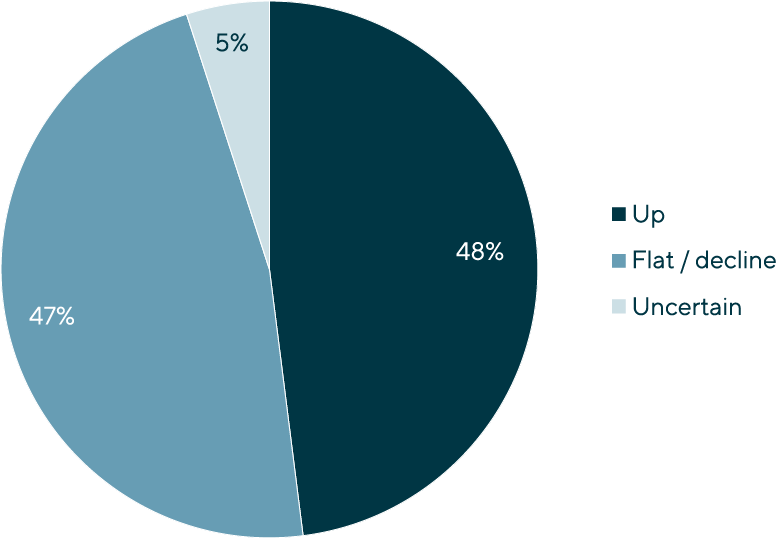

Private Equity Investors Are Split on M&A Outlook for 2023

-

Pulse on PE

Our recent survey of more than 350 global private equity investors uncovers key trends heading into 2023.

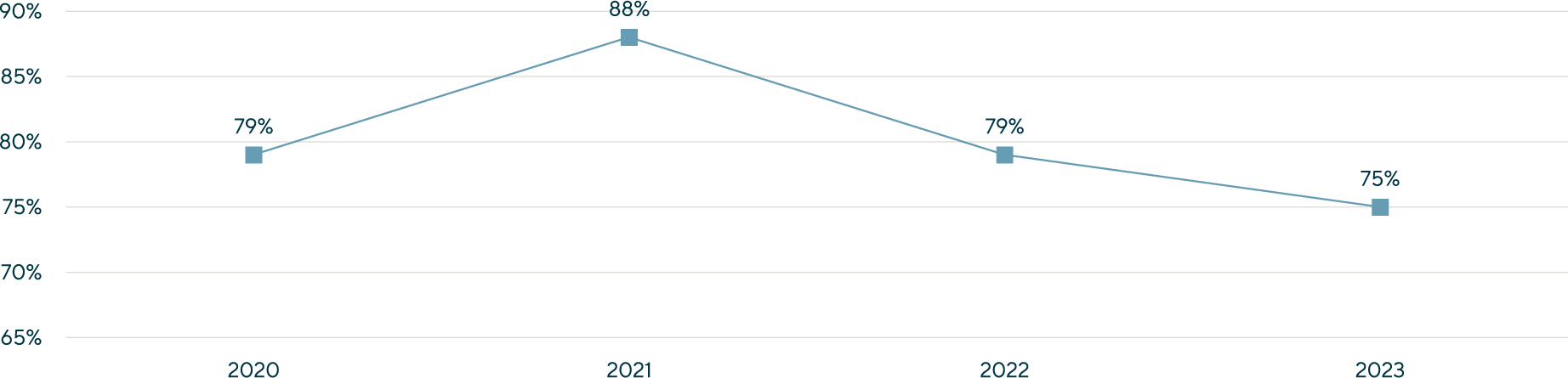

PE investors focus on deploying ample capital.For the fourth year in a row and not surprisingly deploying capital remains the most important strategic objective, selected by 75% of PE investors in the survey – what remains to be seen is HOW MUCH capital. That percentage has declined slightly from previous years, and PE firms may be more selective about where they invest by potentially targeting businesses that are less cyclical. Economic volatility could also prompt some limited partners to retain cash in the year ahead. PE firms have ample cash to invest and will continue to search for strong opportunities across sectors and borders. However, sellers may prefer to engage advisors more discreetly to find the right investors rather than use broader market outreach.

With the potential for a recession ahead (or already underway), more than 13% of investors will focus on priorities related to portfolio companies in 2023:

|

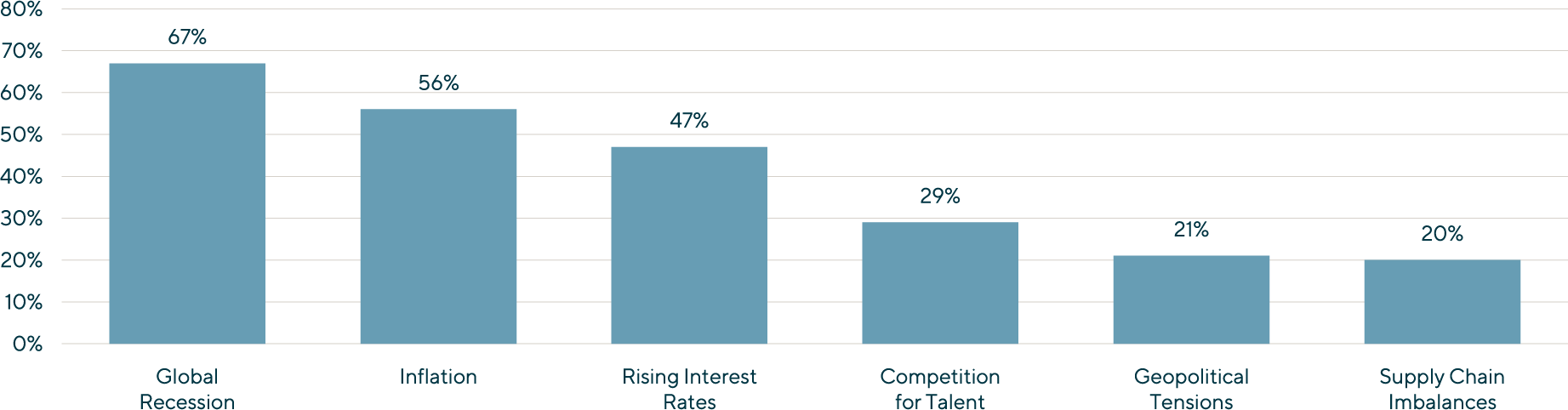

Recessionary pressures top PE investors’ concerns.Amid current volatility, some uncertainty lies ahead, and investors are closely monitoring the warning signs. Public markets tend to be more sensitive to these concerns than private markets, but volatility can impact private equity in a range of ways, from limited partner allocations to waning consumer confidence and reduced spending. Two-thirds of PE investors (67%) say a global recession is among their top three worries. Given the recent headlines, it is understandable that wide-ranging, macroeconomic concerns top the list. Other more specific threats varied, including global and organizational challenges.

|

Economic uncertainty will impact hold periods and valuations in 2023. |

||

|

|

|

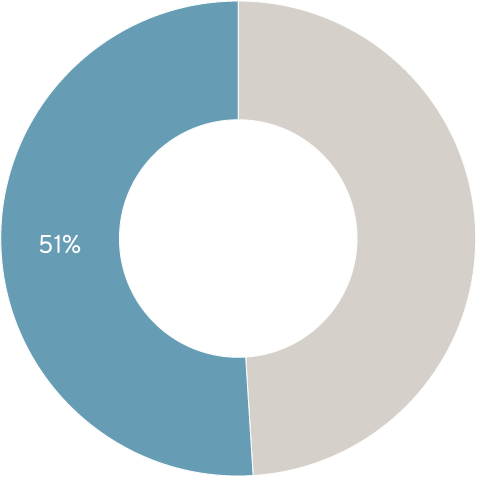

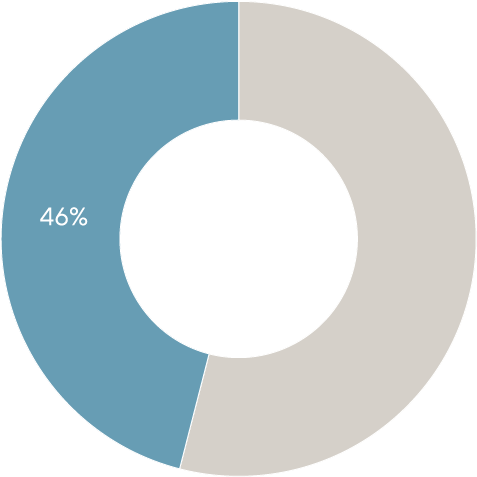

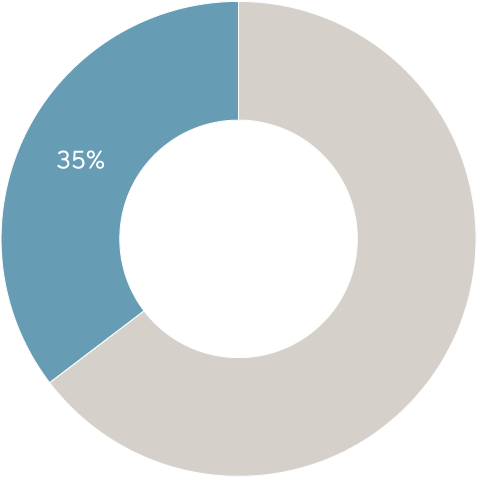

| With several areas of concern posing challenges for growth, half of PE investors (51%) say economic uncertainty will lead to longer hold periods for portfolio companies in 2023. | After many months of high multiples, nearly half (46%) say uncertainty will lead to lower valuations for target businesses, which could favor opportunistic buyers. | More than one-third of respondents (35%) say they will increase their focus on the quality of management teams at portfolio companies, and one-fifth (20%) will continue to focus on portfolio company liquidity. |

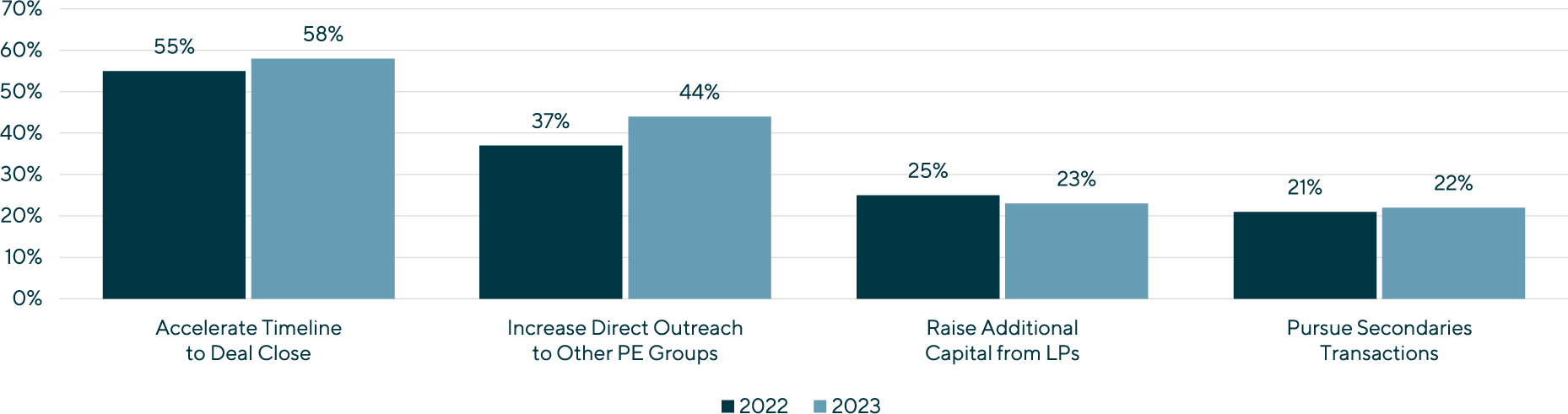

Investors have adjusted strategy to accelerate transaction timelines.The frenzied pace of deal activity during 2021, combined with pandemic-related disruption to standard deal processes, forced PE firms and deal teams to adapt. Compression of deal timelines marked the most significant change. More than half of respondents (58%) say they plan to accelerate timelines to deal close in 2023—a slight increase from 55% last year. Rather than months between the letter of intent and closing, transactions can now be completed in just weeks. As PE investors seek to promptly fulfill the deal rationale and quickly capture deal synergies, technology has enabled speed in multiple ways. The other top strategies also remained the same between plans for 2022 and 2023, with slight changes in percentages:

It is also notable that while 12% planned to pause mergers and acquisitions (M&A) activity in 2022, just 6% plan to do so in 2023. |