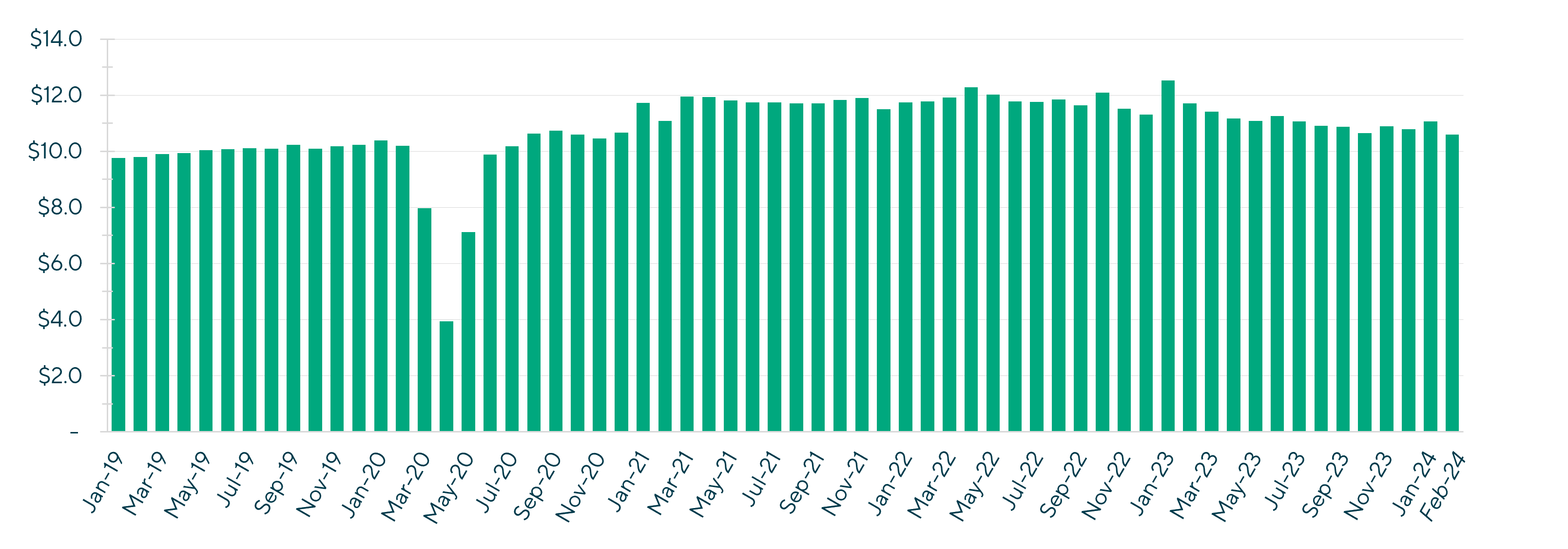

While the supply chain recovered, inflation and rising interest rates contributed to slowing demand throughout 2022 and 2023 as the industry contracted 5.2%. As shipments were delivered, retailers found themselves with excessive inventory. The surplus led to significant gross margin contractions as retailers discounted heavily to move products throughout 2022 and 2023. The chart below highlights the volatility the industry has experienced as reflected by the Monthly Sales for Retail and Food Services Report, published by U.S. Census Bureau over the last three years.

U.S. Furniture and Home Furnishings Retail Sales(1)

($ in billions)

Source: (1) U.S. Census Bureau. It includes establishments primarily engaged in retailing new furniture, home furnishings and related home products.

Despite the significant volatility in performance, the home furnishings industry remains a $132 billion retail market in the United States. There will always be market share takers in this extremely large segment due to superior models, products or services. Based on discussions with dozens of companies in the sector, Lincoln International believes 2024 will be pivotal, given this is the first year where inventory levels are back to normalized levels with a backdrop of moderating inflation and anticipated interest rate reductions.

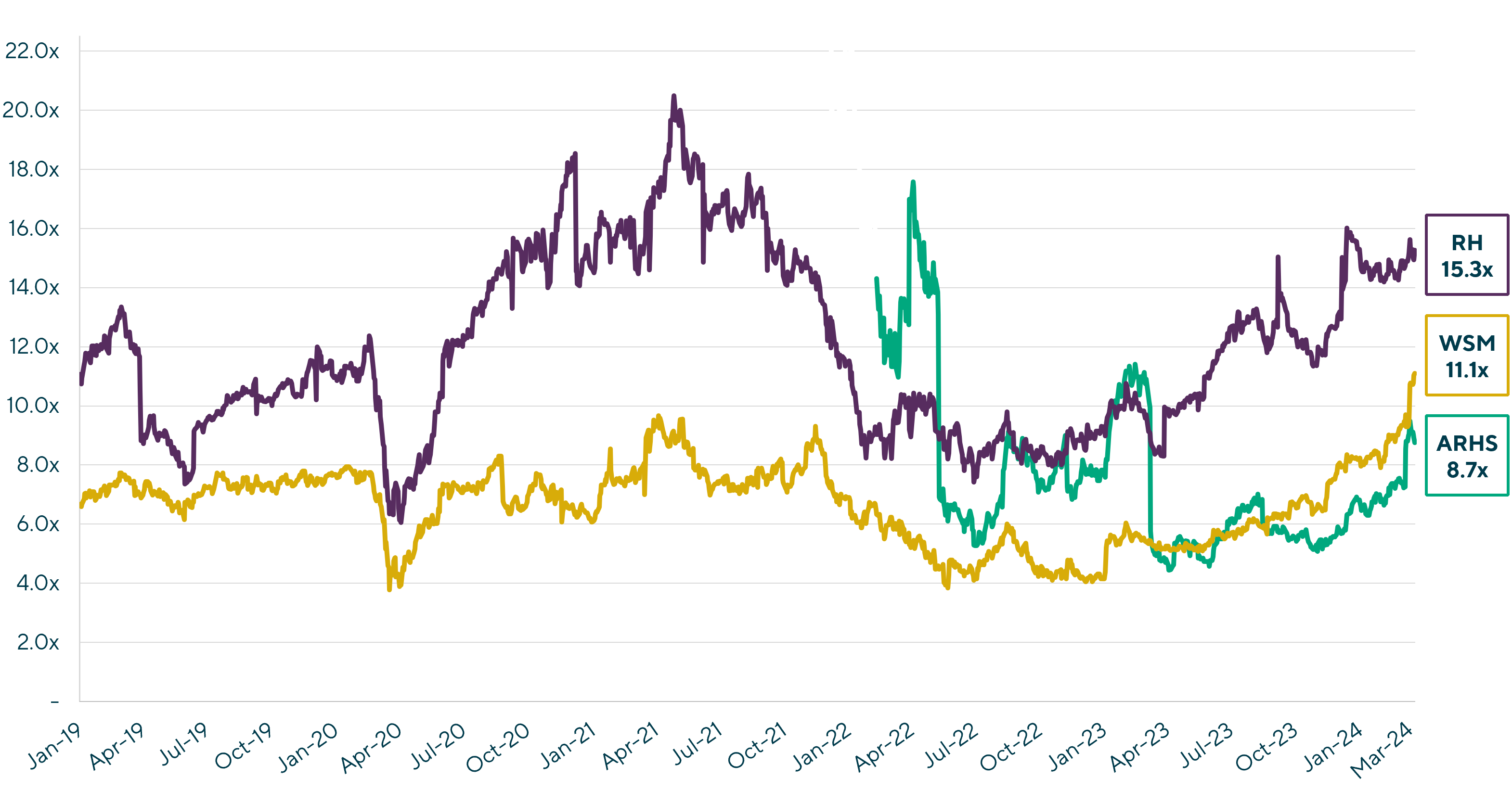

Premium Brands Showing Promise of Growth

While many brands and retailers are facing challenges, several differentiated ones continue to take market share within their sectors. In the public markets, stocks of premium brands, including Arhaus, Williams-Sonoma and RH stocks have rebounded off 2023 lows with companies outperforming analyst expectations (see chart below for enterprise value to LTM EBITDA multiples). Even though stock prices and valuation multiples have increased meaningfully, it’s not all positive as the actual results have shown the stress of the industry on performance with modest or negative revenue growth and contracted margins. Stabilization and expected continued recovery in the premium sector is resulting in investors rewarding these premium brands.

EV / LTM EBITDA Multiples(1)

Notes: (1) CapIQ; Data as of March 20, 2024

(2) Arhaus IPO’don 11/8/2021 and the respective line begins on 2/11/2022 once trading normalized

(3) Lovesac IPO’d on 6/27/2018 and the respective line begins on 9/9/2021 once trading normalized

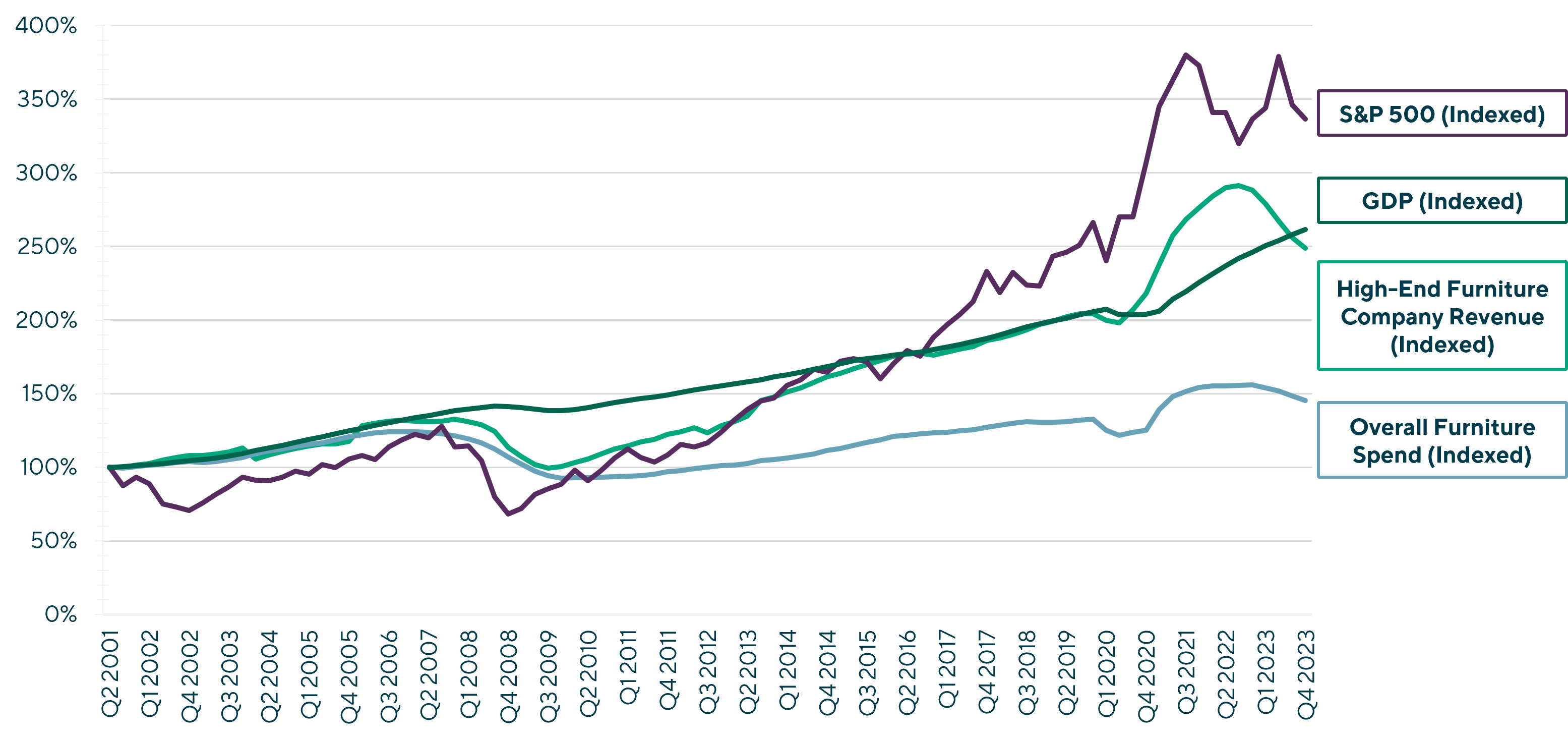

We expect this trend will carry over into the private markets as premium brands and retailers frequently mirror the performance of their public counterparts, given these companies are typically more project-driven than transactional. With the moderation of interest rates and increased wealth, home remodeling trends are improving, generating a positive outlook for the premium segment. In our long-term analysis of the premium segment, the wealth effect, as measured by the performance of the S&P 500 index, is a strong predictor of sales in the premium segment, with the S&P 500 increasing 23% since October 2023. The chart below highlights the relationship between LTM sales of the premium segments and the S&P 500 over the last 20 years.

Furniture Spending vs. S&P 500 and GDP

Stabilization of the Value and Promotional Segment

The value and promotional segment is another area showing signs of improvement. In discussions with a leading manufacturer in this segment, the company continues to experience strong growth on top of 13% growth last year. By focusing on the largest retailers in the value and promotional segment of the market, the company offers retailers a more compelling mixture of products and services to its retailers driving its growth. Additionally, Big Lots recently reported that its furniture sales held up relatively well sequentially versus other categories in Q4 2023 versus Q3 2023. However, according to the Monthly Sales for Retail and Food Services Report, furniture retail stores saw a 10.1% decrease year-over-year in February 2024 to $10.6 billion. In spite of this drop, monthly sales are still ahead of where monthly sales were pre-pandemic.

Despite the conflicting data across the sector, the valuation and outlook for several businesses are more positive than they have been in the last two years. Retailers are calling for a better 2024 and predict an accelerated demand for home furnishings.

2024 M&A Outlook

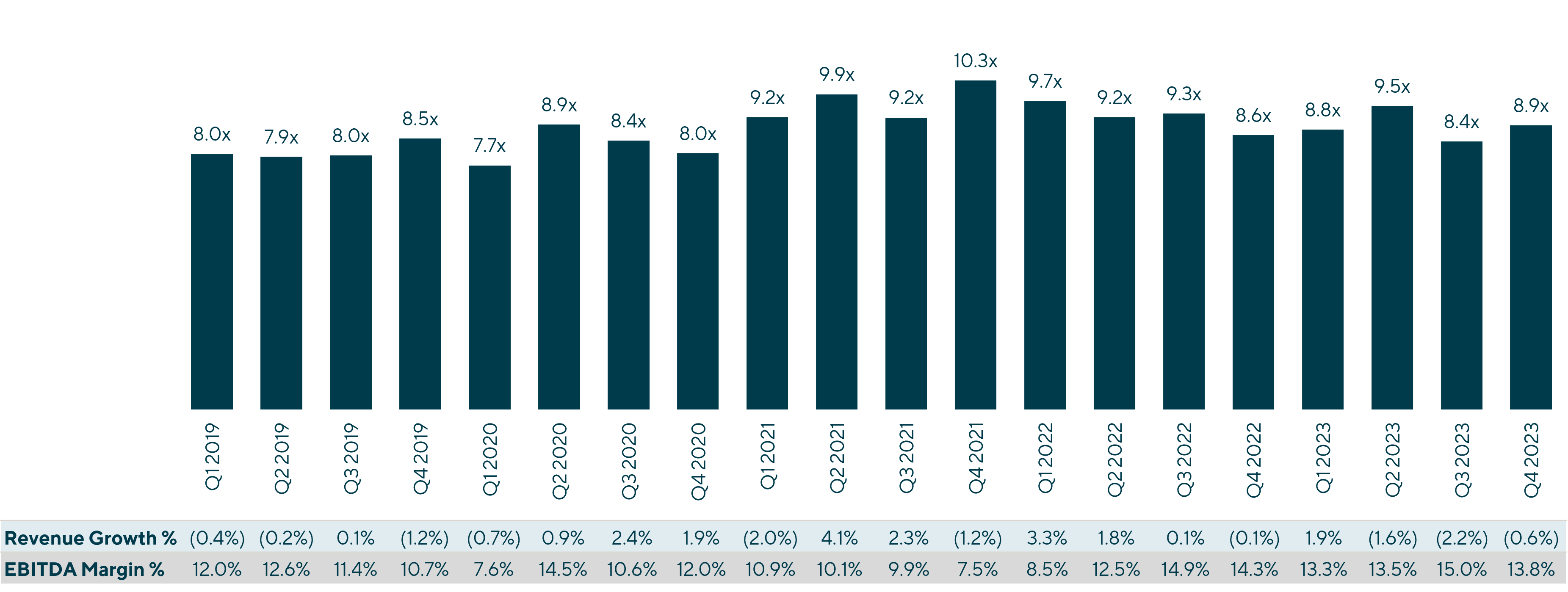

In our discussions with both financial and strategic buyers, we are sensing a greater interest in mergers and acquisitions (M&A) opportunities. During 2023, financial acquirers and lenders exhibited increased discernment and rigor in their investment and financing strategies, particularly regarding large-ticket, discretionary durable companies. This led to a significant impact on home furnishings M&A processes as financial investors shied away from companies battling margin compression, elevated inventories and uncertain growth outlook. 2023 saw very little activity with much of the headlines in the industry driven by distressed sales or unexpected liquidation of some prominent companies. As Lincoln’s Private Market Proprietary Data indicates, private equity groups are marking portfolio company valuations at higher levels but still meaningfully lower than two years ago.

Furniture – Average EV / LTM EBITDA

Source: Lincoln International Private Market Proprietary Data as of March 6, 2024

While most companies are sitting on the sidelines and waiting for either improved company financial performance or financial investor interest in the category to pick back up, we are noticing continued cautiousness. With the compression in M&A valuation multiples and the opening of the lending markets (albeit at higher pricing and lower leverage levels), we are seeing greater interest from financial buyers in differentiated opportunities in the sector. In our discussions with private equity groups, we are seeing investors look for good opportunities at attractive values as platform opportunities or add-ons to existing portfolio companies.

Similar to Tempur-Pedic’s acquisition of Mattress Firm in 2023 (scheduled to close in mid-2024), 2024 has started with a large strategic buyer transaction as Ashley Furniture is acquiring Resident Home – marrying one of the largest home furnishings retailers with one of the largest, and most profitable, direct-to-consumer mattress brands.

Lincoln is in active discussions with clients and strategic buyers as companies are looking towards growth again after focusing much of their recent time on stabilizing their businesses.

After a relatively quiet M&A market over the last two years, we expect 2024 to be more active as both financial and strategic buyers have demonstrated greater interest in the category.

| If you are interested in learning more about what we are seeing in the market, please contact a home furnishing professional below. |

Contributor

Meet Professionals with Complementary Expertise in Consumer

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago

I design strategies and offer solutions that fit the unique ambitions of each client I serve.

Brian Little

Managing Director

Los Angeles

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

LondonRelated Perspectives

Recent Transactions in Consumer

Room for Growth: Home Furnishings Industry Showing Areas of Opportunity

Few industries have experienced highs and lows as much as the home furnishings sector over the last three years. Driven by COVID-19 stay-at-home measures and remote work, the industry saw… Read More

Riddell, a portfolio company of Fenway Partners, has completed a dividend recapitalization

Client: Riddell Client Headquarters: United States Sponsor: Fenway Partners Sponsor Headquarters: United States Client Description: Riddell Sports Group is an American company specializing in sports equipment for American football.

A Paws in the March of Premium Pet: Inflationary Pressure Hits European Pet Foods

In an era where many pet owners lavish their fur babies with everything from spa treatments to gourmet meals, the premium pet food industry highlights the strong bond between humans… Read More

Thriving in Motion: Exploring the Latest Outdoor and Sports Industry Trends

As the dust settles from the pandemic-induced frenzy, the active outdoor and sports equipment industries now stand at a fascinating crossroads. What began as a surge in demand—a lifeline for… Read More

Bird-dogging Opportunities in Pet

Lincoln International recently advised Best Friends Pet Care on a growth capital investment from Turning Rock Partners. Best Friends is a premier, corporate-owned provider of pet boarding, daycare, grooming, and… Read More

Beauty Industry Insights: A Compilation of Recent Press Recognitions

Coming off a slower 2023, beauty mergers and acquisitions (M&A) activity is expected to accelerate in 2024. Ashleigh Barker, Director in Lincoln’s Consumer Group, explores the state of the beauty… Read More

Food & Beverage Market Update Q4 2023

The 2023 mergers and acquisitions (M&A) market was challenging with uncertainty driven by record-high inflation, Federal Reserve interest rate hikes and overall global unrest.

Lincoln International Leader Recognized as Woman of Influence in Finance

Lincoln International is pleased to share that the Los Angeles Business Journal named Ashleigh Barker, Director in Lincoln’s Consumer Group, as a woman of influence in finance. “Ashleigh Barker is… Read More

No Man’s Land Foods has been sold to Bansk Group

No Man’s Land Foods No Man’s Land is a fast-growing, premium meat snacks brand based in Oklahoma. Since its founding by the Smith family in 1997, the company has become… Read More

Supplements – A Bright Spot in the Pet Industry

As we embark on a new year, it’s an opportune time to reflect on the “bright spots” within the pet industry that present exciting prospects, particularly as the pet industry… Read More

Beauty Independent | The Prognosis for Beauty M&A and Early-Stage Funding in 2024

Originally posted by Beauty Independent on January 22, 2024. Mergers and acquisitions (M&A) activity in the beauty market is on the up. “Looking forward, the recent deal announcements support the… Read More

Beatriz Cabrero

Beatriz provides mergers and acquisitions advisory services to private equity firms, entrepreneurs and family-owned and multinational companies, with a focus on the food and beverage, consumer products, apparel and beauty… Read More

Bang Energy has agreed to be sold to Monster Energy

Client: Bang Energy Client Location: United States Target: Bang Energy Target Location: United States Acquirer: Monster Energy Acquirer Location: United States Target Description: Bang Energy is a leading producer of sports nutrition and performance energy… Read More

2023 Global Results

Just Food | Cautious Optimism Oozes Around Food M&A Outlook in 2024 as Risks Fester

Originally posted by Just Food on December 14, 2023. While deal activity in the food industry has slowed, businesses that passed on pricing and kept their volumes from going backward… Read More

CapVest has acquired Recochem from H.I.G. Capital

Recochem Headquartered in Montreal with more than $1 billion in revenue, Recochem is a leading global provider of auto aftermarket transportation and household fluids across diverse end markets. Recochem’s product… Read More

22nd Century Group has sold GVB Biopharma to Specialty Acquisition Corporation

Client: 22nd Century Group Client Location: United States Target: GVB Biopharma Target Location: United States Acquirer: Speciality Acquisition Corporation Acquirer Location: United States Target Description: GVB grows, manufactures and processes hemp cannabinoid products.

Best Friends Pet Care receives a growth investment from Turning Rock Partners

Best Friends Pet Care Best Friends Pet Care was founded in 1995 with the goal of providing first-class pet care to fully accommodate evolving pet parent needs. For 28 years, Best… Read More

Women’s Wear Daily | What to Expect from Beauty M&A in 2024

Originally posted by Women’s Wear Daily on December 8, 2023. Many expect beauty brands to come to market in 2024, but the exact timing will be contingent on several dynamics.… Read More

Leitmotiv Private Equity has sold Groupe Elan to Kresk Developpement and Unigrains

Client: Leitmotiv Private Equity Limited Client Location: China Target: Groupe Elan Target Location: France Acquirer: Kresk Developpement, Unigrains Acquirer Location: France Target Description: Groupe Elan has a portfolio that consists… Read More

Noble House Home Furnishings has sold substantially all of its assests pursuant to section 363 of the bankruptcy code to GigaCloud Technology

Client: Noble House Home Furnishings Client Location: United States Target: Noble House Home Furnishings Target Location: United States Acquirer: GigaCloud Technology Acquirer Location: United States Target Description: Noble House Home Furnishings is a… Read More

Transom Capital Group has sold Mackie to RØDE Microphones

Mackie Mackie, headquartered in Bothell, Washington, is a leading audio products company that designs and markets solutions for creators of all types, including live sound, studio and recording, podcasters and… Read More

Food & Beverage Market Update Q3 2023

The third quarter saw an uptick in new deal launches while overall market activity compared favorably to Q2. Though many believe the Federal Reserve is done raising interest rates, overall… Read More

Louis Delhaize has sold Cora and Match to E.Leclerc

Client: Louis Delhaize Group Client Location: Belgium Target: Cora, Match Target Location: Luxembourg Acquirer: E.Leclerc Acquirer Location: France Target Description: Cora is a chain of hypermarkets, and Match is a… Read More

Crestline Investors has acquired ICEpower

ICEpower ICEpower is a leading provider of high-performance audio technology and complete turnkey solutions to the professional and home automation (business-to-business) audio markets. It was founded in Denmark in 1999… Read More