M&A Activity in Fire and Life Safety Services Continues to Heat Up

Aug 2022

Long-Term Trends Underpinning the Fire and Life Safety Services Industry

Amid mounting regulatory oversight and compliance expectations in the fire and life safety services sector, investors are pursuing roll-up strategies. The fragmented sector’s recession resilience and recurring revenue streams make it increasingly attractive among buyers, driving record levels of consolidation in recent years.

Summary

-

Lincoln International has identified key factors driving interest in fire and life safety businesses.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Regulatory Requirements Drive Demand for Fire and Life Safety Services

Local, state and federal codes mandate regular fire safety inspections, positioning fire equipment inspections and repairs as critical and non-discretionary investments in facilities. These requirements, often created in response to fire outbreaks, are constantly evolving and continue to drive sustained customer demand for fire and life safety service providers.

In addition to regulatory standards issued by and alongside state and local governments, industry organizations such as the National Fire Protection Association (NFPA) also issue mandates. NFPA hosts a library of over 300 consensus codes and standards. Industry organizations, such as the NFPA and Underwriters Laboratories, update key standards every three to five years to address safety requirements for fire alarms and sprinkler systems in various property types and construction-related requirements. For example, a major proposed change to the next edition of NFPA 25 is the requirement that a percentage of concealed cover plates in a sprinkler system be removed every five years to check for hidden issues. This change is expected to increase the number of inspections for sprinkler systems, and therefore increase the demand among fire and life safety service businesses.

Grant entities, such as the Fire Protection Research Foundation (FPRF), also fuel fire and life safety service providers’ revenue. As grants introduce funding for improvements to firefighter safety, smoke detectors or CO2 alarms, they also create revenue for fire and life safety service providers.

Aging Infrastructure, Construction and Remodeling Act as Additional Revenue Drivers

In addition to establishing general codes and safety standards, the NFPA also mandated the installation of fire protection systems in new commercial construction projects. In older buildings, they mandated the replacement of obsolete fire alarms, sprinklers and detectors.

As older properties update fire safety systems to adhere to new policies, remodeling activities are expected to play a key role in fueling the fire and life safety services market. At the same time, construction will drive demand as new buildings comply with regulatory standards.

To further improve life safety and property loss prevention, industry players are turning to technologies that can prevent, detect and respond to fire and life safety related incidents. Armed with the additional information this technology can provide, for instance, the ability to monitor water pressure and flow rate of a building’s sprinkler system or detect fire faster through video-based systems, customer demand for upgrades and follow-on service work will abound.

Molding Business Models to Maximize Customer Trust and Scale Strategically

Multiple delivery models exist within the fire and life safety services market.

| Self-perform fire and life safety businesses employ experienced technicians in-house. By managing technicians as employees, these businesses closely monitor employee training, service quality and job safety—all important facets of building trust with clients. To optimize route density, technicians typically service within a local area. This localized service model often helps self-perform businesses stay well-connected in their communities. |

| Vendor-managed fire and life safety businesses subcontract technicians to perform safety services. A highly scalable model, vendor-managed businesses leverage outsourcing to satisfy specific technician requirements and rapidly grow their geographic reach. |

| Hybrid service businesses combine self-perform and vendor-managed models, which provide the flexibility to service large, multi-site and national customers through vendor partners while also maintaining the expertise that comes from having local technicians on the ground. In addition, the hybrid-service model adapts well in a high-growth business or challenging labor market. |

Lincoln Perspective

For private equity (PE) sponsors and strategics alike, fire and life safety businesses are ripe with opportunity. Deal flow in the space has accelerated throughout 2021 and into this year as investors consolidate the highly fragmented market.

Lincoln International expects high levels of consolidation to continue as PE firms and corporate players pursue roll-up strategies in resilient sectors. As consolidation occurs, portfolio companies will offer expanded capabilities across broader geographic footprints to a wider customer base.

Looking ahead, Lincoln has identified key factors driving interest in fire and life safety businesses:

| Recurring revenue: Local, state and federal mandates create non-discretionary, non-deferrable demand for fire equipment inspections, repairs, renovations and retrofits in existing structures, driving recurring revenue for industry operators. Regulations will constantly evolve to address newly identified dangers that arise, ensuring that fire and life safety services remain top-of-mind.

Recession Resilience: Regardless of occupancy, structures are required to meet regular system inspections and updates. Fire and life safety services will remain critical, regardless of economic conditions. Diversified end markets: Fire and life safety services are necessary in a wide range of commercial buildings from schools to restaurants to warehouses across the country. Service providers, particularly those with a wide geographic footprint, reach a diverse set of end markets, bolstering revenue stability. High barrier to entry: Stringent regulatory hurdles and license requirements create a high barrier to entry in the fire and life safety industry. |

Recent Notable Transactions

Many of the medium-to-large-size independent fire and life safety services companies have gone through successful mergers and acquisitions (M&A) processes since the beginning of 2021, represented by the highlighted transactions below.

- Blue Point Capital Partners has sold Fire & Life Safety America to Summit Companies, a portfolio company of BlackRock Long Term Private Capital

- Fire & Life Safety America (FLSA) inspects, designs, installs and services fire protection systems. The acquisition further established Summit Companies, a fire and life safety service provider, in the industry and provided FLSA with resources to continue its growth strategy of acquiring other fire services companies.

- BlackRock Long Term Private Capital has acquired Summit Companies

- BlackRock Long Term Private Capital’s acquisition enabled Summit Companies to achieve its goal of providing comprehensive fire protection services, execute strategic add-on acquisitions and best serve its customer base.

- Encore Fire Protection has been sold to Levine Leichtman Capital Partners

- Encore Fire Protection provides fire maintenance, repair, testing, inspection and installation services throughout New England. Levine Leichtman Capital Partners’ investment supported Encore’s growth and strategic objectives.

- Altas Partners has acquired a majority interest in Pye-Barker Fire

- Pye-Barker Fire provides fire protection services and has been expanding through the acquisition of businesses across the United States. Altas Partners’ investment backed Pye-Barker’s growth strategy.

- Altus Fire & Life Safety has been sold to AE Industrial Partners

- Altus Fire & Life Safety offers full-service fire and life safety services and has acquired several other companies in the industry. The partnership with AE Industrial Partners will support Altus’ growth strategy, including through acquisitions.

- Audax Private Equity has sold AI Fire to TruArc Partners

- AI Fire provides inspection, maintenance, repair and installation services for portable fire extinguishers, fire sprinklers, fire alarms and emergency lighting. TruArc Partners’ (formerly Snow Phipps) acquisition has enabled AI Fire to continue pursuing strategic add-on acquisitions.

- HGGC has acquired Marmic Fire & Safety

- Marmic Fire & Safety is a full-service fire protection company that provides test, inspection and maintenance services. HGGC plans to execute a number of strategic initiatives to accelerate Marmic’s revenue growth, expand geographic footprint and increase operational efficiency.

The U.S. fire and life safety industry has continued to experience positive tailwinds, creating a highly attractive investment for private equity firms and strategics alike. The recurring nature of the services and regulatory-driven demand provide strong visibility into future earnings. It’s an exciting time to be in the highly fragmented industry as platforms continue to grow through geographic and end market expansion. We look forward to providing high-quality service to our customers with the support of our investors.

Industry Consolidation

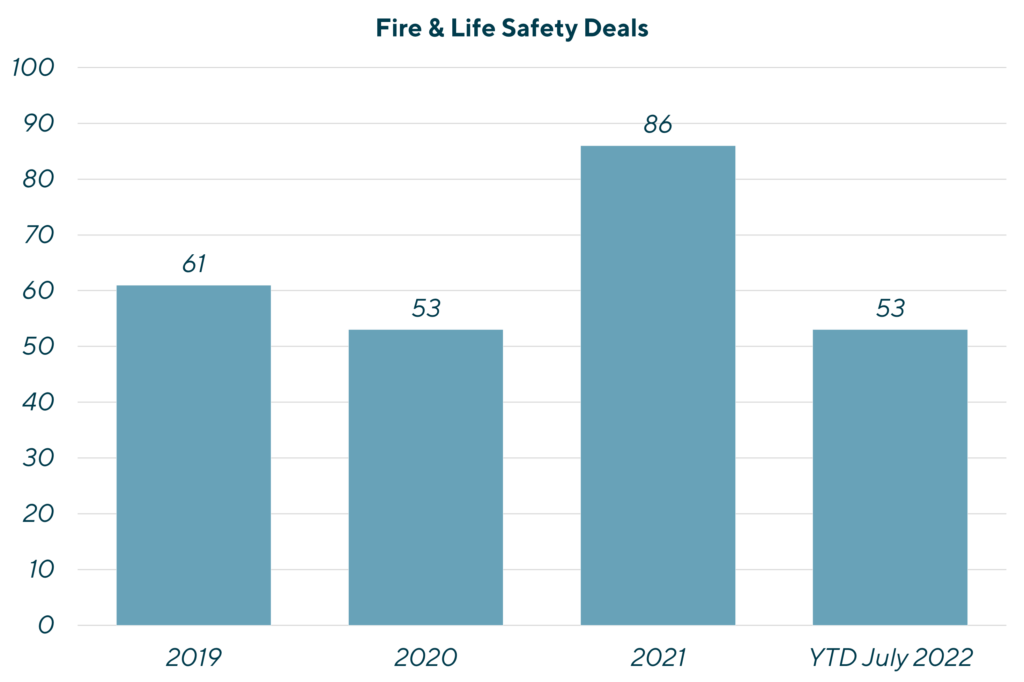

Consolidation activity has been especially high across the past two years, with 86 deals in 2021 and 53 in H1 of 2022. Notable consolidations include:

- AI Fire: 11 fire and life safety deals since 2019

- Pye-Barker: 30+ fire and life safety deals since 2019

- Summit Companies: 12 fire and life safety deals since 2019

Contributors

Meet Professionals with Complementary Expertise in Business Services

I am enthusiastic about creating sustainable growth and the highest value for our clients and strive to leave a positive footprint beyond any successful M&A transaction.

Friedrich Bieselt

Managing Director & Head of Business Services, Europe

Frankfurt

The transactions we work on are often trajectory-altering, with high stakes and pressure to get it right. We know our work, however challenging in the moment, is going to be impactful.

Mike Iannelli

Managing Director & Co-head of Business Services

Chicago