Private Equity and Private Credit Resiliency is Not an Illusion

Apr 2023

| Many macroeconomic factors have contributed to recent public market volatility, including inflation, labor shortages, rising interest rates and recent banking system instability. While private market valuations have demonstrated less volatility and relative strength, the performance disparity has drawn skepticism with many believing private managers are overvaluing their assets.

In our latest perspective, Lincoln International’s Valuations & Opinions Group unpacks three common private market misconceptions, including the valuation and volatility gap, as it explores the differences between public and private markets. |

Summary

-

Lincoln International explores key differences between the public and private markets and explains the valuation and volatility gap that exists by unpacking three key misconceptions.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Myth One: Private Valuations Should Mimic Public Valuations

The composition of private funds is significantly different than the composition of public indices

Managers of PE funds are very focused on investing in businesses that have consistent, sustainable and predictable earnings, often with minimal capital expenditure or working capital needs. This focus can be largely attributable to the need to leverage these companies which facilitates their ability to garner relatively high equity returns for their investors. But this focus on predictable cash flows also allows managers to effectively implement long-term strategic planning for these companies without the potential impact of an unpredictable negative cycle causing disruption.

As a result, PE portfolios are significantly different from the broad public market indices, which encompass companies in industries such as brick and mortar retail or oil and gas, which are highly cyclical and have greater exposure to changing consumer behavior or geopolitical conflict. Diving further, the Lincoln PMI (LPMI), a proprietary index which measures changes in fair value of private companies, primarily PE-owned portfolio companies, and therefore is representative of private manager portfolios, had exposure of only 14% to the energy and consumer sectors combined as of year-end 2022, whereas the S&P 500 weight to the same sectors was nearly 25%.

Barring anything else, this difference in the mix of industries between companies in PE portfolios vs. the public markets accounts for a portion of the difference in the volatility of their valuations.

Private markets are less influenced by capital flows

Greater public market volatility can also be attributed to the influence of capital flows that rarely, if ever, impacts private markets. Large institutional investors, as well as changes in retail investor sentiment, can cause dramatic swings in valuations. In the blink of an eye, public company valuations can fluctuate due to portfolio-level decisions that may be completely unrelated to the fundamental performance of a particular company. On the other end of the spectrum, private managers have access to large and growing capital pools that are either permanent or locked up for extended periods, often over five years. In fact, this capital pool, often referred to as “dry powder”, is used for an array of solutions for private companies including, but not limited to, infusing capital for future growth and shoring up liquidity shortfalls that might present themselves over time. This pocketbook of cash, unredeemable by investors in most cases until the end of a fund’s life, insulates private companies from changes in valuations caused by the market sentiment of investors, who may be making investment decisions on issues unrelated to a specific company, such as diversification issues or capital needs, and at times make irrational or uneconomic short-term decisions.

As a result, over time, the LPMI has increased or decreased primarily as a result of each company’s fundamental performance, with less influence from multiple expansion or contraction. This is dissimilar to the S&P 500, which has historically been primarily driven by changes in multiples.

There is a correlation between private and public markets, it is just not perfect

Trends in public markets normally trickle down to private markets and, in the long run, the two markets are correlated and, in fact, often converge at points, but private markets have historically shown less valuation volatility compared to public markets. Generally, while private market valuations may not suffer the dramatic declines observed in public markets, they often also do not participate in the outsized positive returns public markets can experience over shorter timeframes.

Case in point, reflecting on public and private credit market behavior during the 2020 pandemic illustrates the stark difference between public and private markets in periods of high volatility. At the onset of the pandemic in Q1 2020, the Morningstar LSTA US Leveraged Loan Index, which is an index of broadly syndicated public loans, sharply declined by 14.3%. In contrast, the Lincoln Senior Debt Index, a proprietary index which measures changes in fair value of senior privately held debt investments, fell by only 5.5%. However, by the end of 2020, both declines had almost entirely retraced, with the two indices lower by only 0.6% and 0.4% for the year, respectively.

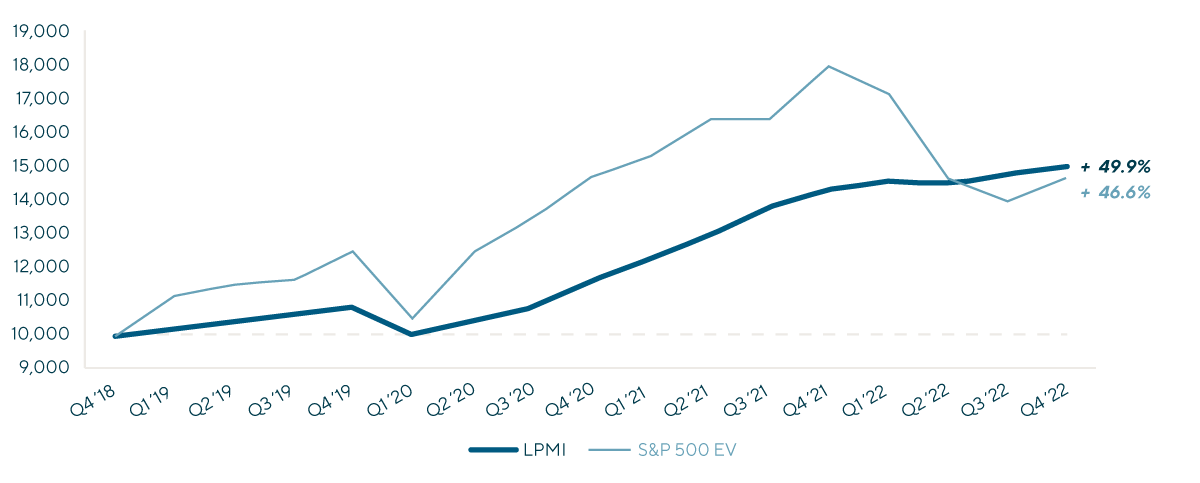

Another example of divergent short-term trends was evidenced in equity markets in 2022, when the LPMI increased by 4.8% while S&P 500 enterprise values (EVs) fell by 18.4%. However, through 2020 and 2021, S&P 500 EVs materially outpaced the LPMI, as shown in the chart below. While 2022 performance could be viewed as a short-term divergence it can also be interpreted as a long-term convergence, with S&P 500 EVs falling back to the LPMI and below during the year, then rebounding to converge again at year end.

It is not uncommon for the two indices to diverge and converge over time. On a longer-term lookback, the lower chart also shows the two indices converging to only a 3% difference over the trailing four years despite extended periods of divergence.

| Lincoln PMI vs S&P 500 EV – 2018 through 2022 |

Myth Two: PE Valuation Processes Lack Objectivity and Transparency as Some Managers Do Not Update Fair Value Inputs, Which Inflates Values Compared to Public Counterparts

Following the 2008-2009 financial crisis and the 2010 Dodd-Frank Act that followed, PE and credit valuations are subject to extensive oversight from board of directors and audit committees, auditors, regulators and investors. This results in a high standard of accountability. Private asset managers take measured steps to ensure compliance with SEC rules and U.S. GAAP, with many large firms employing dedicated internal resources specifically to valuation rather than using deal teams to oversee the valuation processes.

As an example of the omnipresent and continuing regulatory focus on valuation, the SEC’s 2023 SEC Exam Priorities explicitly lists compliance with “Investment Company Act Fair Valuation Rule 2a-5.” While there are certainly many other recent illustrations, suffice it to say that good faith fair value determinations continue to be top of mind for private managers, regulators, auditors, boards, general partners (GPs), limited partners (LPs) and other overseers.

It is not uncommon for private managers to have an independent internal valuations team that prepare valuations without the bias deal teams may have. But that is usually the first step of the process. Most funds utilize third-party valuation firms that provide the manager with their views on valuations. Managers that deviate from the recommendations from these third-party firms normally need to justify these decisions to their valuation committees and auditors. In addition, board valuation committees and auditors regularly review these marks to ensure best practices have been followed and that the marks adequately reflect a company’s performance and market conditions.

In addition to regulatory scrutiny, LPs have placed increasing focus on valuation transparency and conduct regular due diligence to ensure GP processes align with fair value accounting standards. The resulting structure is a checks and balances system in which LPs continuously review GP valuation procedures. LPs regularly request valuation reports to gather insight into the conclusions and fund managers are responsible for clarifying any outstanding questions from investors. These trends have resulted in the increased use of third-party valuation firms, which further buttresses the credibility of PE and credit valuation processes.

Additionally, it is a misconception to suggest that managers are not adversely adjusting their valuation inputs in times of market disruption. In fact, based on a sample of 15 publicly disclosed unobservable inputs tables in regulatory filings of publicly traded PE and credit funds, from Q4 2021 through Q4 2022, over two-thirds of managers indicated they selected lower EV multiples for their portfolio companies and the average multiple decline in the sample was approximately 0.6x of EBITDA. In addition, during the period from Q2 2021 through Q4 2022, the LPMI showed seven consecutive quarters with multiples declining, yet the index actually increased during that period due to steadily improving operating performance.

Myth Three: Leveraged Capital Structures Lead to Conflicts of Interests Amongst PE Sponsors and Lenders That Can Create Negative Outcomes and Lower Valuations for Private Portfolio Companies

Public company capital structures are often comprised of complex financial structures with multiple tranches of debt and equity, all provided by numerous disinterested parties. These stakeholders, such as bond holders and equity holders, often have disparate priorities wherein a bond holder’s goals are primarily focused on recovering principal and interest payments and rarely focused on the next deal nor the strength of the relationship with the equity group backing the company. As a result, economic interests can quickly diverge based on both market sentiment and company-specific circumstances. For example, if a public company requires additional equity, there are few places to turn and it is unlikely that shareholders will closely coordinate with each other or bondholders to achieve a mutually beneficial resolution. All while bondholders will shift their focus to recovery of principal and exiting the position whole. This divergence of interests, alone, often accounts for the swings in sentiment that creates significant volatility to a public company’s valuation.

In the private markets, it has become increasingly common for PE sponsors to use the private debt markets as opposed to the broadly syndicated debt market to finance their transactions. As a result, these structures have fewer lenders, which simplifies negotiation processes if portfolio companies experience headwinds or require access to additional capital to fund growth. This is also facilitated by the increasing prevalence of unitranche financing structures, which results in even simpler capital structures and fewer conflicting interests amongst lenders, allowing for less complexity and quicker solutions. Further, PE relationships have become invaluable to lenders on the back of increased competition due to the large influx of capital to the private debt market, which should lead to more constructive and creative solutions in difficult situations. In fact, many lenders evaluate PE sponsors and funds as part of underwriting processes, with each vetted by lender investment committees. In many circumstances, relationships can make or break deals and, as such, have become an essential consideration for lenders.

Because of the smaller number of lenders and equity holders supporting a PE portfolio company, they are able to closely monitor each company, predict its needs and take the necessary action to effectively ward off any dramatic swings in performance before it even happens, thus mitigating changes to valuations.

| At moments in 2022, the disconnect between private and public valuations and returns was questioned by some observers. The reality is that fundamental structural differences afford PE and credit investors a degree of stability, which is expected to persist through future periods of uncertainty as it has in past periods of uncertainty. Looking ahead, we expect that while private markets may experience similar economic challenges to public markets, they will retain the characteristics described throughout, that should lead to less volatility but general alignment with public market valuations. |

Contributors

I enjoy the opportunity to provide clients with insightful and unbiased advice that will help them make the most informed decisions possible.

Ron Kahn

Managing Director & Co-head of Valuations & Opinions

Chicago

I enjoy sharing insights about market and valuation trends with my clients, while also leading a differentiated and high-touch process.

Brian Garfield

Managing Director & Head of U.S. Portfolio Valuations

New YorkMeet Professionals with Complementary Expertise in Valuations & Opinions

I find immense fulfillment in enabling clients to achieve their objectives and navigate the complexities of today's ever-changing landscape.

Chris Croft

Managing Director & Co-head of Transaction Opinions

New York

I enjoy sharing insights about market and valuation trends with my clients, while also leading a differentiated and high-touch process.

Brian Garfield

Managing Director & Head of U.S. Portfolio Valuations

New York

I enhance my clients’ decision making and governance processes by providing independent and objective financial advice in a highly responsive manner.

Chris Gregory

Managing Director & Co-head of Transaction Opinions

New York

I enjoy the opportunity to provide clients with insightful and unbiased advice that will help them make the most informed decisions possible.

Ron Kahn

Managing Director & Co-head of Valuations & Opinions

Chicago