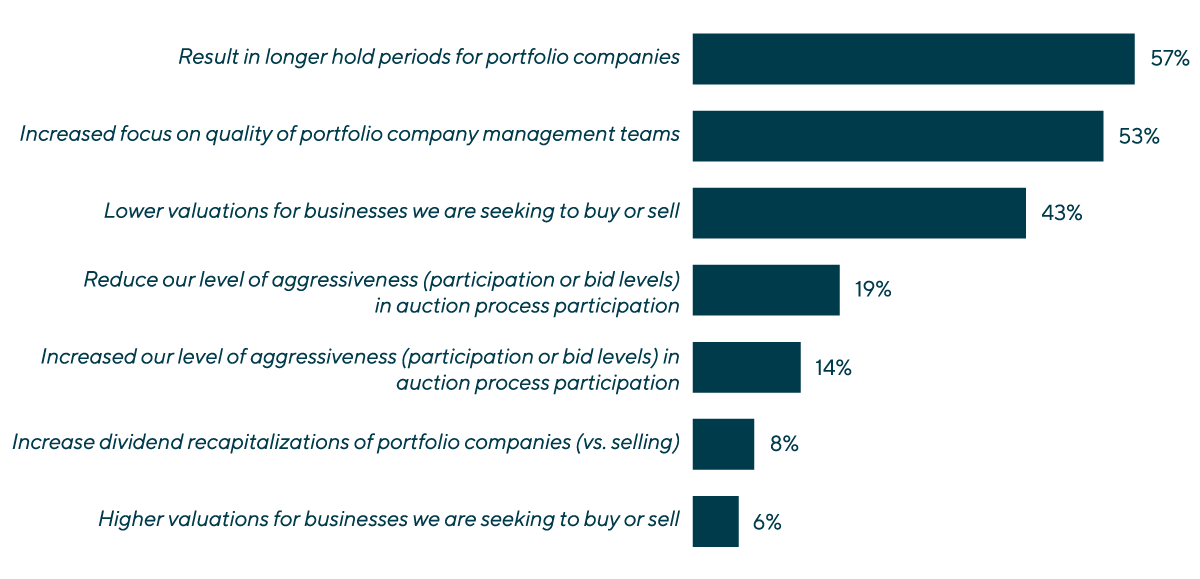

Hold On & Look InwardNearly 60% of respondents to the survey indicated that they will have longer hold periods for their portfolio companies in 2023 as a result of the economic environment. For PE investors in consumer, the challenging economic conditions have caused many to redirect attention that would otherwise be given to M&A toward optimizing performance within their existing portfolio companies. In fact, 53% of respondents reported an increased focus on the quality of management teams, indicating that company leadership is more important than ever in successfully navigating macroeconomic uncertainty and preparing for future growth. Valuations are also down in this environment, creating a misalignment between buyer and seller expectations as companies feel the impact of the inflationary environment on their bottom lines. Buyers are increasingly stretching out the due diligence phase and exercising extra caution to ensure they align their capital with the ripest opportunities—and on the right timeline. |

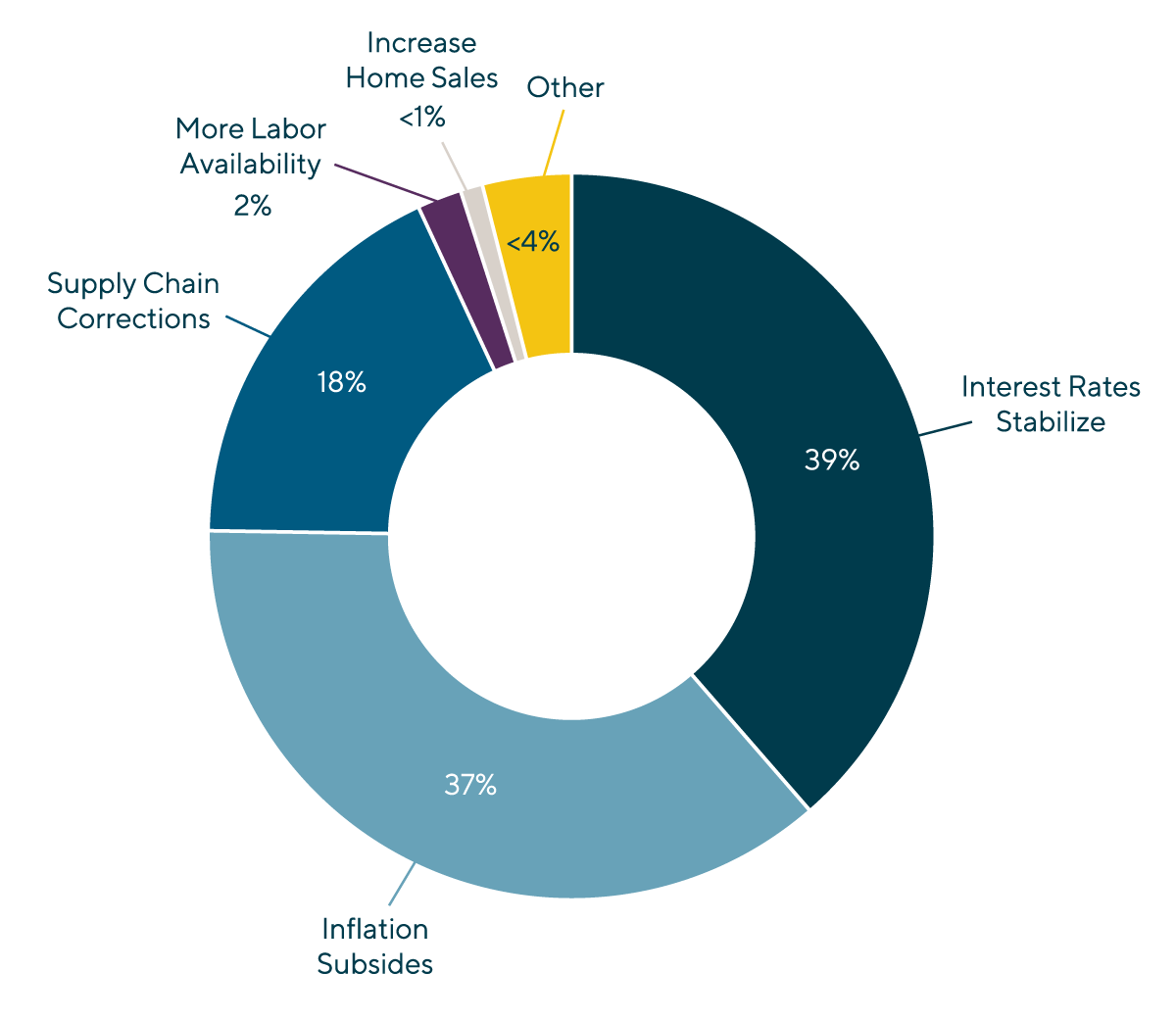

Indicators of an M&A ReboundWhen it comes to factors that can revitalize the M&A market in consumer this year, respondents overwhelmingly agree that interest rate stabilization and inflation subsiding will be the difference makers. Investor eyes remain trained on the Federal Reserve, whose rate hike campaign over the last year has caused delayed deal timelines, decreased debt availability and increased caution across the board. The rising interest rates also put more pressure on companies that were already struggling to make debt service payments. Supply chain issues have been a key concern over the past several years. 18% of surveyed investors agreed that ongoing supply chain corrections post-pandemic will restore confidence around steady state business performance indicators. As companies sell through excess, high-cost inventory purchased at the peak of the supply chain crisis, earnings will continue to show softness. However, we anticipate a meaningful uptick in the profitability of these businesses in Q4 and Q1, which should give sellers and buyers more confidence in transacting. It is clear that there remains a backlog of pent-up demand from both sellers and buyers to transact as soon as the markets support doing so. Sellers that delayed transactions for this past year generally have increased pressure to sell. Many buyers with coffers full of cash for deals are frustrated by the difficulty they see in finding deal flow. Because of these factors, we have confidence in the long-term outlook for the M&A markets. The main unknown is how soon these catalysts will help the market get back to a normalized level. |

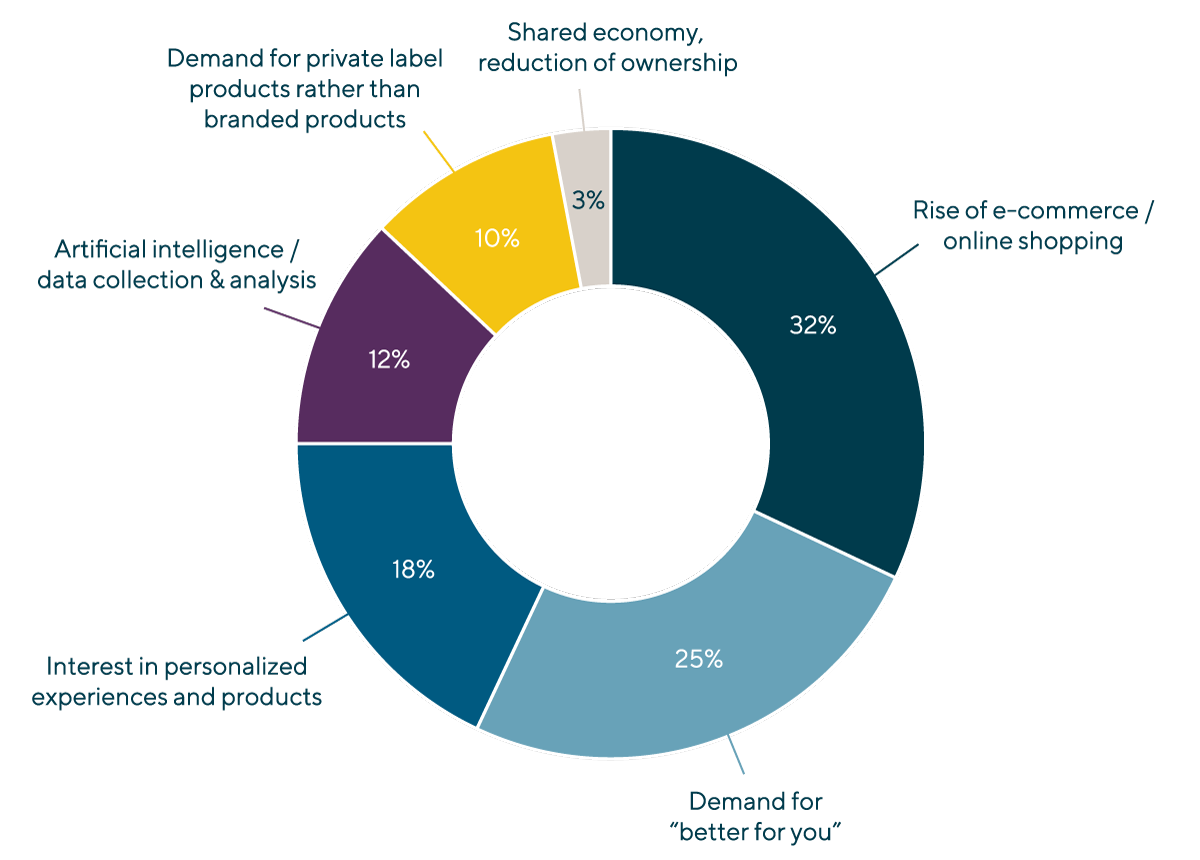

Online Remains On-TrendThe global e-commerce market that experienced spikes in 2020 during pandemic-induced lockdowns continues to grow, albeit at a slower pace. For consumer businesses, a solid and efficient e-commerce strategy has become a non-negotiable attribute for most prospective buyers. More than any other trend, 32% of respondents selected e-commerce and the rise of online shopping as the dynamic causing the most change in the consumer sector. In addition to a move to e-commerce channels, “better for you” products and services continue to be top-of-mind for consumers in the post-pandemic era, with 25% of respondents indicating the trend will continue to drive change across the sector. Consumers prioritizing their health and wellness has translated into new opportunities for investor dollars not just in food and beverage, but across a host of consumer subsectors, such as beauty, that are offering innovative offerings to align with “better for you.” |

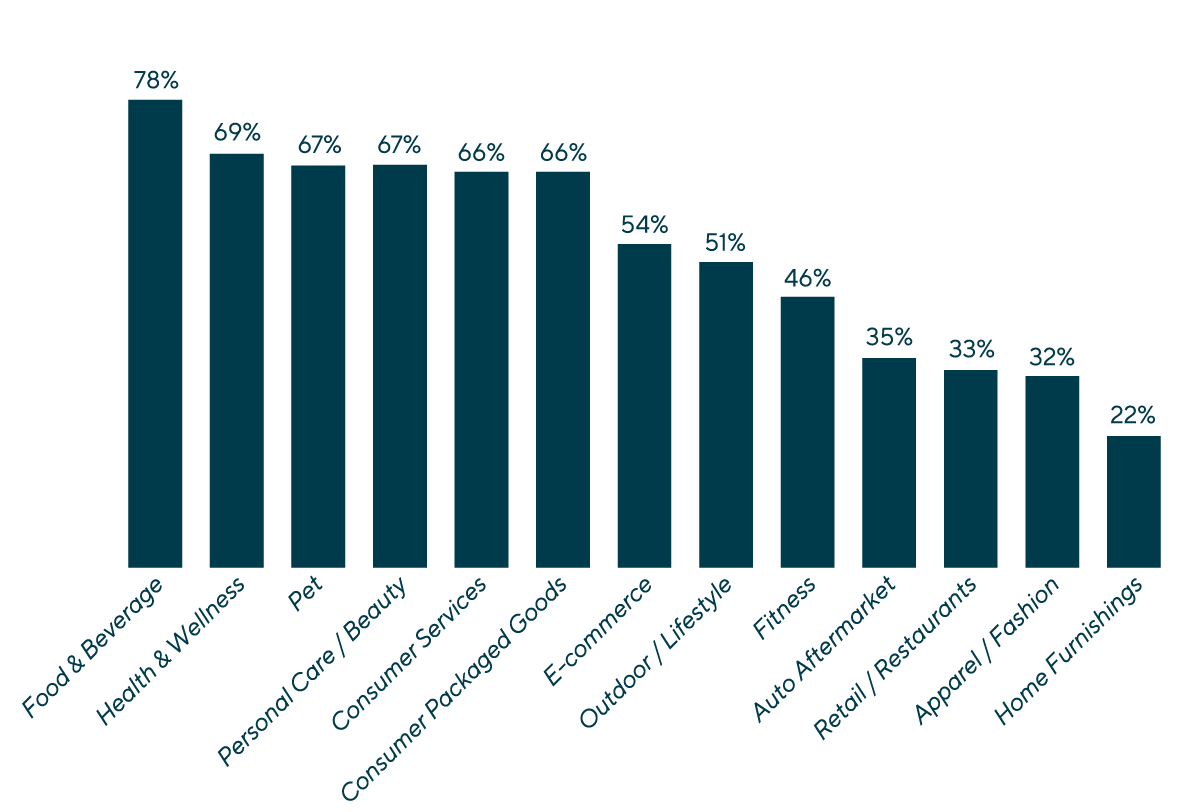

Most Likely Subsectors for InvestmentDealmakers see opportunity in food and beverage, health and wellness, pet and personal care / beauty, all categories that exhibit qualities of recession resilience and steady consumer spending. While the retail / restaurants and auto aftermarket sectors performed well prior to 2020, the pandemic drove shifts across the sector – leading to near-term boosts that have now stabilized, or entire behavior pattern changes that require strategic rethinking to address. That said, dealmakers plan to pursue a wide range of categories in their investment strategies in 2023, with 100 or more respondents selecting each category. |

American & European Consumer Group Heads

Through honest advice, passionate client service and hands-on execution, I strive to deliver outlier results for my clients.

Christopher Petrossian

Managing Director & Co-head of Consumer

Los Angeles

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

LondonMeet Professionals with Complementary Expertise in Consumer

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago

I design strategies and offer solutions that fit the unique ambitions of each client I serve.

Brian Little

Managing Director

Los Angeles

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

LondonRelated Perspectives

Recent Transactions in Consumer

How Consumer Products & Services Companies Are Viewing M&A Outlook for 2023

In today’s dealmaking environment, uncertainty and caution reign supreme. Consumer confidence has seen declines as high inflation and recession fears dominate. At the same time, investors continue to look for… Read More

Private shareholders have sold ISM Heinrich Krämer to Protective Industrial Products, a portfolio company of Odyssey Investment Partners

ISM Heinrich Krämer ISM Heinrich Krämer GmbH & Co. KG is one of the world’s leading and fastest-growing providers of athletic-inspired safety footwear. The company is well known for its… Read More

Webinar | Bringing Sustainability to the Table: Perspectives on ESG in the Home Furnishings Industry

On May 22nd, 2023, Lincoln International and L.E.K. Consulting hosted a webinar which explored the importance of sustainability and subsequent priorities in the home furnishings sector, findings from a recent… Read More

Webinar | Bringing Sustainability to the Table: Perspectives on ESG in the Home Furnishings Industry

On May 22nd, 2023, Lincoln International and L.E.K. Consulting hosted a webinar which explored the importance of sustainability and subsequent priorities in the home furnishings sector, findings from a recent… Read More

Greenleaf Produce has been sold to The Chefs’ Warehouse (NasdaqGS:CHEF)

Greenleaf Produce Greenleaf Produce is a leading purveyor and distributor of produce, dairy, protein and other specialty items to foodservice operators in the San Francisco Bay Area and surrounding region.… Read More

Standard Investment has sold Dierenartsen Groep Nederland to VetPartners, a portfolio company of BC Partners

Dierenartsen Groep Nederland Dierenartsen Groep Nederland (DGN) is one of the best-known independent veterinary groups in the Netherlands. The growth of DGN, which has 26 clinics in 33 sites across… Read More

Litorina has sold Johan i Hallen & Bergfalk to METRO

Johan i Hallen & Bergfalk Johan i Hallen & Bergfalk (JHB) is a leading Swedish specialist provider of fresh proteins to the hotels, restaurants and catering (HoReCa) segment with sales… Read More

Plant-based Alternatives are Poised for Growth

Lincoln International was pleased to host the Plant-based Potential: The Rapid Rise of Alternative Foods and Growth Opportunities Ahead panel at the Food & Drink Expo in Birmingham, UK. During… Read More

PETS International | Investment Spike in the Fresh Dog Food Category

Originally posted by PETS International on April 26, 2023. The natural / minimally processed pet food industry is attracting great investor interest, and the market is growing at a rapid… Read More

Lincoln International Announces Strategic Partnership with Australian Corporate Advisory Firm, Miles Advisory Partners

Lincoln International, a global investment banking advisory firm, announced today that it has established a strategic partnership with Miles Advisory Partners, an Australian-based independent corporate advisory firm, servicing the robust… Read More

Old Time Pottery, a portfolio company of Comvest Partners, has merged with Gabe’s, a portfolio company of Warburg Pincus

Client: Comvest Investment Partners Client Location: United States Target: Old Time Pottery Target Location: United States Acquirer: Gabe’s Acquirer Location: United States Acquirer Sponsor: Warburg Pincus Target Description: Old Time Pottery is a… Read More

In The Style Group has sold its trading operations to Baaj Capital

In The Style In The Style is a fast-growing digital womenswear fashion brand with an innovative social media influencer collaboration model. Founded in 2013 by Adam Frisby, the brand champions… Read More

Canidae, a portfolio company of L Catterton, has merged with Natural Balance, a portfolio company of Nexus Capital Management

Canidae Canidae® is a super-premium, natural dog and cat food brand striving to create a world of sustainable goodness for pets and the planet. The company was founded in 1996… Read More

Palladium Equity Partners has refinanced Del Real Foods

Del Real Foods Del Real Foods, based in Mira Loma, California, is a manufacturer of branded and private label heat-and-serve authentic Mexican cuisine products including meats (like carnitas, barbacoa and… Read More

Beauty Outlook: Optimism for an Attractive 2023

Many investors are eyeing the year ahead for the beauty and personal care industry as it is ripe for accelerated growth due to several factors. 2022 had a key focus… Read More

Food Ingredients: Recipe for Premium Valuations

Buyers have a hearty appetite for value-added ingredient companies, and that craving has only intensified in recent years. The ingredients space is broad and fragmented across the U.S. and globally… Read More

Fondo Italiano d’Investimento and Eulero Capital have acquired a minority stake in HNH Hospitality from Siparex Group

HNH Hospitality Founded in 1999 and based in Mestre, Italy, HNH Hospitality manages 16 hotels located across the country with more than 2,000 rooms under international third-party brands (Hilton, IHG,… Read More

Food & Beverage Market Update Q4 2022

2022 came to a mixed close, public credit and equity markets continued to slow through Q4 as the Fed marched on with its cycle of interest rate hikes. This choppiness… Read More

Court Square Capital Partners has acquired Five Star Parks and Attractions

Client: Court Square Capital Partners Client Location: United States Target: Five Star Parks and Attractions Target Location: United States Acquirer: Court Square Capital Partners Acquirer Location: United States Target Description: Five Star Parks and Attractions… Read More

Glow Recipe’s Strengthen Your Boundaries Summit | Panel: Beginning Your Entrepreneurial Journey

Lincoln International was pleased to have moderated the Beginning Your Entrepreneurial Journey session at Glow Recipe’s Strengthen Your Boundaries Summit on January 21st. The expert panel featured founders of prominent… Read More

Global Consumer Group at Lincoln International Achieves Strong Results in 2022 Despite Sector Challenges in H2 2022

Investor sentiment for select high-quality consumer assets remained robust in 2022, and is expected to continue in 2023 as differentiated businesses outperform competitors and successfully navigate the credit market Despite… Read More

Telemos Capital has acquired Vittoria from Wise Equity

Vittoria Founded in 1953 and based in Brembate, Italy, Vittoria produces bicycle tires that are the reference for professionals and performance-oriented cycling enthusiasts across the world. Vittoria is recognized as… Read More

Shahriar Shamsaei

Shahriar provides mergers and acquisitions advisory services to private equity, small and medium-sized enterprise and family-owned business clients in Lincoln’s Consumer Group. While he focuses on the consumer industry, Shahriar… Read More

Nobuhiro Nakagawa

Nobuhiro provides mergers and acquisitions advisory services to clients in Japan. While he has expertise across multiple sectors, he has a deep understanding of the consumer and industrials industries. Leveraging… Read More

The Business of Fashion | Beauty’s Top M&A Targets

Originally posted by The Business of Fashion on January 23, 2023. Ashleigh Barker, Director in Lincoln’s Consumer Group, shares how leading beauty companies are well positioned to capitalize on the… Read More