Meet our Senior Team

Through honest advice, passionate client service and hands-on execution, I strive to deliver outlier results for my clients.

Christopher Petrossian

Managing Director & Co-head of Consumer

Los AngelesView More Transactions

Harvard Card Systems has been sold to PLI Card Marketing Solutions

Lincoln International is pleased to announce that Harvard Card Systems, Inc. has been acquired by PLI Card Marketing Solutions, a portfolio company of Platinum Equity. Harvard Card Systems, Inc. (Harvard)… Read More

SEVES Group has sold VITRABLOK to ASC Investment

Lincoln International (“Lincoln”), a leading global mid-market investment bank, is pleased to announce that SEVES Group (“SEVES”), a Triton Fund III company, sold its Glass Block Division VITRABLOK (“VITRABLOK” or… Read More

Bain Capital has acquired Italmatch Chemicals from Ardian

Client: Bain Capital Private Equity (Europe) Client Location: UK Target: Italmatch Chemicals Target Location: Italy Buyer: Bain Capital Private Equity (Europe) Buyer Location: UK Target Description: Italmatch is a leading innovative chemical group,… Read More

Philippe Rapin

Philippe has extensive experience in mergers and acquisitions (M&A) transactions and has worked on mandates for financial sponsors and corporate clients in France and Germany for more than eight years.… Read More

Gaylord Chemical Company has been sold to EagleTree Capital

Gaylord (the “Company”) is the superior provider of dimethyl sulfide (DMS) and dimethyl sulfoxide (DMSO) in the Western Hemisphere. The Company offers a full range of high-value product grades, providing… Read More

Molecor has been refinanced

Target name: Molecor Tecnologia, S.L. (“Molecor”) Target country (headquarters): Spain Target Description: Molecor specializes in the development of the latest technology applying Molecular Orientation to pipeline solutions with unique mechanical properties. Founded in 2006, Molecor… Read More

Packaging Stock Index Q3 2018

Q3 2018 global packaging company operating statistics and valuation parameters

Outlook for Industrials

Strong industrials company performance and deal activity will continue to drive success in 2019, despite some uncertainty around tariffs and ongoing trade negotiations. Here are the trends we’re watching. M&A… Read More

Sanjeev Varma joins Lincoln International as a Senior Advisor

Lincoln International, a leading global mid-market investment bank, is pleased to announce that Sanjeev Varma has joined the firm as a senior advisor. He brings extensive expertise that will support… Read More

Chemicals Sector Market Update Q2 2018

Chemical industry momentum continued in Q2, but raw material Inflation to limit gains. Read more

Edward Hanlon

Ed is a senior banker in Lincoln’s Global Industrial Group. He has over 30 years of experience providing mergers and acquisitions (M&A) advisory services to private equity groups, large corporate… Read More

Clearlake Capital has sold Sage to Asahi Kasei

Client: Clearlake Capital Group Client Location: U.S. Target: Sage Automotive Industries Target Location: U.S. Buyer: Asahi Kasei Corporation Buyer Location: Japan Target Description: Sage Automotive Interiors, Inc. is a US-based manufacturer of automotive interior material.

Shweta Malani

Shweta provides mergers and acquisitions (M&A) advisory to clients in the industrials and manufacturing sectors. She has nearly eight years of transaction advisory experience in sell-side and buy-side M&A, divestitures… Read More

The Early Innings of Tariff Impact

Trade tensions between the U.S. and large trading partners like China are increasing. While the future of trade policy and tariffs is less than certain, the impact on middle market… Read More

Verdane has sold Scanacon to Alder

Client: Verdane Capital Advisors AS Client Location: Norway Target: Scanacon AB Target Location: Sweden Buyer: Alder AB Buyer Location: Sweden Target Description: Scancon is a provider of acid management systems used in the production of special metals.

Sanjeev Varma

Sanjeev serves as Senior Advisor to Lincoln International’s automotive and mobility technology team, advising on automotive deals globally. He also advises Lincoln’s Special Situations Group in the U.S., providing advice… Read More

Guillaume Suizdak

As co-head of Lincoln’s Industrials Group in Europe, Guillaume originates and executes mergers and acquisitions (M&A) for European corporate and private equity clients. He has over 25 years of experience… Read More

Walter Surface Technologies has been sold to ONCAP

Lincoln International (“Lincoln”), a leading global mid-market investment bank, is pleased to announce that The Walter Group has sold a majority stake in Walter Surface Technologies (“Walter” or the “Company”)… Read More

Eric Malchow

As President and Managing Director of Lincoln, Eric leads many of the firm’s advisory groups and offerings. In addition to co-heading Lincoln’s Industrials Group in the U.S., he oversees the… Read More

Tom Williams

Tom provides mergers and acquisitions (M&A) advisory services for international industrial companies and manages the firm’s strategic efforts in the sector. He has 30 years of experience working with large… Read More

Björn Åkerlund

For close to three decades, Björn has provided mergers and acquisitions (M&A) advisory services to clients in the Nordic region. He advises on both domestic and international M&A for privately… Read More

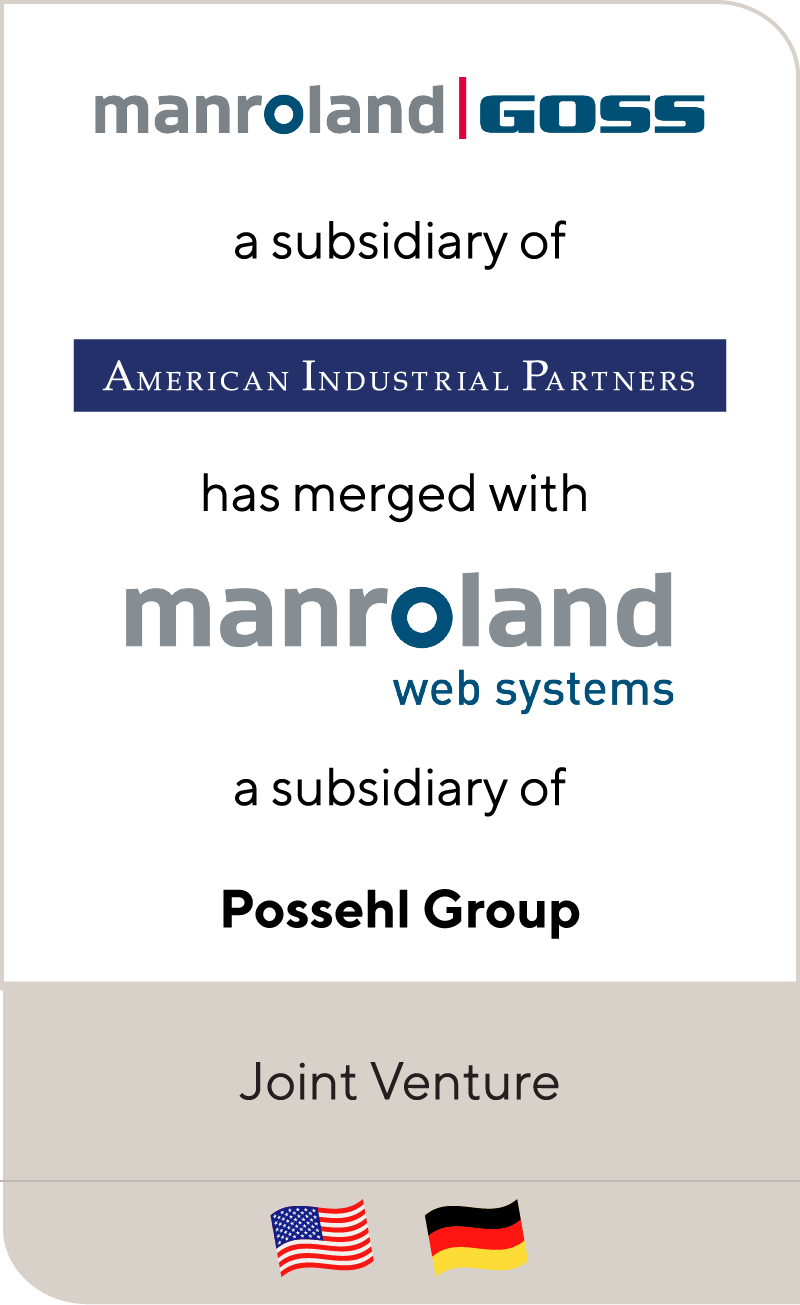

Goss has merged with manroland

Client: American Industrial Partners Client Location: U.S. Target: Goss International Corporation Target Location: U.S. Buyer: manroland web systems GmbH (L. Possehl & Co.) Buyer Location: Germany Target Description: Goss International printing press business manufacturers and services web… Read More

LDC enters agreement to exit from BOFA International to US-listed Donaldson Company

Lincoln International (“Lincoln”), a leading global mid-market investment bank, is delighted to have represented the shareholders of BOFA International (“BOFA”) on its sale to Donaldson Company (NYSE:DCI) (“Donaldson”), a global… Read More

Francis Tran

Francis provides mergers and acquisitions (M&A) and capital raising advisory services for aerospace and defense (A&D) business owners, public corporations, and A&D-focused private equity firms. His experience includes M&A, take-privates,… Read More

Preet Singh

Preet advises industrial businesses on mergers and acquisitions (M&A) and in raising growth capital. He supports family-owned businesses, helping them to find strategic partners for continued growth and providing an… Read More