Along with the demand for expanded connectivity across all parts of the globe, great innovation has occurred by companies spanning start-ups to mature organizations. Governments are pouring billions into the space sector, as are enterprises and individual billionaires. A small group of large GEO satellite providers is now outpaced by numerous companies set up to capitalize on smaller, closer lower orbit LEO satellite technology. These factors, among others, are driving a renewed focus on the space industry. Along with this activity come risks and uncertainties such as costs and malfunctions. Many rockets heading to space fail shortly after launch. It takes a tremendous amount of capital to not only develop cutting-edge technologies but also to execute successful missions.

This perspective explores the space industry, examining SPACs’ impact, the changing landscape of valuations, the growing involvement of private equity (PE) and future market prospects.

Emergence of SPACs

Special purpose acquisition vehicles (SPACs) have been around for decades but have seen a rapid rise in popularity. Given the need to be well capitalized, and the compelling upside if successful, many space companies utilized SPACs starting in 2021.

Recent SPACs

| Company | Year Public | EV via SPAC | Description |

| Amprius Technologies | 2022 | $939M | Energy storage including for satellites |

| Momentus | 2021 | $567M | Space infrastructure for space transport and satellites, services |

| Redwire | 2021 | $615M | Space systems and satellite components, launch and services |

| Terrain Orbital | 2022 | $1.8B | Small satellites and mission solutions for communications |

| Rocket Lab | 2021 | $4.1B | Mission-critical space infrastructure |

| Virgin Orbit | 2021 | $3.7B | Satellite launch services |

The Evolution of Valuations

The promise of rapid revenue and future profitability growth drove strong valuations out of the gate. However, being public places the expectation for companies to generate returns for shareholders through strong financial performance. In the private markets, where annual results often trump the importance of quarterly results, top or bottom-line misses can better survive scrutiny.

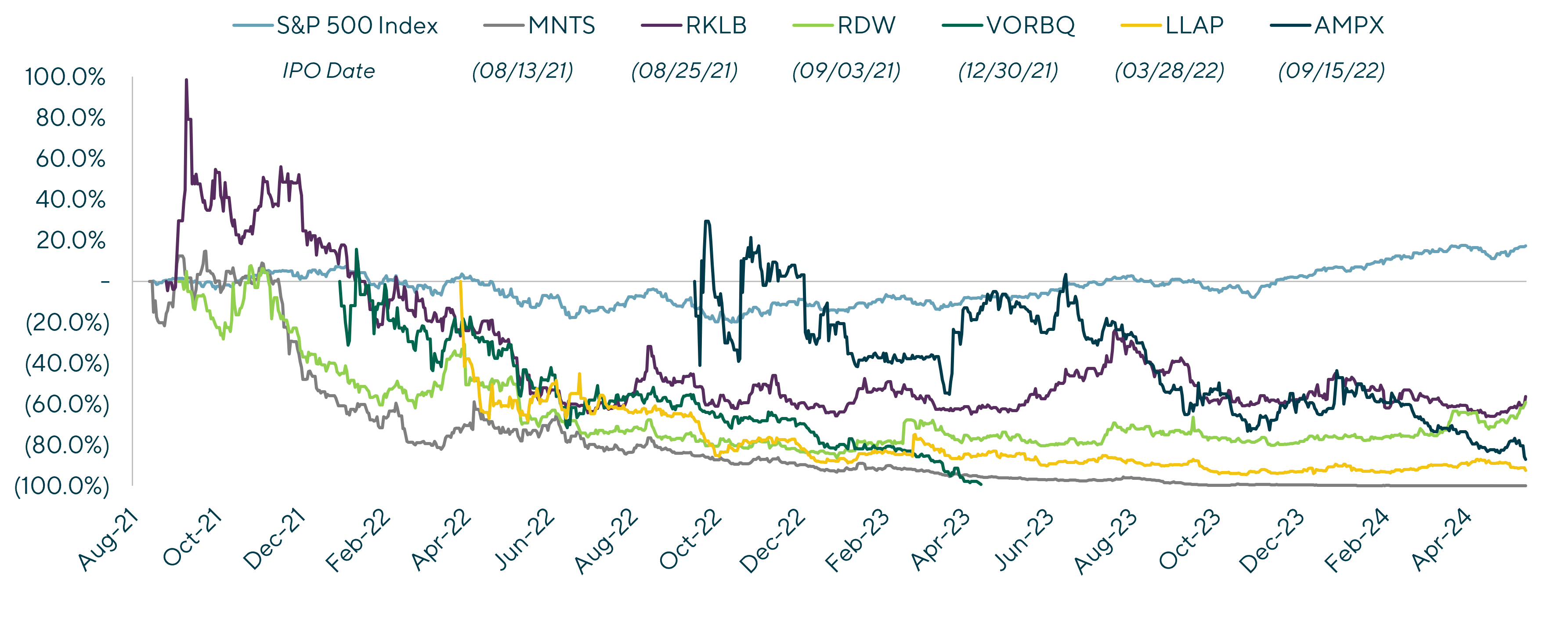

Stock Market Performance of Public Companies from IPO Date12

The share price underperformance of some space companies may be a mismatch of financial performance versus timing expectations given the growing competition, the rate of technology advancement and slower-than-expected adoption. However, long-term demand prospects remain bright, these companies are still solving huge challenges and societal goals and the interest in space has not waned.

Companies like SpaceX’s Starlink are bringing the internet to areas of the world that are inaccessible through traditional terrestrial infrastructure. Maxar is providing governments with high-resolution satellite imagery and Rocket Lab is enabling more frequent space launches.

Space-related activity is at an all-time high. That said, the question remains if companies operating in the sector are better suited to access the private markets.

PE in Space

In addition to governments, ultra-high-net-worth individuals and multi-billion-dollar enterprises funding space advancement, PE has emerged as a major player. AE Industrial, Arlington Capital Partners, The Jordan Company, Veritas and Trive Capital, in particular, have been leaders in the sector.

Precedent Transactions

| Financial Investor | Platform | Description | Acquirer Companies |

|

Complete solutions for mission design, spacecraft, launch, ground and operations |  |

|

|

Spaceplanes, space stations and propulsion systems | N/A | |

|

End-to-end space transportation | ||

(public but still major investor) |

Space infrastructure for civil, commercial and national security space |

|

|

|

|

Produces radio frequency amplification products for space |

Electron Devices and Narda Microwave-West Divisions

|

|

Satellite communications solutions | N/A | |

|

|

Provider of software-defined, cyber-secure and integrated satellite avionics | N/A |

| Ruggedized magnetic solutions for manned and unmanned space and others |   |

||

|

Manufacturer of complex sub-assemblies for launch vehicles and hypersonics |      |

|

|

|

Advanced electronics for space, defense and commercial operations in the harshest environments |

|

The growing list of PE-backed space companies indicates the overall market’s support by both equity and debt investors. Eventually, these companies will change hands or go public, further fueling deal activity as the market matures and companies continue to prove their strategies through financial performance.

Outlook on the Space Sector

The macro backdrop for space remains promising. McKinsey estimates that the global space economy will be worth $1.8 trillion in 2035 versus $630 billion in 2023.1 In some areas, demand will outpace supply. Oliver Wyman estimates that by 2030 MILSATCOM supply (in Gbps) will be unable to match demand by as much as 68%. OW also believes that by 2028 Starlink will be unable to meet demand over North America for commercial broadband despite a projected 5,980 satellites in orbit.2 Emerging companies and technologies will need to continue ramping up efforts to satisfy this demand, which creates the need for further public and private investment.

As the desire to explore space continues to grow, public and private investors will be interested in deploying capital and driving deal activity. In a sector where attracting capital is imperative to enable growth, mergers and acquisitions will continue to play a major role in defining the space industry.

Connect with a Lincoln expert below to discover how we can elevate your business to its next level of success.

1) McKinsey & Company. Space: The $1.8 trillion opportunity for global economic growth, Report, April 8, 2024.

2) Oliver Wyman. Space Market Excerpts, March 2024.

Contributors

Meet Professionals with Complementary Expertise in Aerospace & Defense

I strive to deliver value-added advice, leveraging deep industry knowledge and extensive industry relationships.

Guillaume Suizdak

Managing Director & Co-head of Industrials, Europe

ParisRelated Perspectives

Recent Transactions in Financial Institutions

The State of Space

As the world population increases, technology evolves and the earth’s resources come under stress, the desire to explore and invest in the space frontier continues to grow. While space tourism… Read More

GP Minority Stakes Investments Set to Take Off in Europe’s Mid-market

There is a huge opportunity for mid-market general partners (GPs) in Europe to take advantage of the growing interest in them by the rapidly emerging specialist GP minority stakes fund… Read More

De-Stocking has Subsided, Pricing has Normalized and Demand is Returning in Packaging

As supply chain disruptions ease and consumer demand stabilizes, the prolonged period of de-stocking, within packaging and the broader economy, is ending, as supported by the most recent Monthly Wholesale… Read More

2024 Lincoln International Transportation & Logistics Luncheon

We recently hosted a Transportation & Logistics Luncheon in New York, gathering industry leaders and private equity professionals for networking and a panel discussion. The event facilitated a rich exchange… Read More

Consumer, Business and Economic Trends Align to Drive New Interest in Recommerce

Back in 2021, the recommerce industry seemed to have finally hit its stride, with the sector experiencing a surge in transactions, valuations and deal sizes. At the brink of becoming… Read More

Entering the Age of the AI Economy

Artificial intelligence (AI) continues to rapidly evolve and reshape industries and how people work. AI’s ability to analyze data, identify patterns and streamline operations makes it a powerful tool that… Read More

The Fitness Investment Landscape

State of the Fitness Market: presented by L.E.K. Consulting Fitness Market Stabilization and Return to Growth Few industries were as negatively impacted by COVID-19 as the in-person fitness industry. Deemed… Read More

Lincoln Private Market Index Continued to Climb in the First Quarter on the Back of Steady Earnings Growth

Despite solid portfolio company performance, buyout activity remains sluggish, but sponsors have deployed alternative strategies to distribute capital to investors The Lincoln Private Market Index (LPMI), the only index that… Read More

Echoes of Innovation in Audio Electronics

Lincoln International recently advised Transom Capital Group on its sale of Mackie to RØDE Microphones. Mackie is a leading audio products company that designs and markets solutions for creators, whether… Read More

Room for Growth: Home Furnishings Industry Showing Areas of Opportunity

Few industries have experienced highs and lows as much as the home furnishings sector over the last three years. Driven by COVID-19 stay-at-home measures and remote work, the industry saw… Read More

Dividend Recapitalizations: Hit the Market Before M&A Activity Rebounds

Private debt funds have increased their dry power to $506.2 billion and acquisition-related private debt volume has reached all-time lows. As a result, private debt investors have become more aggressive… Read More

A Paws in the March of Premium Pet: Inflationary Pressure Hits European Pet Foods

In an era where many pet owners lavish their fur babies with everything from spa treatments to gourmet meals, the premium pet food industry highlights the strong bond between humans… Read More

Building Products M&A Market Finds its Footing

The building products industry gathered at well attended conferences in early 2024. The National Association of Home Builders International Builders’ Show (IBS) and Kitchen and Bath Show (KBIS) attracted its largest crowd… Read More

Succeeding in the Fast Lane: Strategically Navigating GP M&A

In today’s high-stakes market, successful general partners (GPs) in private markets are at the forefront of a thriving M&A landscape characterized by a growing number of deals and rapidly… Read More

Thriving in Motion: Exploring the Latest Outdoor and Sports Industry Trends

As the dust settles from the pandemic-induced frenzy, the active outdoor and sports equipment industries now stand at a fascinating crossroads. What began as a surge in demand—a lifeline for… Read More

Bird-dogging Opportunities in Pet

Lincoln International recently advised Best Friends Pet Care on a growth capital investment from Turning Rock Partners. Best Friends is a premier, corporate-owned provider of pet boarding, daycare, grooming, and… Read More

Forecasting Success: Mid-market European M&A Set for Active 2024

2023 was a slower year for mergers and acquisitions (M&A), but the private mid-market fared better than the large-cap arena. Globally, the elements are in place for 2024 to be… Read More

What Price is Right? Trends and Opportunities for Private Equity in Pharma Market Access

The cost of developing new drugs is staggering. Among the top 20 global biopharmas, the average cost of developing a candidate from discovery through clinical trials to market was approximately… Read More

Lincoln Private Market Index Closes 2023 at a Record High Despite a Prolonged Misalignment on Valuation Expectations Among Buyers and Sellers

Despite lower deal flow, credit markets saw spread compression beginning in the fourth quarter The Lincoln Private Market Index (LPMI), the only index that tracks changes in the enterprise value… Read More

The Rising Popularity of NAV Loans

The current economic environment has called for partial liquidity alternatives that provide value for private equity firms and other fund managers. One of those alternatives, the net asset value (NAV)… Read More

Distribution M&A: Outlook on 2024

The distribution sector has faced a series of challenges initiated and driven by the COVID-19 epidemic over the past several years. These have included changes directly attributable to the epidemic,… Read More

Investment Opportunities in Pharma: A Data-Driven Exploration of CDMO Appeal

The report discusses the current state of the contract development and manufacturing organization (CDMO) market within the pharmaceutical industry, emphasizing the increased interest from private equity (PE) investors. The pharmaceutical… Read More

Supplements – A Bright Spot in the Pet Industry

As we embark on a new year, it’s an opportune time to reflect on the “bright spots” within the pet industry that present exciting prospects, particularly as the pet industry… Read More

Navigating Regulation: Recent Developments in the Private Capital Markets

Companies have raised more money in the private markets than in public markets every year since 2009. Consequently, private funds today are an important source of capital throughout the world.… Read More

Sustainability in Focus for Packaging M&A

The packaging industry faces a paradigm shift amidst a growing public conversation on climate change and, as a result, the concerted endeavors of governments worldwide to regulate single-use packaging and… Read More