Deals Accelerated in 2020 for Lincoln International’s Auto Team

Despite significant bumps in the road for the automotive sector in 2020, Lincoln International closed 16 successful transactions – testament that original equipment manufacturers (OEMs) and automotive suppliers alike are eager to adapt their business models to the future of the industry.

Looking ahead, we expect mergers and acquisitions (M&A) activity in the auto space to fire on all cylinders in 2021. Momentum around electrification is accelerating. As the industry recovers, Tier 1 suppliers are divesting from combustion engines to fund acquisitions in EV and other auto technologies. With significant capital requirements essential in the race to build the cars of the future, industry consolidation and partnerships—even between direct competitors—will abound.

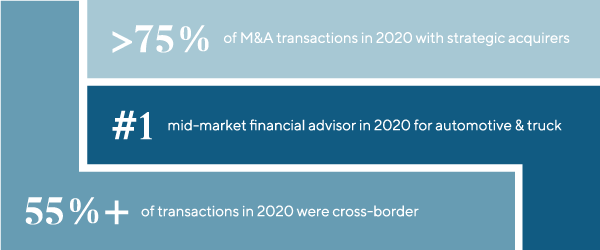

Lincoln’s auto team by the numbers:

Notable transactions included:

Lincoln acted as the exclusive buy-side advisor to Trèves, working closely with the company’s management team and advisors while providing process, financial and tactical advisory expertise. Learn more |

Lincoln acted as the exclusive M&A advisor to Altenloh, Brinck & Co, preparing and managing a successful competitive M&A process as well as identifying an ideal partner for the successful future development of the target company. Learn more |

Lincoln acted as the exclusive buy-side advisor to Brembo, providing process, financial and tactical advisory expertise and managing all phases of the transaction within a highly accelerated time frame. Learn more |

Lincoln represented The Starco Group in its sale of API Automotive Products, Inc. (d.b.a. BlueDevil Products and PJ1 Motorsports) to Highline-Warren, a Pritzker Private Capital company. Learn more |

Lincoln advised TrafficCast International in its sale to Iteris, Inc. company. Learn more |

Lincoln advised Insight Equity in its refinancing of the European subsidiary of A.P. Plasman Corporation. Learn more |

Lincoln advised the official committee of unsecured creditors of DURA Automotive. Learn more |

Lincoln acted as exclusive sell-side advisor to Valmet Automotive Group and orchestrated a successful sell-side auction process, which was executed and closed during the peak of the COVID-19 pandemic. Learn more |

Lincoln advised Plews & Edelmann on the sale of its retail segment to Highline Aftermarket, a portfolio company of The Sterling Group. Learn more |

Lincoln advised Kyokuto Kaihatsu Kogyo Co. Ltd. on its acquisition of Satrac Engineering Pvt. Ltd. Learn more |

Lincoln acted as the exclusive financial advisor to the shareholders of PRECO Electronics, working closely with the management team throughout the sale process. Learn more |

Lincoln acted as the exclusive financial advisor to the shareholders of CMORE Automotive, working closely with the management team throughout the sale process. Learn more |

Lincoln advised Willi Elbe Group and its shareholders, working closely with the stakeholders of Willi Elbe Group throughout the sale process. Learn more |

Lincoln acted as the exclusive financial advisor for Woodall Nicholson, working closely with the management team and shareholders, leveraging the depth of experience in the specialist vehicle segment and both the M&A and Debt Advisory Groups. Learn more |

Lincoln acted as the exclusive M&A adviser to Conzzeta, providing process, financial and tactical advisory expertise and managing the preparatory, marketing, due diligence and negotiation phases of the transaction. Learn more |

Lincoln advised Gilde Buy Out Partners on its refinancing of Gundlach. Learn more |