Global Dynamics Drive Hazards and Opportunities in the Auto Industry

Aug 2019

As the economy shudders, dipping its toe into the waters of a recession, macroeconomic, regulatory and geopolitical trends have been disrupting the automotive industry, creating headwinds and pockets of opportunity in each geography. U.S. auto production volumes are continuing to fall from their peak in 2016, while Europe struggles and the Chinese market has collapsed. What are the global factors at play impacting the industry?

1. Trade Wars

Trade wars between the U.S. and China have not only hurt both countries’ auto industries, but also have caused damage to innocents caught in the crossfire. Trump’s tariffs impacted Chinese component suppliers shipping product to the U.S. for assemblies or subassemblies for U.S. produced vehicles. Auto suppliers in the U.S. could no longer rely on inexpensive Chinese suppliers and have been forced to bring that sourcing back to the U.S.—putting pressure on margins or requiring them to shift their supply chain to other low cost countries like Thailand or Vietnam. Meanwhile, China’s retaliatory decision to restore 25 percent tariffs on imported U.S. vehicles beginning December 15, 2019 will disrupt the U.S. auto industry exports, although these are limited today.

Most importantly, escalating U.S. tariffs imposed on China have damaged and will continue to wound Chinese consumer optimism, sinking demand for big-ticket items. This has left Germany caught in the fray, as a major exporter of vehicles to the Chinese market. In fact, German auto giants Volkswagen, Daimler and BMW all earn more than a third of their revenue by exporting to China. Economic indicators show that Germany teeters on the edge of a recession, largely influenced by contracted auto demand in China and U.S. threats to impose additional tariffs on European imports. In fact, Germany’s industrial output is now down 5.2 percent year over year, eliciting warning signs that softness in the German economy, coupled with the anticipated Brexit this fall, will send chills throughout the EU.

Of continuing concern to the U.S. industry is the threat of Trump introducing s232 tariffs on imports from countries other than China; these have been deferred until mid-November but would have a material impact on the industry if introduced. Some uncertainty was removed with the new NAFTA agreement, United States-Mexico-Canada Agreement (USMCA), which stipulates that more U.S. materials should be produced domestically. The agreement still awaits approval in the U.S. and Canada.

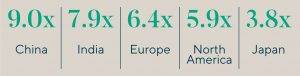

Valuations as a function of geography

Forward 2019 EV / EBITDA multiples

Geography also plays a major role in the auto industry, impacting performance and valuations, as well as the pace of innovative change. China and India are valued the highest due to the size and scale of their markets and the growth potential embedded in the automotive supply chain. More mature markets including North America, Europe and Japan have lower EV / EBITDA multiples. In particular, the lower forward multiples reflect declining volumes, more efficient supply chains and lower margin profiles of businesses in these regions.

Lincoln Perspective: In Tariff-Laden Market, Local Suppliers Come Out on TopIn the tariff environment, selling vehicles in the region they are produced has become prudent. Original Equipment Manufacturers (OEMs) in Europe have been building significant footprints in North America, while Japanese OEMs have made large investments in Mexico. This is why American car companies like Tesla are building plants in China to localize production. This localization of production by global OEMs is also a key driver of auto supplier M&A globally. As OEMs expand their footprints globally, they continue to encourage their domestic suppliers to support them in each of the major vehicle producing regions. A supplier often prefers an acquisition or can better afford a joint venture to establish this presence, as it brings critical mass, customer diversification and local resources much more quickly than can be achieved by a greenfield approach. The battle to find the best acquisition targets and joint venture partners has already begun. |

2. Electrification and Emissions

Meeting regulatory thresholds on emissions has long been a challenge for the industry and these pressures have accelerated in Europe following the Dieselgate Volkswagen emissions scandal.

- Europe: The European Union continues to tighten control of carbon dioxide emissions—these restrictions have forced the European auto players to make significant changes. There has also been a strong consumer shift away from diesel. Penetration had peaked at 55% in 2011, but is now falling precipitously. For example, starting this summer France enforced a ban on diesel cars from Parisian streets during the work week, in an effort to curtail pollution. Several countries have also announced future banning of internal combustion engine vehicles from as early as 2030, shifting demand toward Electric Vehicles (EV).

- U.S.: Meanwhile, across the pond, the Trump administration is working to lower standards, even as some states (notably, the California emissions deal) seek to raise them.

- China: China has moved toward more stringent guidelines: one year from now, vehicles in China will be held to the China 6a emission standard, which is aligned with European and U.S. regulations. It is also placing significant emphasis on EVs.

Electrification has gathered real momentum now, becoming an irreversible force that will change the industry forever. Although EV penetration continues to be low today (2018 marked a high point for Alternative Fuel Vehicles with only a 6% market share), we expect this to continue to rise given the dual impact of government policy and consumer preference.

In fact, the International Energy Agency forecasts that by 2030 there will be 125 million EVs on the road worldwide.

With this irreversible transition toward EV underway, components suppliers are feeling the heat.

Lincoln Perspective: Suppliers to Internal Combustion Engine Cars Look to Sell or PartnerMultibillion-dollar companies supplying combustion engine parts are actively seeking to transition their businesses to supplying electric powertrain components and to exit product lines that will not factor into the future of the industry. Managing this transition successfully involves both risk and investment. Many suppliers are looking at partnering as an option—collaborating to build shared critical mass and knowledge in evolving EV technologies. Components suppliers seeking to release capital to build their investment “war chest” can still find buyers if they know where to look. The most likely targets?

|

3. Market Sputters

As the market swings weekly, investors wonder how another recession would impact the auto space. While no one expects another recession like 2008, the question remains: how deep will this downturn be?

The U.S. auto industry is in much better shape now than it was in 2008. Following the last recession, the auto industry streamlined, reducing the number of assembly plants by 10. OEMs are being more disciplined in managing production schedules and inventory levels while also managing the shift in consumer preferences from sedans to SUVs and pick-ups. Suppliers generally have higher levels of liquidity, leaving them in better shape to face a downturn. For these reasons, the U.S. industry should take much less of a hit this time than in 2008-2009.

In contrast, European OEM plants are currently running below full capacity, in many cases at 60-70 percent. This is partly as a result of slow to flat growth in Europe and lower China exports. This weakness is causing issues for suppliers and we are now seeing real evidence of distress amongst European suppliers.

Lincoln Perspective: Facing Volatility, Suppliers Consolidate or PartnerThe combination of the shift to electrification and market volatility should continue to drive consolidation and partnerships in the supplier space. Suppliers are carefully evaluating their portfolios to assess non-core assets which they will look to realize to free up capital and invest in higher growth areas. As production volumes fall, pressures will build on the supplier base, providing opportunities for further consolidation by strategics and for financial investors who are confident enough in their knowledge of the industry to adopt a contrarian view. |

Summary

-

Lincoln International global experts explore factors that are impacting the automotive industry.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Contributors

Meet our Senior Team in Automotive & Truck

I leverage strategic insights and industry connections to unlock value for clients.

Joe Sparacino

Managing Director

Boston