Financing Markets: A Look Into 2020

Jan 2020

In 2019, middle market lending was characterized by heavy competition and favorable market conditions for borrowers. This environment has persisted for several years, with many lenders commenting they can’t see how the market can get more aggressive…and then it does. However, 2020 could be a pivotal year on several fronts.

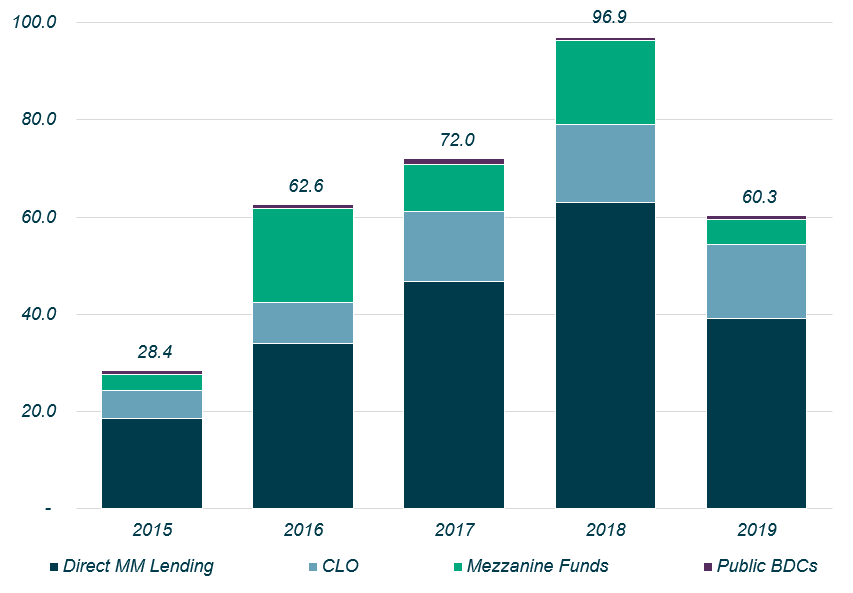

Fundraising for Direct Lending is finally cooling off

Middle Market Private Debt Fundraising$ in billions

|

||||||

| Refinitiv Middle Market Weekly |

Following several years of growth and an all-time-record in 2018, fundraising for middle market debt funds has moderated. Beneath this data, established platforms are getting larger and new, smaller funds are facing a more challenging fundraising environment.

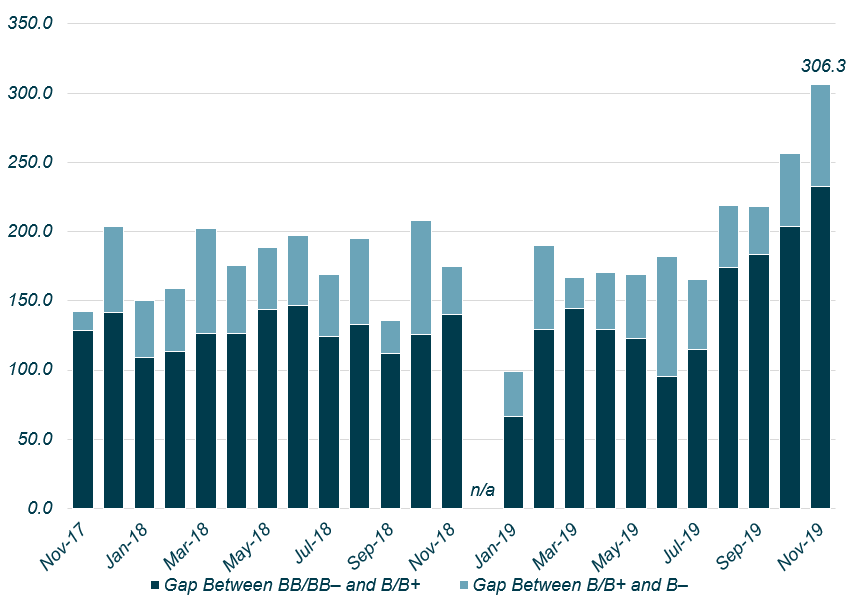

A bifurcation in the market has emerged, based on credit quality

Spread Gap Between Lower-Rated and Higher-Rated LoansSpread gap (bps) |

||||||

| S&P Leveraged Commentary and Data |

As indicated in the chart above, the leveraged loan market has become increasingly divided, evidenced by a widening gap in pricing available to higher-rated versus lower-rated borrowers. According to LCD, the gap between the spread of BB/BB- rated issuers and B/B- rated issuers tripled during 2019, reaching its highest level in 10 years. In the upper end of the market, CLOs and other institutional investors have become more averse to lower-rated leveraged loans. Meanwhile, in the traditional and lower end of the middle market, lenders are concerned about a possible recession, trade wars and the potential impact of the presidential election. As a result, beneath aggressive competition for strong, non-cyclical companies, it has become increasingly difficult to finance cyclical and/or more “storied” businesses.

A new era: the lender universe is shifting

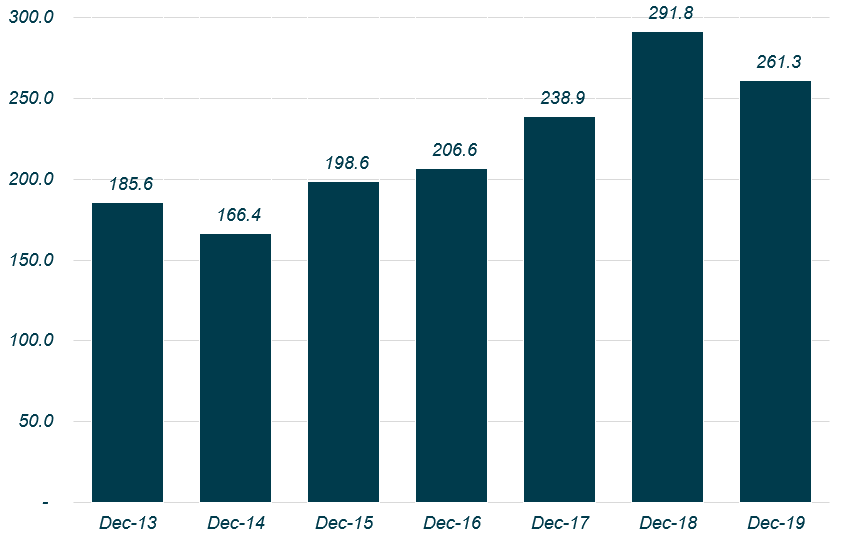

As the chart below shows, despite the recent slowdown in fundraising, dry powder in private debt is near an all-time high. In 2019, direct lenders began putting this capital to work on much larger deals.

Private Debt Dry Powder$ in billions |

|

| Preqin |

The occurrence of $500 million – $1 billion loans being executed by private credit funds as club deals in the private market accelerated in 2019, especially in the second half of the year. Changes in the behavior of market participants including retail loan mutual funds, CLOs, and even rating agencies, has ushered in a new era of large deals being led by non-bank lenders. Given the size and breadth of today’s private debt funds, as well as the advantages of a private/club execution versus a broadly syndicated financing process, these changes are likely here to stay. This ongoing shift of market share taking place in large deals will likely create a “ripple effect” that will play out during 2020 in the traditional and lower ends of the market. As financing providers jockey for position looking to grow in new segments of the market, it will be increasingly important for sponsors and borrowers to spend more time in the coming year deepening their understanding of the financing market and lenders’ capabilities.

Summary

-

Lincoln International's Debt Advisory Group looks into middle market lending in 2020

- Click here to download a printable version of this perspective

- Sign up to receive Lincoln's perspectives

Meet our Senior Team in Debt Advisory

By linking my experience in debt advisory and mergers and acquisitions, I look forward to delivering flexible and innovative financing solutions to make an impact that matters with long-term target clients, as Lincoln does best.

Daniele Candiani

Managing Director & Co-head of Capital Advisory, Europe

Milan

I build trust with clients by putting their interests first at all times.

Aude Doyen

Managing Director & Co-head of Capital Advisory, Europe

London

I strive to be a strong advocate for my clients and offer a fresh and creative perspective to financing situations that exceed expectations and provide the flexibility needed to grow their businesses.

Christine Tiseo

Managing Director & Co-head of Capital Advisory

Chicago