Health club membership grew to approximately 77 million members in 2024, a 6% increase year-over-year, while club visits rose by 8%, underscoring growing consumer commitment to wellness. Even as individual usage patterns continue to evolve and potentially indicate a new post-pandemic baseline, overall member engagement and participation are trending upward.

This renewed momentum is powered by shifting demographics and priorities. Gen Z and Millennials are leading the charge, exercising more frequently and seeking personalized, purpose-driven fitness experiences. At the same time, an increased focus on preventative health, performance longevity and strength training has expanded the industry’s relevance far beyond traditional gym offerings. As a result, the fitness industry is not only growing, but evolving and poised to play a central role in the broader health & wellness ecosystem.

Strength Training & Holistic Wellness Take Center Stage

|

1 |

The Continued Rise of Strength TrainingStrength training has emerged as the dominant fitness trend, particularly among younger demographics. As published research and consumer dialogue on strength training increase, fitness operators have undergone strategic realignment, with many gyms reallocating space to free weights and functional training zones.

|

|

2 |

Holistic Health Becomes a Core Consumer PriorityFitness is no longer just about physical exercise, as mental wellness, recovery and social connection have become critical pillars of the modern fitness experience. Recovery services such as cold plunges, red light therapy and compression therapy are increasingly being adopted by gyms, with Crunch Fitness, Life Time and boutique chains rolling out dedicated relax and recover zones. Wearable technology and AI-driven personalization have further blurred the lines between fitness and health optimization, with consumers increasingly using data-driven insights to tailor their wellness journey. As interest in holistic health and wellness rises due to general consumer health trends and increased awareness of weight management options (e.g., GLP-1s), fitness businesses have expanded their value proposition beyond memberships to create new revenue opportunities in wellness-driven services. |

Shifting Business Models and Competitive Landscape

|

1 |

The Strength of High-Value, Low-Price (HVLP) and Premium ModelsTwo business models continue to outperform the market:

While these models continue to enhance metric performance, the bifurcation in the market has left mid-tier operators struggling, with many shifting toward specialization to maintain relevance. |

| Life Time, Average Center Revenue per Center Membership |

|

2 |

Increased Personalization Through Digital Integration, AI and Fitness InstructorsWhile technology continues to reshape the fitness landscape with wearable integration and AI-powered coaching, fitness instructors remain important to the personalized fitness experience. As consumer expectations evolve, fitness operators must embrace digital transformation and personalization to remain competitive.

|

Source: eMarketer; U.S. Bureau of Labor Statistics; NASM

1) Ages 18+ individuals who wear a single-purpose wrist-worn electronic device with limited functionality solely for tracking health and fitness activities (e.g., steps taken, heart rate, distance, speed, calories burned) at least once per month

2) Includes both self employed and wage & salary earners as reported in the annual BLS employment projection series

Fitness Industry Poised for Continued Expansion

The outlook for 2025 and beyond remains strong, with the industry benefiting from several key tailwinds:

- Consumer health trends toward fitness participation and holistic wellness.

- Strength training and recovery services becoming essential components of gym offerings, driven by consumer demand as well as increased adoption of GLP-1s.

- Wearables, AI and personalized training expanding the ecosystem beyond traditional gym settings.

While the fitness industry has several years of strong performance under its belt, the opportunities for innovation and expansion are greater than ever. Operators who successfully integrate technology, prioritize strength and recovery and foster strong communities will be best positioned for long-term success.

The fitness industry’s next phase of growth will be defined by adaptation, personalization and expansion into holistic health experiences, offering consumers more than just a place to work out, but a true health and wellness hub.

The Fitness Investment Landscape in 2025:

| 2024 was a banner year for the fitness sector, with global mergers and acquisitions (M&A) recording over 70 completed transactions. The category continues to experience significant momentum, driving increased investor optimism across most ecosystems and concepts—both from legacy investors and new entrants focusing on the space. Although much of the fitness sector saw growth, certain ecosystems failed to regain pre-pandemic membership levels, forcing some groups to delay transactions or transfer ownership to lenders.

Navigating the evolving M&A landscape remains a priority for industry executives and investment professionals. With 2025 poised to match 2024’s record-setting activity, Lincoln International’s team of dedicated bankers is prepared to help fitness sector leaders capitalize on emerging trends and navigate the shifts shaping the market this year. |

Key M&A Investor Themes

M&A Activity is Robust; More Investor Groups Enter the Category

While many of the 70+ M&A transactions involved consolidation by established platforms or experienced investment firms, a significant number of investment groups entered the fitness category for the first time. Within the Crunch ecosystem alone, Trive Capital, CapitalSpring and Meaningful Partners each made significant investments in fast-growing franchisee platforms. Within the Planet Fitness franchise Mayfair Capital acquired Baseline Fitness with plans to grow unit count both organically and through M&A. As the fitness sector gains recognition as a key area for investment, this influx of new participants will continue to reshape the competitive landscape and accelerate consolidation across the industry.

Member Visits at HVLP Locations Outpace Other Concepts in the Industry

Crunch Fitness annual visits across the ecosystem are up over 150% since pre-COVID, and Planet Fitness visits are up 65%. In contrast, higher-end gym visits remain flat or slightly down. The key driver here relates to the investment in new, larger HVLP locations across the country along with consumer trends impacting per membership visits.

Out of the Box Strategics are Actively Participating in Processes, But Not Making It Across the Finish Line, Yet

In late 2023, the Flynn Group made its first non-restaurant acquisition by purchasing a Planet Fitness franchisee. This transaction sparked anticipation that a new class of nontraditional strategic buyers could emerge as prolific acquirers and drive up valuations. Despite the initial splash, this buyer type has remained on the sidelines. That said, interest from this buyer-type has remained strong during several recent processes and it is only a matter of time before this out of the box strategic buyers makes it across the finish line.

The Regional HVLP M&A Market is Off to the Races

It was widely known last year that Mountainside Fitness would be just the start of many M&A opportunities within the regional HVLP landscape. In 2025, preparation is underway to finally liquidate long-held positions of concepts that have carved their niche in specific regions or within a specific consumer segment of the HVLP ecosystem. Although multiple assets hitting the trading block simultaneously might result in certain opportunities garnering more attention than others, demand for high-quality opportunities remains at an all-time high, and it is expected that most of these assets will attract a strong hand of initial bids.

International Markets are Key Growth Avenues for Select Ecosystems

For fitness concepts that have successfully built out large U.S. platforms, a clear strategy for 2025 includes mapping out international markets to drive accelerated growth and clear differentiation. As part of the strategy, platforms are seeking international acquisition prospects to either lock up select territories or find additional avenues of growth. Investors should be ready to see significant cross-border activity over the coming months and years.

Following Barry’s and Solidcore Transactions, Eyes Turn to the Next M&A Opportunities within Boutique Fitness

Barry’s and Solidcore were key topics of interest in 2024 for investors looking at where to deploy capital within boutique fitness. When these M&A processes crossed the finish line (in arguably very different ways from each other), the groundwork was set for shareholders of other boutique brands to look ahead towards potential liquidity events. CrossFit will be the most prevalent name to transact in 2025, but given the significant interest in leading Pilates, yoga and strength training concepts, several other platforms will likely test the market as well in the near term. On the flip side, ecosystems facing challenges, such as OrangeTheory, are seeing conversations shift toward lenders rather than acquirers in the near term.

Buy-Side Strategy is Critical to Winning a Process, Given Investor Funnel Trends

Following trends first established in Europe, the U.S. market is beginning to recognize the significant value of buy-side M&A guidance in helping buyers position themselves to succeed in evolving M&A strategies. In the fitness sector specifically, the initial bid deadline generates elevated expectations both in terms of valuation and total quantity of bids. This leads to many groups dropping out of the process due to valuation expectations or failing to secure an invitation to the second round. Sellers then see higher than expected attrition in the later stages of the transaction which increases the probability of a busted process. While A+ quality M&A opportunities find a simple path to the finish line, strategic buy-side guidance and insights can be a game-changer for navigating more complex transactions. Lincoln has seen a significant uptick in U.S. demand for buy-side advice, as buyers seek to increase the probability of a successful outcome. Across the pond, Europe is watching and saying, “It’s about time.”

Fitness Products Continues to See Near Term Headwinds with Long Term Visions of a Fully Connected Ecosystem

Given geopolitical unknowns, tariff implications and decreasing consumer sentiment, the fitness products sector continues to see earnings choppiness. While select companies, especially those focused on developing innovative products or over-indexed on commercial markets, are starting to gain market momentum, the vast majority of players are heads down improving operational efficiencies and identifying new avenues for growth. Despite these near-term challenges, the industry anticipates a potential revolution over the next decade, driven by increasing consumer demand for fitness data tracking. The growing need for innovation will create significant opportunities for fitness product companies to connect the broader ecosystem, enabling consumers to track workout metrics across brand ecosystems and workout modalities. Over the next five to ten years, many incumbent brands risk irrelevancy as new entrants redefine the connected ecosystem environment.

HVLP 3.0 is Officially Here! Great—Now What Do You Do With the 1.0s?

As fitness concepts evolve their offerings to provide additional value to their consumers—and improve cost efficiencies for shareholders—the investment landscape becomes further focused on a platform’s mix of newer versus older locations. The 1.0 versions of the gyms may not necessarily command premium valuation multiples given the perceived future capex requirements and limitations in unit economics, but these locations can still hold value for cash flow or real estate lock-up investment strategies.

Prior to future transactions, current shareholders need to assess whether to A) go to market with a mix of older and newer locations, accepting that new investors will discount the value of older locations; B) spend capex to bring older locations up to the quality of the newer locations; or C) split up the platform, selling the newer locations at a premium while finding a separate buyer for the older locations. While concepts A and B have been tested many times, concept C could be the path to achieving outlier valuations for select operators. For investors, this underscores the importance of factoring in location mix when evaluating which platforms to back. Platforms with a proven ability to optimize location performance are clearly well-positioned to attract attention and capital in today’s market.

Are you Tired of Talking About GLP Implications Yet?

Us too – let’s keep it brief. Over 90% of industry executives interviewed by Lincoln believe GLPs are a net positive for the industry, both positioning more people to beginning exercising and also revenue generation for clubs that lean into the concept of the “gym as a clinic.”For more insights, check out our perspective with Athletech News, where we delved into this topic.

Celebrity and Athlete Endorsements Create Perception of Differentiation

2024 was the year of athlete endorsements of traditional HVLP systems. James Harden followed in the footsteps of Dak Prescott and Cristiano Ronaldo by launching three Crunch Fitness franchisee gyms in Texas with special “HIIT Like Harden” classes. Athletes becoming a part of the gym’s cap table isn’t anything new (e.g., NFL MVP Steve Young’s 2021 Planet Fitness acquisition), but amidst continued consolidation, the strategy is taking on renewed importance in the HVLP ecosystem as investors try to differentiate their platforms. Based on the unit metrics for specific locations, this strategy seems to be working and is a net positive for both the industry and platforms preparing to trade hands in the coming years.

The M&A Takeaway

The M&A fitness landscape remains dynamic and multifaceted, with trends varying across subsegment. However, the industry will likely see a continued, heightened level of M&A activity. Investor appetite for fitness businesses remains strong relative to other consumer categories, which will drive a robust M&A environment for the foreseeable future.

From a fitness club perspective, traditional HVLP systems will continue consolidating their ecosystems, ultimately trading hands to an ever-evolving buyer landscape. Meanwhile, regional HVLP systems may look to test if large funds will step up to the plate for a nationwide brand rollup strategy. For fitness product manufacturers navigating the broader consumer discretionary landscape, success will favor companies with a clear multi-channel strategy, strong product differentiation and healthy balance sheets—key attributes for thriving in the ‘new normal.’

Ultimately, as the industry adapts to evolving buyer and consumer dynamics, M&A activity will remain a driving force in shaping the future of the fitness sector. Connect with Lincoln’s team of dedicated bankers today to learn more about our sector insights through 2025 and beyond.

M&A and Public Markets Exhibits

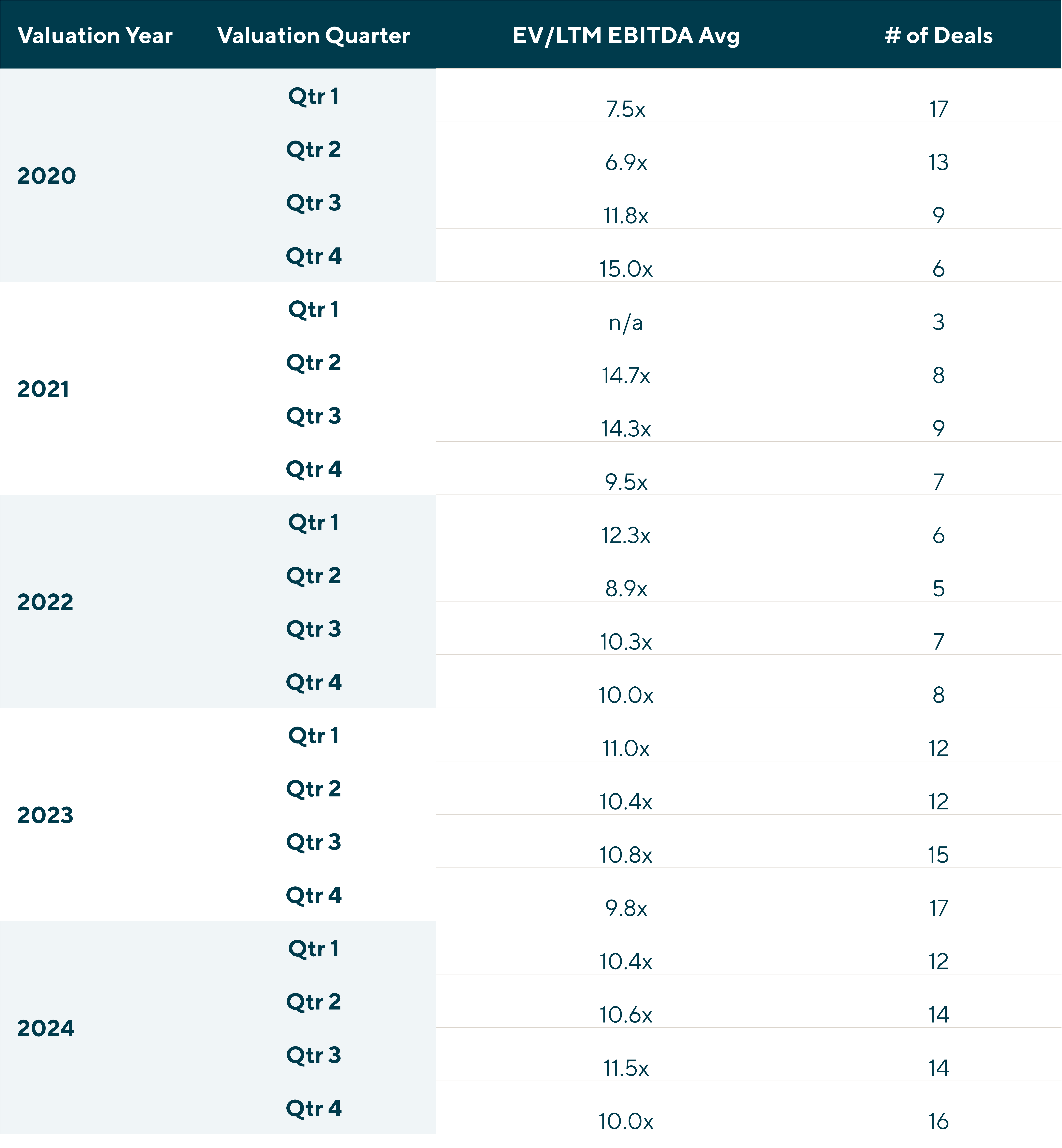

Lincoln Valuations Group Market Data for Fitness Sector

Source: VOG Private Market Proprietary Data

Data as of: March 2025

| Fitness Index (EV / LTM EBITDA Multiples)

Source: CapIQ as of Mar-2025 |

Contributors

Through honest advice, passionate client service and hands-on execution, I strive to deliver outlier results for my clients.

Christopher Petrossian

Managing Director & Co-Head of Consumer

Los AngelesRelated Perspectives

Recent Transactions in Consumer

State of the Fitness Market: 2025 Edition

2025 Fitness Market Update The fitness industry enters 2025 with strong tailwinds, building on multiple years of sustained growth and transformation. Following the pandemic-era disruptions and inflationary headwinds, 2024 marked… Read More

Automotive M&A: Electrification in the Spotlight

Automotive original equipment manufacturer (OEM) suppliers have faced extraordinary challenges between 2018 and 2024. The implementation of the Worldwide Harmonized Light Vehicles Test Procedure (WLTP) in 2018 resulted in several… Read More

Fortifying Returns in Commercial Security Systems Replacement & Services

State of the Sub-Sector: Presented by Lincoln International and STEER Partners The broader fire & life safety industry has been driving transaction headlines for several years, and the commercial… Read More

Six Key Themes from Infrastructure Investor Global Summit 2025

Lincoln International’s Energy Transition, Power & Infrastructure Group recently attended the 2025 Infrastructure Investor Global Summit, one of the industry’s largest events that brought together 3,000 of the world’s top… Read More

Handelsblatt | How Private Equity Investors Are Consolidating the German Consulting Industry

Published by Handelsblatt on April 2, 2025 Friedrich Bieselt, Managing Director and head of Lincoln International’s Business Services Group in Europe, recently shared insights with Handelsblatt on the private equity-led… Read More

2025 Furniture Sector Outlook

In an uncertain economic climate in 2024, investors and companies adopted a “wait-and-see” approach, prolonging a slowdown in home sector mergers and acquisitions (M&A) activity. Valuation gaps between buyers and… Read More

Licensing as an Exit Strategy: Maximizing Brand Value

The brand licensing industry generated over $350 billion in global retail sales in 2023 and outperformed the overall global retail market.1 For fashion and apparel brands, licensing offers a unique… Read More

Private Equity’s Continued Confidence in Fund Administration, Trust and Corporate Services

The fund administration, trust and corporate services (FATCS) sector continues to exhibit resilient growth, driven by enduring structural factors. With global capital expanding, regulatory challenges increasing and outsourcing on the… Read More

Cybersecurity Report: Year-end 2024

In 2024, cybersecurity mergers and acquisitions (M&A) and growth investments saw a massive rebound, fueled by slowing inflation, stable interest rates, healthy spending growth and available capital across a widening… Read More

Investors Should Target B2B Ingredients in 2025

B2B ingredients have emerged as perhaps 2025’s most promising theme in the food and beverage sector. Many favorable tailwinds and trends—e.g. health and wellness, cleaner ingredient labels, the proliferation of… Read More

Philipp Isbarn

Philipp provides mergers and acquisitions (M&A) advisory services to private equity firms, their portfolio companies and other businesses in the DACH region. Philipp leverages deep sector expertise across the software… Read More

Dr. Karl Popp joins Lincoln International as a Senior Advisor

Lincoln International, a leading global middle market investment bank, is pleased to announce that Dr. Karl Popp has joined the firm as a Senior Advisor. Karl brings over three decades… Read More

Beauty Independent | The Bullish Outlook for Beauty M&A and Bearish Prospects for Early-Stage Funding This Year

Published by Beauty Independent on February 12, 2025 Ashleigh Barker, Director and head of beauty and personal care in Lincoln’s Consumer Group, recently discussed her 2025 sector outlook with Beauty… Read More

Asset Management in Transition: M&A Trends and Strategic Shifts for 2025

The asset management industry is undergoing a period of profound transformation, driven by shifting investor preferences, regulatory changes and the need for scale in an increasingly competitive landscape. These dynamics… Read More

2025 Energy Transition Outlook: Digitalization, Decentralization and the Future of Power

The global energy transition is being shaped by two interconnected forces: digitalization and decentralization. These pillars are not only reshaping how energy is produced, managed and consumed but are also… Read More

Wouter Abrahams

Wouter provides mergers and acquisitions (M&A) advisory services for clients in Lincoln’s Business Services Group. He has experience advising both sell-side and buy-side transactions for private equity and founder clients.… Read More

John Eckhart

John provides mergers and acquisitions (M&A) advisory services to founder-owned, private equity-backed and public companies. As a member of Lincoln’s Business Services Group, he specializes in middle market buy-side and… Read More

European Fire Safety Consolidation Seminar 2025 Roundup

The European Fire Safety Consolidation Seminar on February 5 in London, co-hosted with Roland Berger, featured an insightful panel discussion on the evolving trends in the European fire safety sector. Panelists from… Read More

PETS International | Pet Sector Continues to Bring in Investors

Published by PETS International on February 11, 2025 The pet consumables and pet services sectors have continued to be attractive markets, persisting as one of the most investable segments within the consumer sector… Read More

Acceleration in Global Industrials M&A in 2024

Lincoln’s Industrials Group closed 97 transactions globally in 2024, a 20% increase from 2023. Our Industrials platform continues to drive transformative outcomes across all industry sectors, helping clients innovate, expand,… Read More

PE Hub | GPs Skeptical of European IPO Revival; Private Capital “Crucial” in UK Nuclear Energy Development

Originally posted by PE Hub on February 10, 2025 Carlos Candil, Managing Director and head of Lincoln International’s European energy transition efforts, recently shared his perspective with PE Hub on… Read More

Scrip Asks…What Does 2025 Hold for Biopharma?

Originally posted by Scrip in February 2025 James West, Managing Director in Lincoln’s Healthcare Group, recently discussed his expectations for the biopharma market in 2025 as part of Citeline’s Scrip… Read More

Dr. Karl Popp

Dr. Karl Popp serves as Senior Advisor of Lincoln’s Technology Group, providing mergers and acquisitions (M&A) advisory services in Germany. He currently sits on several Advisory Boards and has a… Read More

Matthias Ramming

Matthias Ramming provides mergers and acquisitions (M&A) advisory services to corporations including publicly listed companies, private equity firms and private shareholders. He works within Lincoln’s Industrials Group to advise clients… Read More

Packaging Quarterly Review Q4 2024

2024 was another somber year in packaging M&A activity, shaped by the lingering effects of 2023 destocking trends, economic uncertainty and evolving industry dynamics. This mirrored the broader M&A market,… Read More