Thriving in Motion: Exploring the Latest Outdoor and Sports Industry Trends

Mar 2024

| As the dust settles from the pandemic-induced frenzy, the active outdoor and sports equipment industries now stand at a fascinating crossroads. What began as a surge in demand—a lifeline for many sector participants—has now evolved into a nuanced landscape of opportunities and obstacles that Lincoln International explores in the below article. |

Summary

-

Lincoln International explores the nuanced landscape of opportunities and obstacles in the outdoor and sports industry.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Active Outdoor Dynamics Shaping the Industry

Navigating rocky terrain: short-term hurdles, long-term summit views

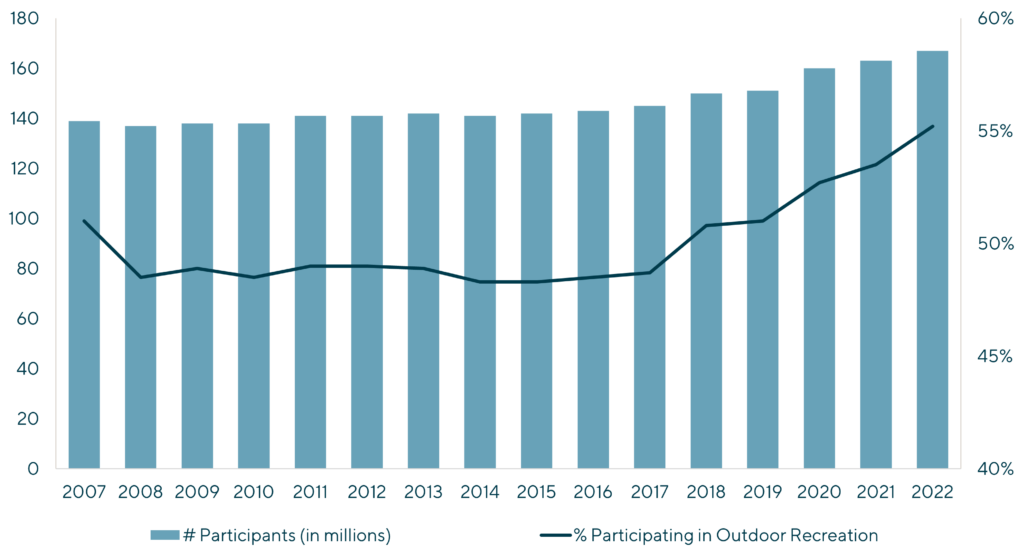

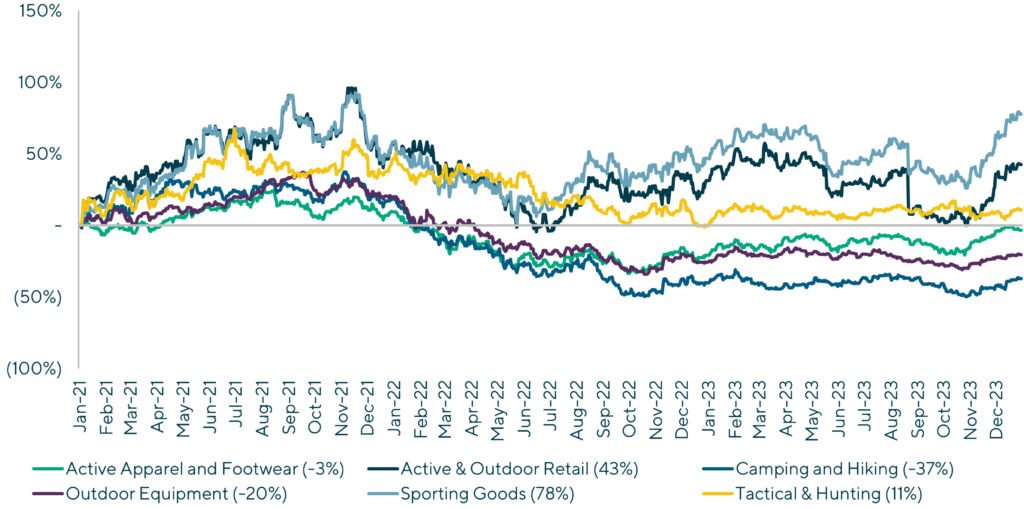

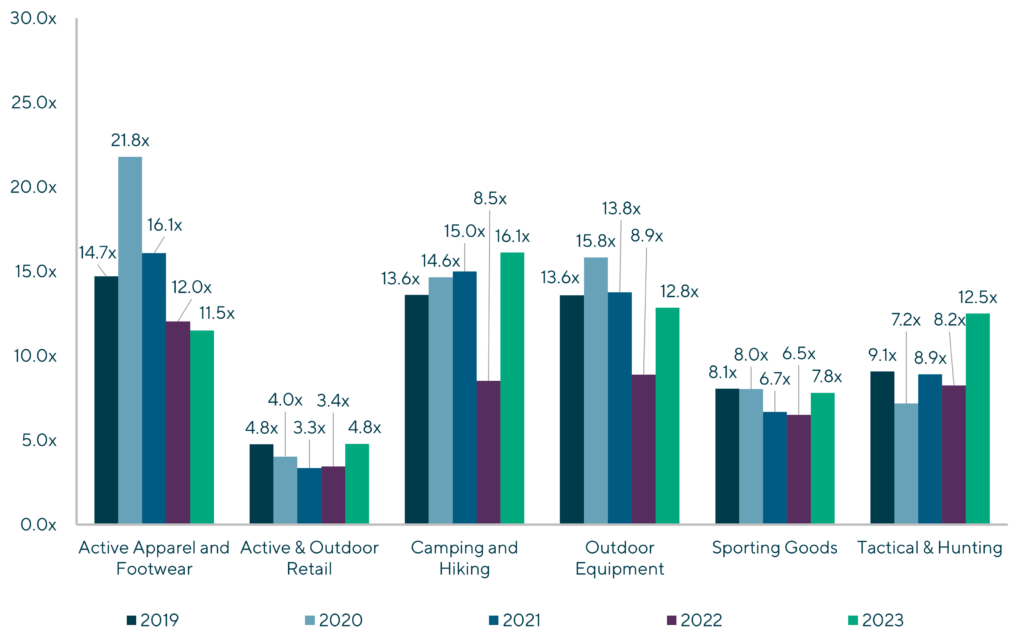

Driven by changing consumer preferences during COVID-19, the active outdoor market saw a step change increase in consumer participation, representing a fundamental recalibration of lifestyle choices, with lasting implications for the industry. Participation rates and per-participant spending in many outdoor activities increased dramatically over this period with significant growth over pre-COVID-19 levels. As demand outstripped supply, brands were steadfastly focused on trying to maintain stock levels while battling elevated costs throughout their supply chains.

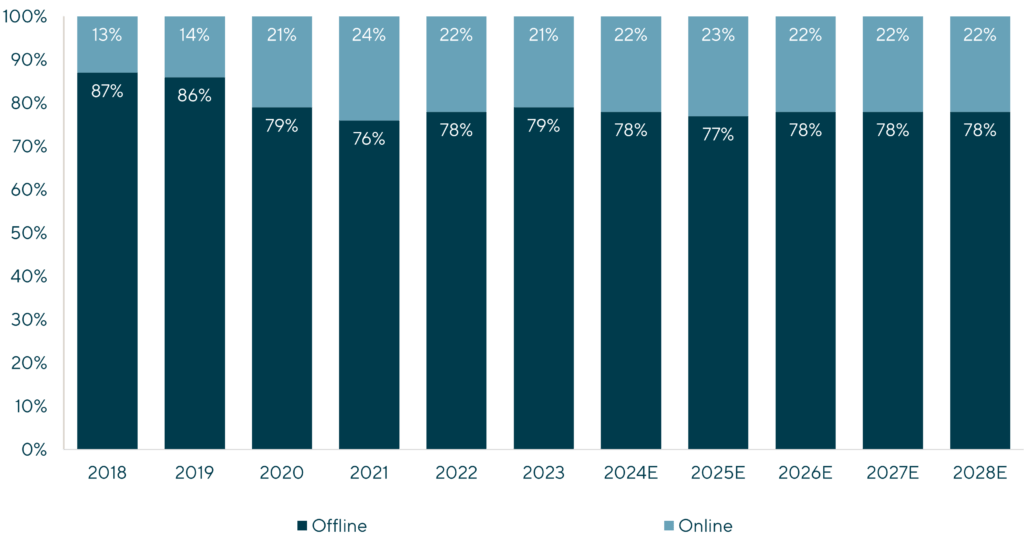

As the supply chain recovered and consumer demand preferences began to evolve, the market had to manage through elevated inventory levels in 2023, leading to significant discounting from brick-and-mortar and e-commerce retailers, or inventory being pushed back onto brands. In response, many companies tried to double down on finding ways to grow their e-commerce presence to avoid potential inventory challenges with retailers. Despite strategic initiatives to reduce the impact, many outdoor brands and retailers, including Columbia Sportswear, Nike, Solo Brands, Revelyst, VF (North Face) and REI are now experiencing significant revenue declines and cost cutting measures as they react to these market difficulties.

While many brands are facing these challenges, several differentiated outdoor product companies continue to take market share within their categories. These companies typically have a similar trait such as an insatiable consumer following (e.g., Yeti, Arc’teryx) or a technical differentiation that provides a competitive advantage over others in the pack (e.g., Gore-Tex, BOA).

While headwinds will persist for some subsectors within active outdoor in the near-term, the long-term view for the industry is positive, with many brands and retailers looking ahead to brighter days. The active outdoor industry will continue to push forward and while the path ahead may be full of switchbacks, the long-term summit views remain promising.

Innovation Fueling the Future of Sports Products

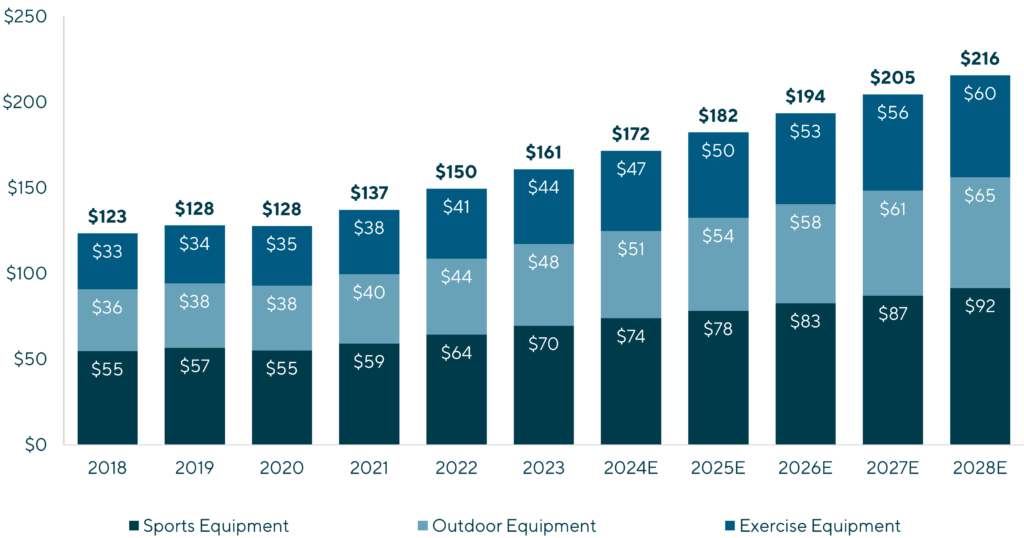

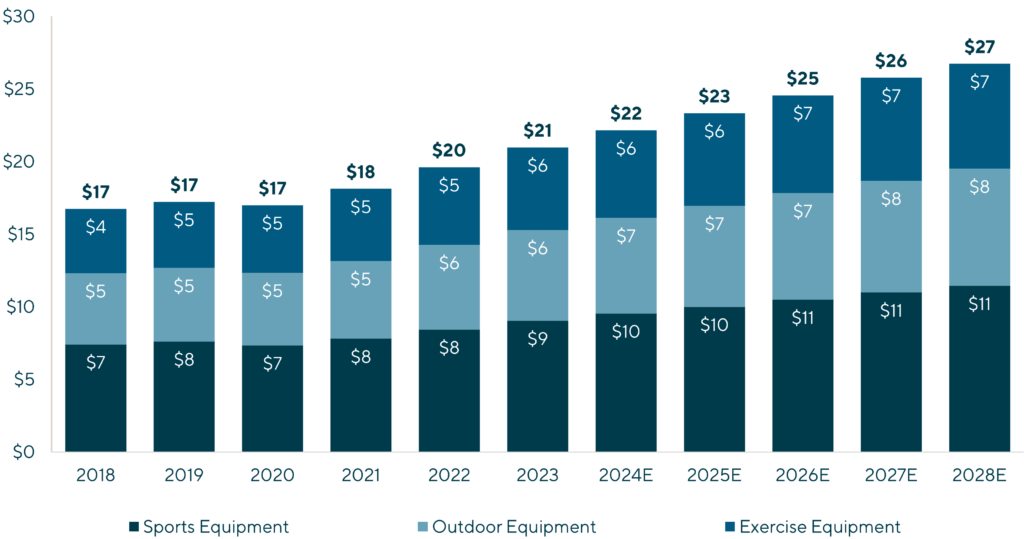

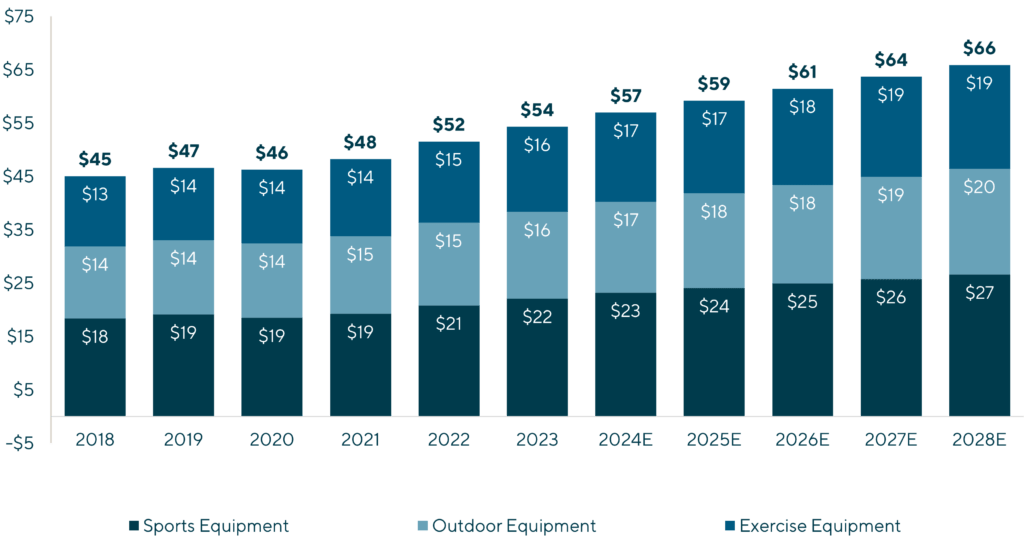

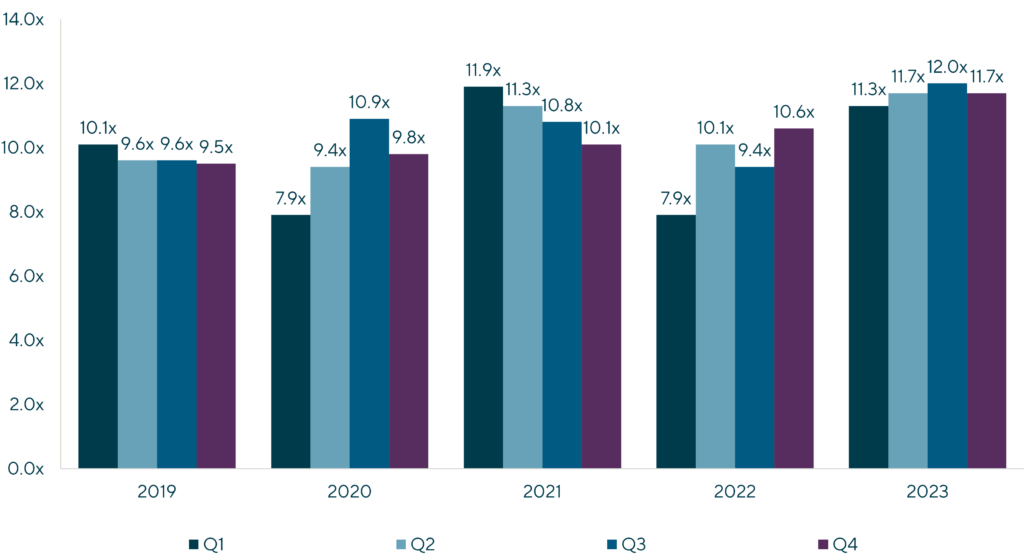

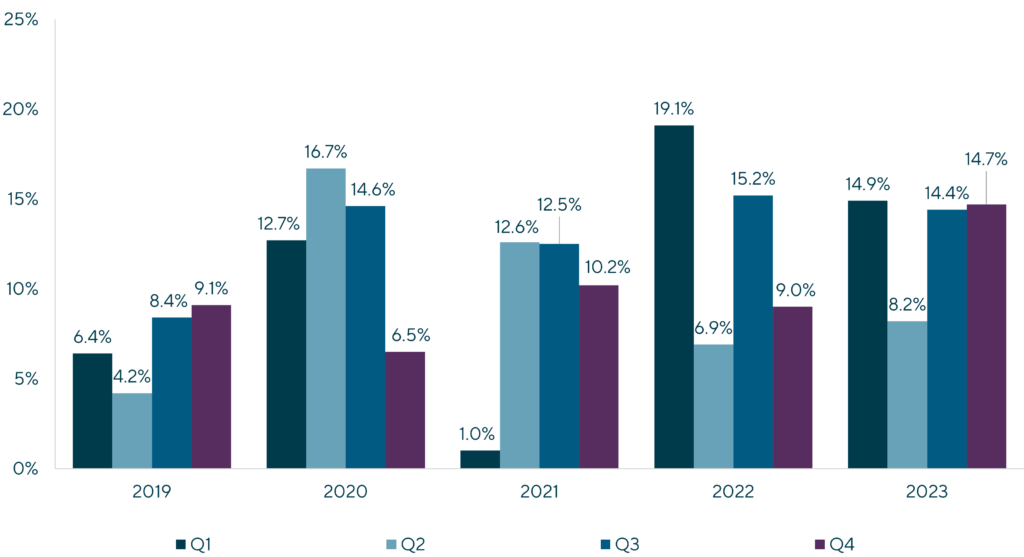

Winning streak: sports sector keeps outperforming the broader discretionary market

Representing a bright spot within the broader discretionary consumer product sector, many sports equipment product companies have continued to deliver impressive financial results, as the recurring nature of this subsector leads to more stable consumer spending trends year over year. These companies are taking advantage of the continued consumer spending on youth sports and the need for consistent innovation within the category. What was once thought of as a category soon to be impacted by generational shifts to video games rather than team sports, is now experiencing increasing average spend per athlete, pricing power and overall category revenue.

While the industry battled similar supply chain challenges as the active outdoor category, the path forward is far less rocky. Companies will be able to lean on their resilient consumer base and bring innovation to a category that consistently craves the “next best thing”. The desire of athletes to gain an edge over their competitors and parents’ willingness to spend money on their kids’ sports endeavors will remain constant symbols of stability for the category.

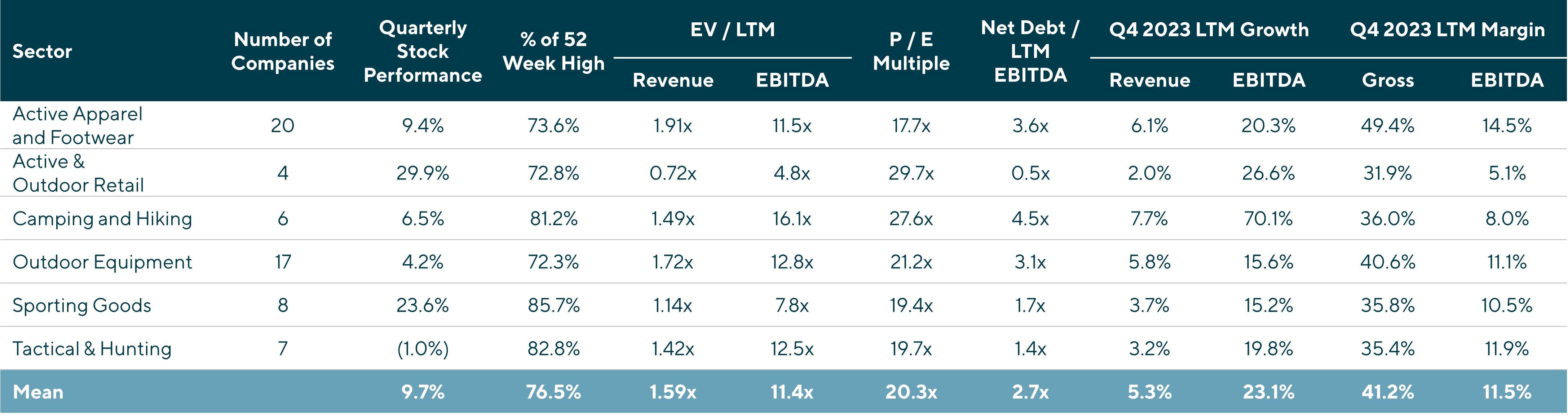

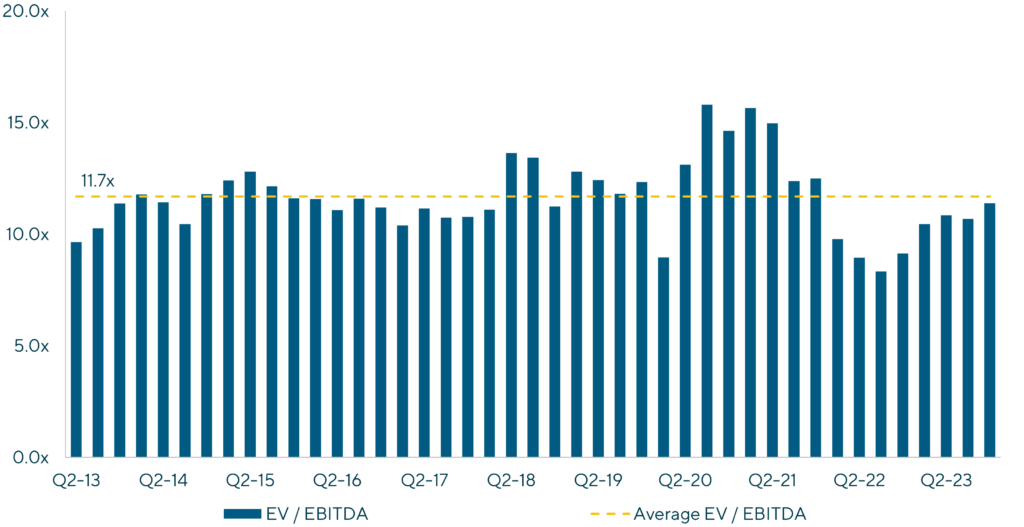

Future Prospects: 2024 M&A Outlook

Active Outdoor:Financial acquirers and lenders exhibited increased discernment and rigor in their investment and financing strategies, particularly regarding discretionary consumable product companies. This led to a significant impact on active outdoor M&A processes, as financial investors shied away from companies battling margin compression, elevated inventories and changing consumer preferences. Given these dynamics, most companies are sitting on the sidelines and waiting for either improved company financial performance or financial investor interest in the category to pick back up. In the interim, active outdoor M&A processes with strategic or strategic financial buyer outcomes will continue to be over-indexed to historical averages (such as Yeti’s acquisition of Mystery Ranch). As company financials continue to improve and the challenges related to the inventory glut of 2023 move farther in the rear-view mirror, the expectation is that buyer and seller valuation expectations will become closer aligned and investor interest in the category will follow the heels of the long-term consumer participation rate in the industry. |

Sports Products:On the other end of the spectrum, sports product companies fared better and as such, financial investors are still been willing to aggressively pursue A+ assets in this sector. This is evident in recent successful transactions such as Compass Diversified’s sale of Marucci to Fox Holdings and Bregal Partner’s sale of United Sports Brands back to Norwest Equity Partners. Expect to see several more companies trade hands in the near term. |

Precedent Transactions

| Date | Target | Business Description | Acquirer |

| Jan-24 | Mystery Ranch | Designs and provides technical outdoor backpacking products | YETI Holdings |

| Jan-24 | TruBlue dba Head Rush Technologies | Manufactures equipment for the climbing and adventure industries | TZP |

| Dec-23 | Phenix Rods | Provides fishing rods and gear | GSM Outdoors |

| Nov-23 | United Sports Brands | Operates a portfolio of sporting goods and active lifestyle brands | Norwest Equity |

| Nov-23 | Wheelhouse dba Marucci | Provides baseball bats, gloves, gear and apparel | FOX Factory |

| Nov-23 | Camillus and Cuda | Provides knives, hunting and fishing products | GSM Holdings |

| Sep-23 | B4 | Manufactures outdoor toys and backyard games | Animal Spirits; D3; i-nest Capital |

| Jul-23 | Arcus Hunting | Manufactures bowhunting and archery consumables and accessories | Unknown Acquirer |

| Jul-23 | Delta P Design | Manufactures centerfire rifle suppressors and accessories for military applications | True Velocity Ammunition |

| Jul-23 | Ontario Knife Company | Provides knives, cutlery and tools | Blue Ridge Knives |

| Jul-23 | Al’s Goldfish Lure | Manufactures iconic fishing lure equipment | Fin Rage Tackle |

| Jul-23 | Van Raam Reha Bikes | Manufactures non-motorised bicycles and cycles | Armira Partners GmbH & Co |

| Jul-23 | Forwell Sports Equipment Co. | Manufactures carbon fiber bicycles and rackets | Consortium of 3 Individuals |

| Jun-23 | Triangle’s – Cycling Equipments | Manufactures aluminum bicycle frames | Aphelion |

| May-23 | Wolf Tactical | Operates a tactical gear company | Society Brands |

| May-23 | Terra Flame Home | Designs portable fireplaces for offices, apartments, condos and lofts | Solo Brands |

| Apr-23 | Monpedalada Sociedad | Provides bicycles and related accessories | Bicicletes Sabadell |

| Apr-23 | Evnroll Putters | Manufacturers golf putters and golf accessories | Creatz |

| Apr-23 | Baum Enterprises | Designs and manufactures wood composite baseball bats | Marucci Sports |

| Mar-23 | Tuffstuff Fitness International | Provides fitness equipment for institutional and consumer markets | Brooks Industrial |

| Mar-23 | EastPoint Sports | Designs and delivers home recreational products | Buffalo Holding |

| Mar-23 | Dynamic Distribution | Provides disk golf goods and services | House of Discs |

| Mar-23 | FlagHouse | Provides equipment and resources for physical education and fitness | School Specialty |

| Feb-23 | Tianjin Jiahao Bicycle Co. | Engages in the manufacture and sale of e-bicycles | Sutai (Tianjin) Packaging Materials Co. |

| Feb-23 | Precision Shooting Equipment | Manufactures archery equipment | Heritage Outdoor Group |

| Feb-23 | Classic Motor Sports & Lawn | Engages in the dealership of power sports equipment | Hutson |

| Jan-23 | Stages Cycling | Provides stationary smart bikes for the commercial gym and home markets | Giant Manufacturing Co. |

| Jan-23 | D3 Lacrosse | Operates lacrosse events | 3STEP Sports |

| Jan-23 | GT Golf Holdings | Produces golf grips, accessories and tees | Kinzie Capital Partners |

| Jan-23 | Naish | Manufactures water sports equipment | Kubus Sports |

| Jan-23 | Michigan Elite Volleyball | Operates a training and education academy | 3STEP Sports |

| Jan-23 | Ouray Sportswear | Manufactures headwear and bundled products | L2 Brands |

| Jan-23 | Powerbull Bats | Manufactures baseball bats | Big Fly Factory |

| Dec-22 | Ocean Rodeo Sports | Manufactures water sports equipment | ALUULA Composites Inc. |

| Dec-22 | Topo Athletic | Operates as an athletic gear company that manufactures shoes for men and women | Designer Brands |

| Dec-22 | SAS | Designs and manufactures high-end fishing products | AFL Pêche |

| Dec-22 | Vittoria | Engages in the manufacturing and distribution of bicycle tires | Telemos Capital |

| Dec-22 | Reel Icon Pty | Manufactures and sells fishing reels | Gowing Bros. |

| Dec-22 | NPJ Volleyball | Operates as a volleyball club | 3STEP Sports |

| Nov-22 | Chesapeake-Angler.com | Operates an online platform that provides fishing equipment | Sport Fishing |

| Nov-22 | Best Soccer | Operates as a youth soccer training and development firm | 3STEP Sports |

| Nov-22 | Tide Tamer Industries | Manufacturers aluminum watercraft lifts, docks and related waterfront accessories | Waterfront Brands (MPE Partners) |

| Nov-22 | LeagueSide | Operates a youth sports sponsorship platform | TeamSnap |

| Nov-22 | L2 Brands | Retails apparel, headwear, college gear, home decor and custom products | Sentinel Capital Partners |

| Nov-22 | RIP-IT Sports | Manufactures technical, sport-specific footwear, apparel and gear | Gauge Capital |

| Nov-22 | Ashley Outdoors | Operates as a RV dealer that offers travel trailers, fifth wheels, toy haulers and tractors | Camping World Holdings |

| Nov-22 | North Bay Basketball Academy | Operates as a basketball training and development program for athletes | 3STEP Sports |

| Oct-22 | Outdoor Products Innovation | Produces archery, hunting and outdoor products | Feradyne Outdoors |

| Oct-22 | Penalty Box Hockey | Operates as a hockey retailer that offers hockey equipment and sportswear | Pure Hockey |

| Oct-22 | Bob Ward & Sons | Operates as a sporting goods retailer in Montana | Al’s Sporting Goods |

| Oct-22 | Fins And Feathers of Bozeman | Operates as a fly shop providing flies and small fishing items | Yellow Dog Flyfishing Adventures |

| Oct-22 | Project 321 | Comprises an outdoor sporting goods components manufacturing business | North Arc |

| Oct-22 | Dirty Jigs Tackle | Provides fishing bait and jigs | Nichols Lures |

| Oct-22 | Patriot Lacrosse Club | Operates as a youth sports club offering programs for student athletes | 3STEP Sports |

| Oct-22 | Whisker Seeker Tackle | Manufactures and sells fishing rods for catfish anglers and other catfish tackle products | PRADCO Outdoor Brands |

| Sep-22 | Score Sports | Manufactures and sells sports uniforms and equipment | BVP Management Company |

| Sep-22 | Barnesmith | Manufactures and sells authentic collegiate apparel for schools and colleges | Society Brands |

| Sep-22 | HLC | Distributes bicycle parts and accessories | MiddleGround Management |

| Sep-22 | The BFC Company | Provides ski and snowboard rental delivery services to resorts and consumers | Alterra Mountain |

| Aug-22 | FaR OUT Volleyball | Operates a volleyball club | 3STEP Sports |

| Aug-22 | The Hoop Group | Provides basketball instructions, camps and competitions | 3STEP Sports |

| Aug-22 | TRX | Provides workout equipment and training programs for full body health | JFXD Capital |

| Aug-22 | Sports Endeavors | Operates as a multi-channel multi-sport retail company | Seawall Capital |

| Aug-22 | SkyTrak | Manufactures and sells golf trajectory measuring instruments | Golftec Enterprises |

| Aug-22 | Wildfire Volleyball | Operates a volleyball academy | 3STEP Sports |

| Jul-22 | Simms Fishing Products | Manufactures and sells fishing gear for professional guides | Vista Outdoor |

| Jul-22 | Hollywood Bases | Operates a sporting goods manufacturing business | Rawlings Sporting Goods Company |

| Jul-22 | SIDI SPORT | Manufactures footwear for off-road and on-road cycling and motorcycling | Italmobiliare |

| Jul-22 | ArachniGRIP | Manufactures stick-on grips for guns | TALON Grips |

| Jul-22 | Pure Archery | Designs and manufactures archery equipment | JDH Capital Company |

| Jul-22 | Sergio Tacchini IP Holdings | Designs and retails sportswear | F&F Co. |

| Jul-22 | Fox Racing | Designs and manufactures motocross gear and apparel for riders | Vista Outdoor Operations |

| Jul-22 | Overland Vehicle Systems | Manufactures and sells outdoor automotive parts | Caymus Equity Partners LLC; Caymus |

| Jun-22 | Giant Loop | Manufactures packing systems and gears for motorcycles and snow bikes | Uswe Sports AB |

| Jun-22 | Marathon Sports | Operates as a specialty running retailer | Fleet Feet |

| Jun-22 | SuperStroke | Produces putters and club grips | Daol Investment; Voice Caddie |

| May-22 | Zimagear | Engages in the design of helmet decals, uniform and apparel | Lax.com |

| May-22 | Assets of New Ultralight Arms | Manufactures rifles | Wilson’S Gun Shop |

| May-22 | GSI Outdoors | Operates as a household appliances producers company | Pelican International |

| May-22 | Pearl Izumi USA | Manufactures and sells sports apparel for men and women | United Sports |

| May-22 | Bill Lewis Lures | Provides lures for fishing | Good Sportsman Marketing |

| Apr-22 | Glacier Outdoor | Produces gloves and hats for fishing, sporting, hunting and other activities | Elvisridge Capital |

| Apr-22 | RGT Cycling | Designs and develops a virtual indoor cycling platform | Wahoo Fitness |

| Apr-22 | Lyalvale Express | Produces shotgun ammunition | Fiocchi Munizioni |

| Mar-22 | X Games | Comprises an action sports events brand | MSP Sports |

| Mar-22 | Sun Mountain Sports | Produces apparel, accessories, luxury goods and sporting goods | Solace Capital Partners |

| Feb-22 | Defender Industries | E-commerce platform for motorcycle, dirt bike, ATV and snowmobile gear | FortNine (Novacap) |

| Feb-22 | BBS Tech dba Fins Fishing | Produces braided fishlines | Elvisridge Capital |

| Feb-22 | HS Fitness dba Reach Fitness | Manufactures fitness and gym equipment | GlobalBees Brands |

| Feb-22 | Worldwide Camping Holdings | Produces outdoor camping equipment | Clearview Capital |

| Feb-22 | Svendsen Sport | Distributes fishing tackles | Pure Fishing |

| Jan-22 | Snake Eyes | Manufactures golf equipment | Forethought |

| Jan-22 | The Wildland Trekking Company | US outdoor adventure tour operator | Intrepid Group |

| Jan-22 | Cascadia Vehicle Tents | Manufactures rooftop vehicle tents, awnings, off-road trailers and car camping equipment for cars, trucks and SUVs | Gathr |

| Jan-22 | Assets of Detroit Bikes | Bicycle frame and component manufacturer | Cardinal Cycling |

| Jan-22 | Killer Instinct | Engages in online and offline retail crossbow products and accessories | Aldine Capital / Generation |

| Jan-22 | Outdoor Edge | Manufactures knives and outdoor tools | Revo Brand Group |

| Jan-22 | TopYa! | Develops a virtual coaching and engagement platform | ProMentor |

Contributors

Through honest advice, passionate client service and hands-on execution, I strive to deliver outlier results for my clients.

Christopher Petrossian

Managing Director & Co-head of Consumer

Los AngelesMeet Professionals with Complementary Expertise in Consumer

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago

I design strategies and offer solutions that fit the unique ambitions of each client I serve.

Brian Little

Managing Director

Los Angeles

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

London